- A study by Ripple’s Xpring concludes that crypto investors are turning to XRP as a means of value transfer in times when Bitcoin and Ethereum’s networks are congested.

- XRP’s transaction volume between different exchanges has a consistently increased in recent months when Ethereum’s fees have been rising.

In a new blog post, Xpring, the investment arm of Ripple, reflects on the behavior of crypto investors during past crashes. In this context, the company claims that Bitcoin and Ethereum investors turned to XRP as a transaction vehicle in times of network congestions. Xpring states that transaction fees for both Ethereum and Bitcoin soared during the crash on March 12th and were “5 times” the normal fees. This, according to Xpring, led to an increased use of XRP for deposits and withdrawals on crypto exchanges.

e saw evidence that many users, especially Ethereum users, may be shifting to the digital asset XRP for exchange balance transfers—and we’re not surprised.

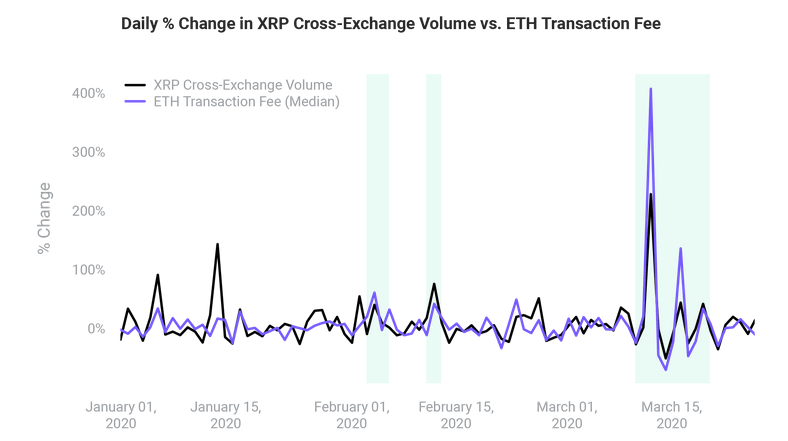

Xpring explains that XRP was created for value transfer. So the sudden change comes as no surprise. Xpring also backs up its statements with various metrics. The chart below shows that as the ETH cost per transaction increases, there are more XRP cross-exchange transactions. According to Xpring, this is especially true on days when Ethereum’s fee level indicates that the network is heavily overloaded. To determine the metric, Xpring has taken the average cost, resulting in a stronger effect.

On days when Ethereum fees were skyrocketing, XRP transactions between exchanges also increased significantly. Overall, higher Ethereum fees correlate with higher volumes in XRP. The Pearson correlation value is 0.7, which statistically indicates a strong positive correlation.

For example, on 12 March 2020, Ethereum’s transaction fees increased by over 400%. On the same day, XRP transactions increased by 226%. According to Xpring, when Ethereum’s transactions are in a “normal” range, the correlation becomes weaker:

This relation is weaker, but still existent, when Ethereum fees are within a normal range (median to high) — and strongest when Ethereum is at its lowest and highest. This means when Ethereum fees lower, XRP cross-exchange transactions decrease.

This ratio is also shown in the graph below, which shows the volume of XRP transactions between different exchanges on a daily average basis.

Ripple’s XRP is cheap in all market situations

In the blog post, Xpring also emphasizes that XRP can always be transferred at low cost, regardless of the market situation. As shown in the figure below, XRP fees always remain at a stable level, both when Ethereum’s and Bitcoin’s fees are rising.

As Xpring states, this provides an important advantage for the entire cryptocurrency market:

Even though traders likely shifted to XRP for interexchange rebalancing, it did not get more expensive. When listed on exchanges as a base pair, this characteristic of XRP removes blockchain network load as a bottleneck for market liquidity.

Recommended for you:

- Buy Ripple (XRP) Guide

- Ripple XRP Wallet Tutorial

- Check 24-hour XRP Price

- More Ripple (XRP) News

- What is Ripple (XRP)?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.