- Chainlink stands as a seminal innovation within the blockchain sphere, a decentralized oracle network that fundamentally augments the capabilities of smart contracts.

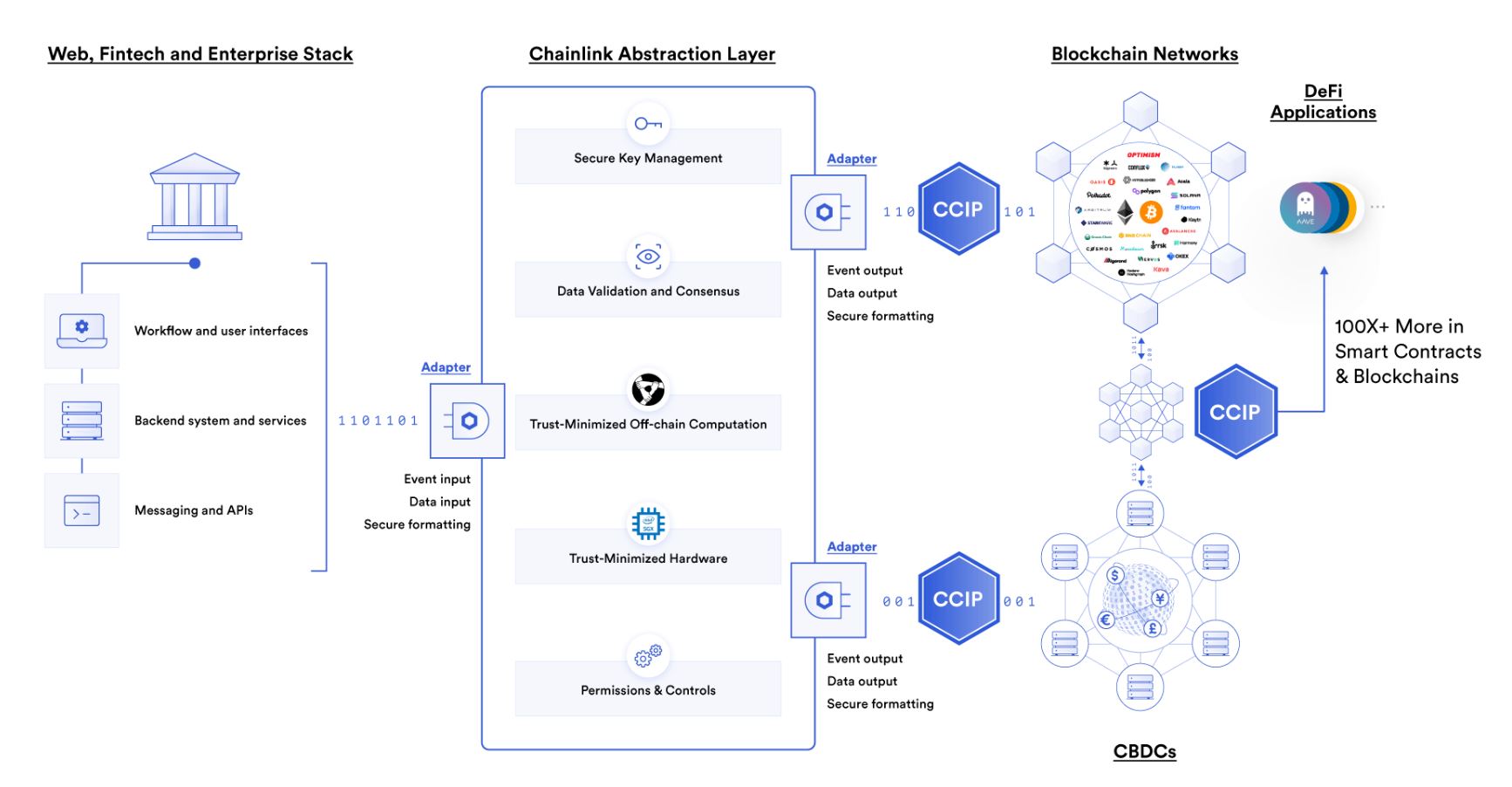

- By bridging the gap between on-chain and off-chain environments, Chainlink enables smart contracts to securely and reliably interact with external data feeds, APIs, and traditional payment systems.

This interaction is pivotal for the realization of complex, real-world applications on the blockchain, extending beyond mere token transfers to encompass a wide array of functionalities.

Discover the latest Chainlink (LINK) price here. Stay informed about all developments within the LINK ecosystem by exploring our Chainlink news. Seeking the best wallet for storing your LINK? Delve into our comprehensive Chainlink wallet guide. Interested in purchasing LINK? Learn how with our Chainlink buying tutorial. Now, let’s delve deeper into the topic.

The Genesis of Chainlink

Chainlink’s inception is rooted in addressing a critical limitation inherent to smart contracts: their inability to access or verify real-world data independently. Dubbed the “oracle problem,” this limitation hampers the potential applications of smart contracts by confining them to the data available on their respective blockchains. Chainlink’s decentralized oracle network emerges as a solution to this problem, facilitating a secure and reliable exchange of data between blockchains and the external world.

The Mechanics of Chainlink

Chainlink operates through a network of decentralized nodes that independently fetch data from a variety of external sources. This data is then aggregated and conveyed to smart contracts, ensuring the integrity and reliability of the information by mitigating single points of failure inherent to centralized systems. The decentralized nature of Chainlink’s network is a cornerstone of its design, ensuring that no single node or entity can compromise the accuracy or availability of the data provided to smart contracts.

The Role of LINK Token

The LINK token, native to the Chainlink network, serves a dual purpose: it compensates node operators for their services in retrieving and providing data, and it acts as an incentive mechanism, encouraging the provision of accurate and timely data. As an ERC-677 token, an extension of the ERC-20 standard, LINK facilitates more sophisticated interactions within smart contracts, further enhancing the utility of the Chainlink network.

Distinguishing Chainlink from Competitors

Chainlink’s unique value proposition lies in its decentralized approach to data retrieval and verification, setting it apart from centralized oracle services. By sourcing data from multiple independent entities and aggregating it to provide a single validated data point, Chainlink ensures that smart contracts can operate based on reliable and timely information, free from the influence or failure of any single data source.

Real-World Applications: Chainlink in Use

The practical applications of Chainlink are as diverse as they are impactful. In the realm of decentralized finance (DeFi), Chainlink oracles enable the creation of more secure and transparent financial products by providing accurate, real-time data for asset pricing, interest rates, and collateralization verifications.

Beyond finance, Chainlink is facilitating the development of parametric insurance contracts, enhancing the fairness and efficiency of blockchain-based gaming, and enabling the integration of traditional data systems with blockchain networks, thereby broadening the scope of possible smart contract applications. The most recent use case is the tokenization collaboration with major banks, including Goldman Sachs.

Following the approval of Bitcoin ETFs, Chainlink has seen notable price increases. Yet, its robust technology and strong partnerships with central banks such as the Australia and New Zealand Banking Group (ANZ), SWIFT, Google, Microsoft, Amazon, and other major tech corporations also present positive signs. With the CCIP protocol and the ongoing development in the trillion-dollar tokenization market, there is promising potential for further advancement leading up to 2030.

The Future Path of Chainlink

Looking ahead, the potential for Chainlink to catalyze a new era of smart contract applications is immense. As the platform continues to evolve, with a focus on enhancing its security features and expanding its data sources, Chainlink is set to play a pivotal role in the broader adoption and maturation of blockchain technology. The ongoing research, community engagement, and commitment to open-source principles are likely to further solidify Chainlink’s position as a key enabler of a more connected, decentralized digital world.

At the time of writing (23.02.2024), the LINK price shows gains of 22.72% in the last 30 days, trading at $18.09.

Recommended for you:

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.