- According to Unchained Capital Bitcoin will be the dominant currency in the upcoming years and will outpace every other currency, like the US-Dollar, Euro and also Facebook’s Libra.

- Demand for Bitcoin is on the rise and is driven by its monetary properties and supply scarcity.

The cryptolending platform, Unchained Capital, published a blog post about the adoption of Bitcoin. The post, written by Parker Lewis, recounts the features that will make Bitcoin the dominant currency over Bitcoin Cash, Litecoin, Ethereum, Cardano and thousands of other cryptocurrencies and fiat money.

Bitcoin will be the dominant global currency

Lewis begins his post by talking about how the supply of Bitcoin (BTC) is becoming increasingly limited. The total supply of Bitcoin will be 21 million BTC and for Lewis Bitcoin has proved that this number will remain unchanged, therefore its supply becomes even more limited compared to the high demand that is rising. Lewis says

It may sound crazy to believe that Bitcoin will be the dominant global currency, and it likely would be if evaluating the possibility from a top-down, probability-weighted perspective.

Lewis says that from the outside the idea of Bitcoin’s domination may sound even more farfetched considering its short history, just a decade since its activation, and its market capitalization. In addition, there is the large number of competitors to Bitcoin and the possibility that some of them will take its place. However, Lewis said that the key to understanding Bitcoin’s dominance as a global currency lies not in its price or market capitalization but in its foundational principles.

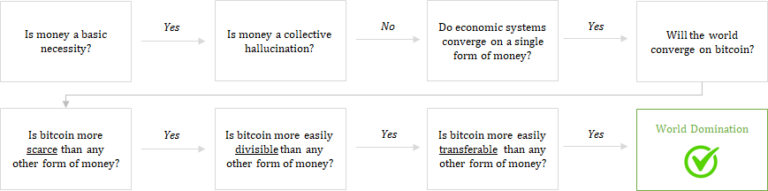

In the image below, Lewis explains how these principles can help “eliminate the noise” of competition and lead to the conclusion that Bitcoin will be the dominant currency.

This image shows the “path to global domination” in which “hallucinations” and perceptions are set aside. Money, Lewis says, is a necessity that is not supported by any system of beliefs. The success of Bitcoin and its position as a global currency is supported by the following conclusion:

Individuals adopt Bitcoin because it possesses unique properties that make it superior as a form of money relative to all other currencies. Because money is a solution to an intersubjective problem, monetary systems tend to converge on a single medium.

These properties are also causing a change in the market and in the traditional financial system. Lewis says these changes are causing the market to move toward Bitcoin and its use as a tool to “communicate and measure value”. This is because it represents an improvement over any other monetary medium.

Currently, Bitcoin faces several issues such as market volatility and the long time it can take to validate a transaction. Still, Lewis says Bitcoin’s problems won’t stop its adoption and that its benefits outweigh its limitations. Finally, Lewis’ conclusion is simple and based on a practical argument:

Currency A has a fixed supply. Currency B does not. Currency A keeps increasing in value relative to Currency B. Currency A continues to increase in purchasing power relative to goods and services while Currency B does the opposite. Which one do I want? A or B?…

Bitcoin obsoletes all other money because economic systems converge on a single currency, and Bitcoin has the most credible monetary properties.

The price of Bitcoin trades at $9,343 at the time the article was published and has moved sideways (-0.94) in the last 24 hours.

Follow us on Facebook and Twitter and don’t miss any hot news anymore! Do you like our price indices?

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.