- Despite a correcting Bitcoin price, seven fundamentals show that the bull run may be far from over.

- Indicators show that there is “a steady pivot away from profit taking and towards HODLing.”

The Bitcoin price has now been trapped within the $33,900 to $40,000 range for a week. After BTC bounced off the current all-time high of around $42,000 several times and subsequently corrected to as low as $30,100, there is now some uncertainty about the next major move in the Bitcoin price. However, as seven fundamentals show, the sentiment among Bitcoin investors remains bullish.

Analytics firm Santiment noted that a number of indicators suggest that there is “a steady pivot away from profit-taking and towards HODLing, regardless of increased price volatility and downward pressure.” This is evidenced by Bitcoin’s Age Consumed indicator, which tracks the renewed activity of dormant BTC, among other indicators. On that note, Santiment tweeted:

#Hodling #Bitcoin is becoming the trending strategy once again, after AllTimeHigh‘s were made repeatedly the past couple months. Dormant coins that were being moved during the sharp rise above $40k are now… back to being dormant.

While there is an increasing amount of traders who doubt that Bitcoin will reach $40,000 again in a timely manner, according to Santiment, the long-term trend of daily active addresses and trading volume “still look plenty healthy,” as the chart below shows.

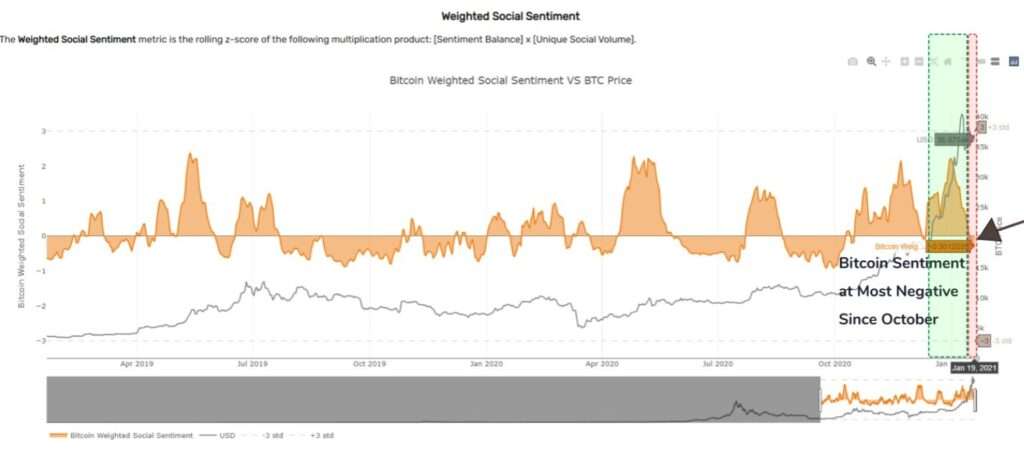

As the analytic firm also notes, the sentiment towards Bitcoin on Twitter is tipping more to the side of the bears and thus is no longer as euphoric. The sentiment is at its most negative level since October. However, this could be a positive sign:

This actually is a positive sign for $BTC, as prices tend to rise with crowd disbelief.

Bitcoin whales buying the dip

Another bullish sign is the behavior of “Bitcoin whales”. As elicited by analyst CryptoKea, the demand by institutions and large investors is unabated:

The amount of #Bitcoin still being bought and pulled off exchanges is ? . Institutions/HNWI still busy at work accumulating and withdrawing #Bitcoin to compliant custodians.

This thesis is supported by several facts. For example, the number of Bitcoin addresses holding over 1,000 BTC hit a new all-time high yesterday. This year alone, 164 addresses have been added, which are currently worth $6 billion.

In addition, according to a recent analysis by Glassnode, the number of BTC held in “accumulation addresses” has exceeded 2.7 million, representing a 17% increase in a single year. Accumulation addresses are addresses (excluding miner and exchange addresses) that have only ever received BTC and never spent it.

This increase highlights the massive supply restriction that is occurring in the BTC market, with almost 15% of the total supply held in these addresses. When combined with the general decrease in bitcoin’s liquid supply and the number of lost coins, this leads to an even more limited supply, which is helping BTC maintain the highest prices it has ever seen.

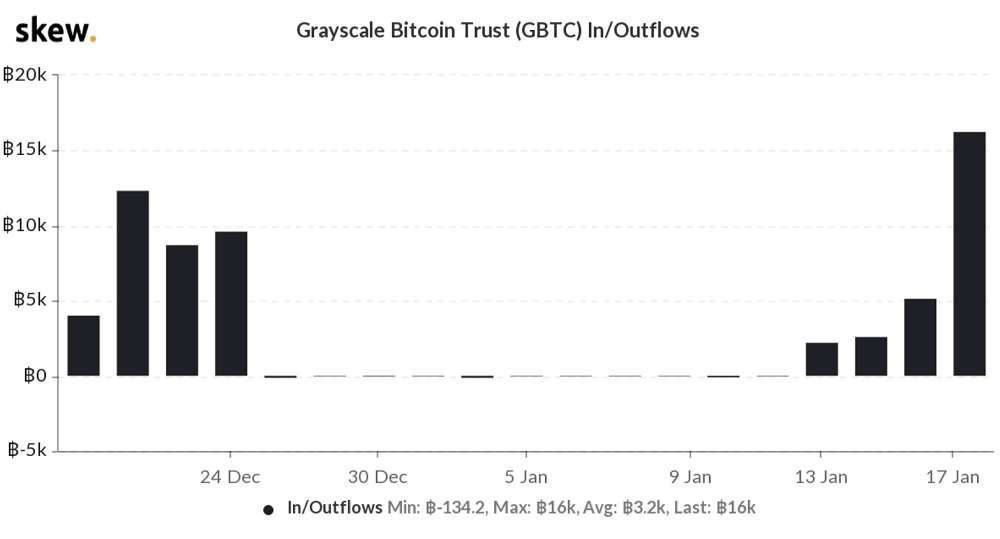

Last but not least, Grayscale is also once again seeing massive inflows from primarily institutional investors following the pause of the Grayscale Bitcoin Trust (GBTC). Just yesterday, Grayscale set another record by allocating a total of 16,000 BTC to GBTC. This is equivalent to 18 days worth of Bitcoin mining.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.