- Bitcoin SV is one of the most controversial tokens in the cryptocurrency space, and in recent months, has grabbed headlines for delistings and 51 percent attacks.

- Then there’s Craig Wright, the de facto leader of the BSV ecosystem, who due to claiming to be Satoshi Nakamoto has attracted a whole host of enemies.

You’ll be hard-pressed to find a cryptocurrency that’s more controversial than Bitcoin SV. Since forking from Bitcoin Cash in 2018, BSV has managed to attract attention for all manner of reasons – from its de facto leader Craig Wright going against an entire cryptocurrency industry to being hit by multiple 51 percent attacks and much more. Is the cryptocurrency project judged too harshly and does it have a future, or will it continue slipping down the charts into oblivion?

The double-spend attacks

Bitcoin SV isn’t one of the projects that grab headlines often, such as Ethereum or its predecessor Bitcoin. But when it does, it seems to grab them for the wrong reasons.

One prime example is the recent spate of 51 percent attacks the project has been experiencing. Between June 24 and July 9, it saw four attacks, all carried out by one entity calling itself Zulupool, at least according to the BSV-affiliated Bitcoin Association. In early August, it suffered yet another attack, the fifth in three months, still from the same entity.

BSV is a small chain in terms of miners and hash rate. As such, it’s much easier to attack compared to say, Bitcoin which has over 150 times more computing power.

To make matters worse for the project, upon the attacks, Binance revealed it would be shutting down its BSV mining pool by the end of July. Binance Pool contributed to about 8 percent of the overall BSV computing power, and by pulling out, it was making it even easier to attack.

However, the most controversial aspect of Bitcoin SV has to be Craig Wright, the self-declared Satoshi Nakamoto.

Related: BSV sheds 5% after the network suffers malicious 51% attack

Craig Wright – Satoshi or not?

Wright declared himself to be Satoshi years ago, and unsurprisingly, not many believed him. Some of the cryptocurrency industry’s foremost leaders have called him a fake and a liar. These include Vitalik Buterin, the Ethereum founder who in a conference a few years back, described him as a fraud.

That Vitalik and several others called Wright a fraud wasn’t a major issue for the BSV holders. The real problem came about when Wright began getting into legal battles with figures such as “Cobra”, the anonymous owner of the Bitcoin.org website over the rights to the Bitcoin whitepaper.

These lawsuits led to some of the leaders of major exchanges siding with everyone but Wright and in response, retaliated by delisting Bitcoin SV.

Kraken’s CEO Jesse Powell is a fierce Wright critic and in April 2019, the exchange announced it was delisting BSV. It claimed the ‘team behind BSV’ had “engaged in behavior completely antithetical to everything we at Kraken and the wider crypto community stands for.”

A day before, Binance had announced that it was taking a similar stand against BSV. CEO Changpeng Zhao had threatened to delist BSV if Wright continued his legal actions against some people in the Bitcoin community. And he followed through, delisting the token because of his personal stand against Wright, at the expense of thousands of faultless investors.

Craig Wright is not Satoshi.

Anymore of this sh!t, we delist! https://t.co/hrnt3fDACq

— CZ 🔶 BNB (@cz_binance) April 12, 2019

Erik Voorhes, a longtime cryptocurrency entrepreneur expressed solidarity with CZ and announced that his platform ShapeShift would also delist BSV.

And it’s not just the big exchanges that have delisted BSV, smaller ones have also jumped in. In January this year, Independent Reserve, an Australian exchange, announced it was also taking BSV off its platform due to “controversial behaviour by its team.”

The CEO later clarified to one outlet the reason for the delisting, claiming:

The behavior shown by the team behind BSV has been completely counter to these ideals, repeatedly spreading misinformation and making baseless threats against the community. […] These are the actions of a bully and they must stop.

Gigabyte blocks and overtaking Ethereum – the other side of BSV

Bitcoin SV is certainly controversial and Wright will continue to attract his own fair share of enemies. However, looking past these controversies, BSV has grown into one of the most robust ecosystems. Unfortunately, this goes unnoticed.

BSV forked from Bitcoin Cash primarily due to a lack of consensus on whether Bitcoin should have a limited block size. Ironically, the Bitcoin Cash team had forked from Bitcoin because they wanted bigger blocks – just not too big, it would appear.

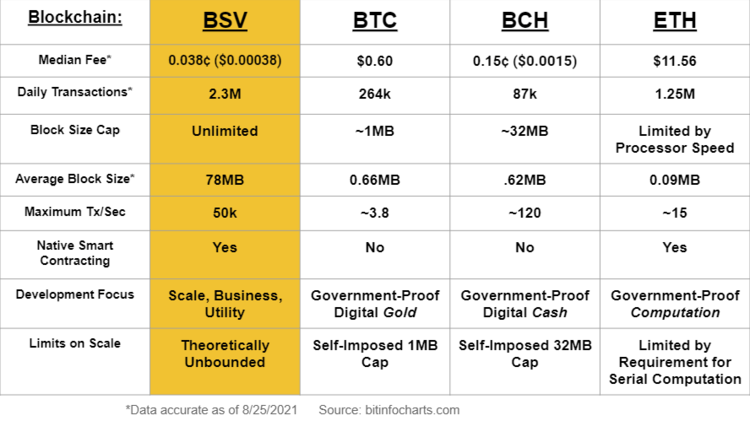

BSV has built on this idea of unlimited block sizes and continues to churn out some very large blocks, sometimes going up to a gigabyte. For context, Bitcoin has limited its block size to 1 megabyte. With its much bigger block size, BSV intends to process more transactions in each block and by this, have a much larger throughput capacity than its rivals.

According to the Bitcoin Association, earlier in August, BSV set the record for the highest daily average block size on a Bitcoin network at 45MB.

Through its much larger block size, BSV is able to process many more transactions than Bitcoin and Ethereum. Recently, according to BitInfoCharts, BSV overtook Ethereum in the number of transactions. BSV is processing more than twice the number of transactions that Ethereum is, as shown below.

While being able to process more transactions is one thing, having enough users to make these transactions is a whole other thing. And BSV seems to have a large enough community for this.

According to a blog post by Unbounded Capital, one game built on BSV known as Crypto Fights processed more transactions alone than the entire Ethereum network. Ironically, the company behind the game deployed it on Ethereum first but migrated to BSV after they realized that the former didn’t share the vision they had.