- The analysis company Clover has published a new study on the inequality of wealth distribution in Bitcoin, Ethereum, Litecoin and various ERC20 projects.

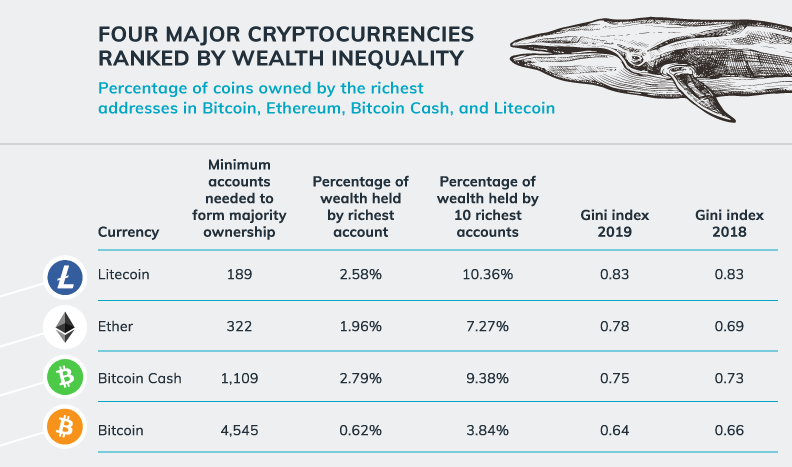

- According to the results of the analysis, Litecoin has the largest inequality, while Bitcoin is the most decentralized among the largest cryptocurrencies.

A new study by Clover concludes that the leading cryptocurrencies are still held by a small group of whales. For its analysis, the company compared the wealth distribution among the 140,000 non-exchange addresses of Bitcoin, Ethereum, Litecoin and Bitcoin Cash and found that “surprisingly few accounts are needed to form majority ownership of many coins”.

Litecoin owns the largest whales

According to Clover’s results, Litecoin is among the top cryptocurrencies with the greatest wealth inequality. Only 189 addresses have assets that account for more than 50% of the total supply. The richest Litecoin address owns about 2.58% of all Litecoin. Regarding Ethereum, Clover concluded that only 322 “whale” addresses own more than 50% of all ETH, with Ethereum being the only leading cryptocurrency in 2019, whose wealth inequality increased by 13% in 2019.

The wealth distribution is slightly better for Bitcoin Cash (BCH). A little more than 1,100 wallets hold more than 50% of the total supply. From the Clover study’s point of view, however, Bitcoin (BTC) has the “fairest” wealth distribution. For 50% of the total supply, as many as 4,545 wallet addresses would have to be owned by one person (whereby several addresses can belong to one person). The richest Bitcoin address contains only 0.62% of the current circulation.

To measure wealth inequality, Clover used the Gini index, a classic measure to assess the distribution of wealth across the entire distribution of the 10,000 richest addresses in each currency. Among the top 4, Bitcoin (0.65) had the lowest wealth inequality, ahead of Bitcoin Cash (0.75), Ethereum (0.78) and Litecoin (0.83). In comparison, Clover stated that the income inequality of the United States of America was 0.49 in 2018.

ERC20 tokens are much more centralized

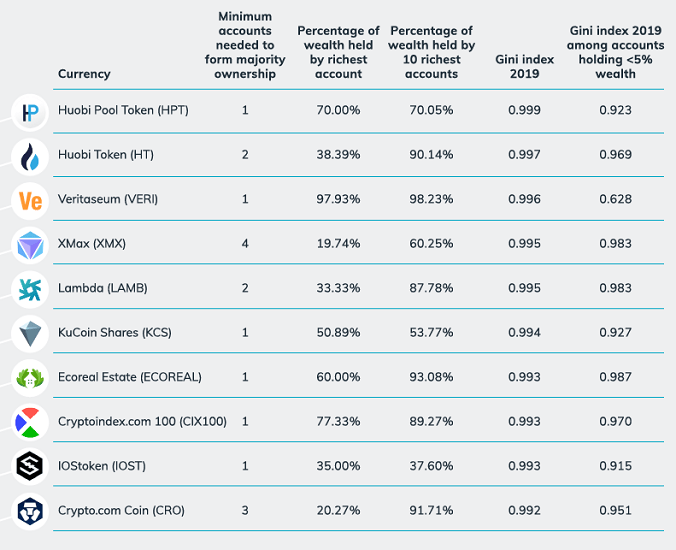

Regarding ERC20 tokens, Clover has found that even leading assets have a significant uneven distribution. Among the 100 Ethereum tokens with the highest market capitalization, the average number of addresses that could control a majority of the assets was 34 addresses, with this number varying widely from token to token.

Clover also found that 24 of the 100 largest tokens were majority owned by one address, almost always owned by the founder. According to the following list, the Huobi token has the highest wealth inequality measured by the Gini index. However, 97.93% of the Veritaseum tokens, which had the third highest wealth inequality of the 100 analyzed tokens (Gini 0.996), is held by one person, the founder Reggie Middleton.

As market capitalization increases, however, the inequality of distribution also tends to decline. In this respect, the study concluded:

Perhaps successful tokens attract more investors and divide wealth among more addresses. It is possible that tokens with smaller market capitalizations are younger and can balance wealth over time.

What are the consequences of inequality for the market?

As Clover points out, a few “whales” could undermine the decentralized principles of the individual blockchains and cryptocurrencies:

Just as whales cause the most excitement in the oceans, some investors trade coins in such large quantities that they affect the value of the coin itself and possibly undermine the decentralized principles on which blockchains and crypto currencies are based.

Lower liquidity and higher volatility mean that whales can make “bigger waves” on the crypto market. This could also explain the high volatility of the cryptocurrency market in 2019.

Follow us on Facebook and Twitter and don’t miss any hot news anymore! Do you like our price indices?

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.