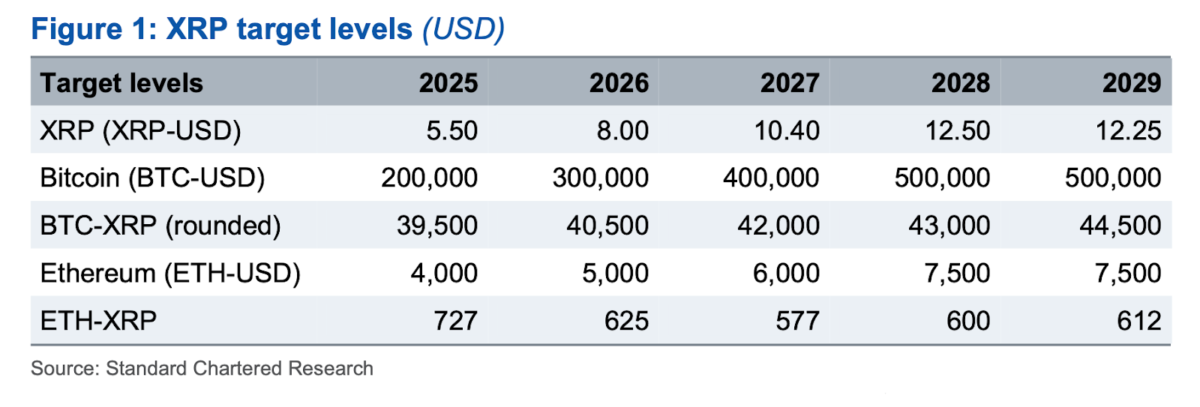

- Standard Chartered also outlined interim price targets of $5.50 by 2025 and $8.00 by 2026, driven by factors such as a potential spot XRP ETF approval and growing use cases in tokenization.

- Ripple’s acquisition of Hidden Road and its integration into global prime brokerage further strengthen XRP’s institutional appeal.

XRP has made headlines again as Standard Chartered forecasted that the crypto asset will achieve $12.50 by 2028, representing a growth of 500%. The projection puts the XRP in front of Ethereum (ETH) in terms of the market capitalization. If realized, XRP would become the second-largest crypto.

Why Does Standard Chartered Expect Such A Massive XRP Surge?

The bank’s global head of digital assets research, Geoffrey Kendrick, laid out the factors determining this surge. Some of the developments include regulatory and institutional engagement as well as XRP’s emergence in tokenization and global payments infrastructure. Kendrick noted the growth of XRP in the financial ecosystem by saying that by 2028, XRP’s market cap will exceed Ethereum’s.

In 2025, depending on approval from the U.S. Securities and Exchange Commission (SEC), the bank is anticipating a critical turning point — a successful approval of a spot XRP ETF, as mentioned in our previous story. Such an approval, Kendrick estimates, could pave the way for a huge capital inflow into XRP. Moreover, they predicted that over the course of a year, an inflow ranging between $4 billion and $8 billion could flow into XRP.

“The ‘tariff mess’ will be over soon,” he said. Here, the analyst highlighted the regulatory headwinds and pointed out that due to Bitcoin’s resiliency in the face of regulatory uncertainty he expects more upside for both the crypto market.

Furthermore, the XRP Ledger (XRPL) is set to develop into a tokenization foundation with underlying no longer just for payments. Additionally, according to Kendrick, XRP’s ambition in the market is similar to Stellar, which has today the second-largest share in the tokenization market.

Other Long-Term Targets For XRP Price

Apart from the long-term target of $12.50 by 2028, Kendrick has projected a Milestone for XRP price is at $5.50 at the end of 2025 and another is at $8.00 in 2026. To arrive at these predictions, Bitcoin has to end up being worth over $500,000 by 2028. While the developer base on XRP is ‘relatively small’ and running on a ‘low-fee model,’ Kendrick said the asset’s upward potential remains intact due to growing institutional adoption, use cases.

Whilst, Recent activity in U.S. markets highlights XRP’s expanding reach. For context, XRP futures–based ETFs began trading on NYSE Arca, offering a magnified exposure to the asset. After Bitnomial Exchange launched physically settled XRP futures, Coinbase has also submitted filings to the CFTC to bring forth nano XRP futures.

Further, Ripple’s acquisition of Hidden Road for $1.25 billion also marks a strategic move. Via this initiative, the team has successfully integrated XRP Ledger into global prime brokerage networks. Ripple CTO David Schwartz termed the deal a “defining moment.” Meanwhile, CEO Brad Garlinghouse said institutional interest is on the rise.

On another positive note, Ripple and the SEC also jointly asked for a pause of their ongoing lawsuit with the aim to finalize a $50 million settlement, as highlighted in our previous story. Netizens believe that this legal relief could also provide a much-needed boost to XRP price.