- Flipside Crypto has found in an analysis that on weekends the XRP transaction volume decreases drastically, which is probably caused by the use of the XRP token by payment service providers.

- The exchange BTC Markets also noticed an increased use of XRP by companies using On Demand Liquidity.

A report by blockchain intelligence firm, Flipside Crypto, is revealing new data on the cash flow and trading activity of Ripple’s token, XRP. The report also provides data on four other tokens: OAN, Algorand, Metronome and Zilliqa. However, Ripple’s token has the highest rating in the Fundamental Crypto Asset Score (FCAS) with 816 points.

According to the report, during the last 30 days, 1.009 billion XRP have been moved from Ripple’s escrow. Flipside Crypto notes that only 10% of the amount moved has reached the exchanges for sale, the rest returned to the escrow. Ripple releases one billion XRP every month and returns those that are not sold to his escrow account. After receiving criticism for negatively influencing the price of the XRP, Ripple has increased the information on these sales. Flipside Crypto found that the recorded activity and announcements of the XRP sale are consistent.

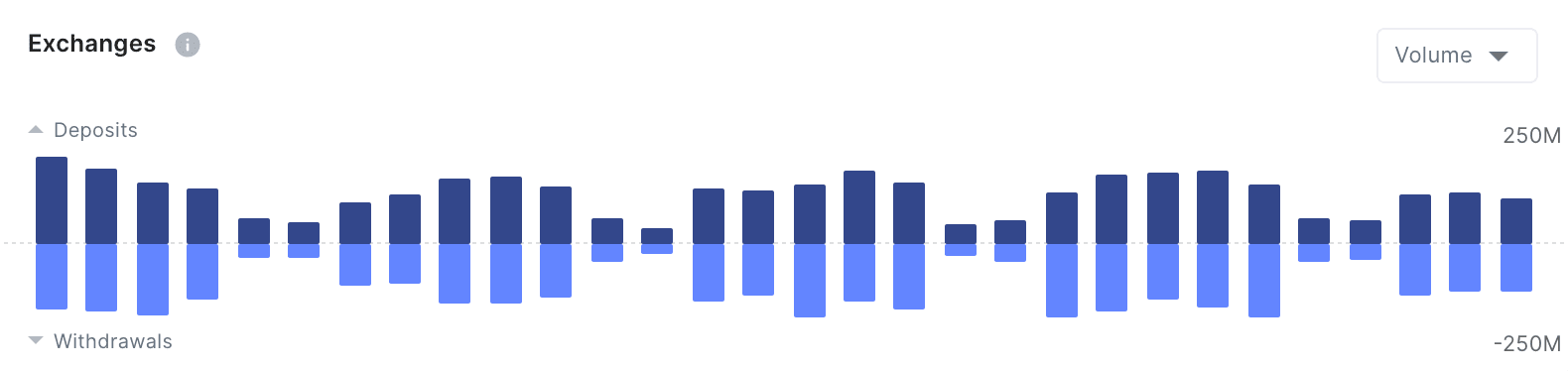

The intelligence firm blockchain also concludes that Ripple’s day-to-day business is dominated by exchanges and large corporations. According to the report, daily XRP transactions over the past 30 days average 37 thousand transactions with 120 million XRP being moved per day. In this sense, the report shows a unique pattern in the token activity. As shown in the graph below, XRP trading activity decreases on weekends, which, according to Flipside, only occurs with the XRP token. This in turn indicates that the majority of XRP activity is caused by payment processors such as Ripple’s partner MoneyGram and professional investors.

Increased XRP usage by companies

On the other hand, the crypto exchange BTC Markets has recorded an increase in the use of XRP by businesses. According to BTC Markets CEO Caroline Bowler, the XRP token and its On-Demand Liquidity payment solution are an effective, fast and secure way to send money across borders:

Companies are using the asset to make more effective cross-border payments. This use case is a real differentiator to other digital assets (…)

Bowler said that companies have recognized the token’s ability to reduce costs and increase its effectiveness in making payments. Bowler supports her claims based on the increased transaction volume on the exchange:

Using XRP to cut transaction fees and make same-day payments brings real benefits and fixes the problems of the existing system. XRP is a bridge between traditional financial institutions and the new world of fintech.

The amazing thing about ODL is that businesses using XRP for faster and cheaper cross-border payments are driving volume through our exchange, which is unique in the crypto markets. It fits with our business model seamlessly and gives us a huge competitive advantage.