- Ripple transactions consume less energy than Visa and Mastercard, with an average of 0.000011 KWh.

- German companies are the most likely in Europe to accept payments with cryptocurrencies in the next 18 months.

A Deutsche Bank report entitled “The Future of Payments: Series 2” addresses the adoption of cryptocurrencies in the global landscape. The banking institution makes its predictions for the long term and the biggest challenges facing the integration of cryptocurrencies into the mainstream.

The main challenges, according to the report, are scalability and energy consumption. On the first point, it appears that Facebook’s Libra project has made progress by using the FastPay service. As the chart below shows, Libra ranks second with 80,000 transactions per second (TPS), behind China’s CBDC with 300.000 TPS.

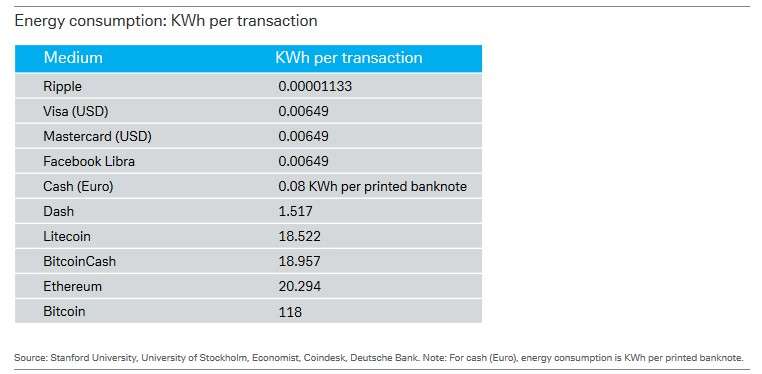

In these terms, Ripple‘s network ranks 5 below China’s CBDC, Libra, Visa and Mastercard. However, Ripple occupies the first position in the amount of energy consumed per transaction. Data cited by Deutsche Bank indicates that unlike Bitcoin’s network, Facebook’s Libra, and the networks of the largest payment processors in the world, each Ripple transaction spends 0.00001133 KW/h, making it the least energy consuming.

However, as numerous experts have noted, the reasoning behind comparing the power consumption of the Bitcoin network to other networks needs to be contrasted with more data. The host of the “What Bitcoin Did” podcast, Peter McCormack, most recently pointed out the poor comparability of Bitcoin and the Visa network.

The purpose of the two networks is different and, therefore, McCormack believes there can be no point of comparison. In addition, he adds that it is necessary to determine the power sources used to keep the Bitcoin network online.

3/ Further you also failed to:

– Look at the energy sources for #bitcoin mining

– Discuss the disastrous environmental impact of gold miningYou can use pejorative terms such as #bitcoin obsessive but it won't make your work any less misleading.

Anyway here to help, just ask.

— Peter McCormack🏴☠️ (@PeterMcCormack) January 27, 2021

More companies will accept Bitcoin as a means of payment

In 2020, Deutsche Bank made two predictions. First that companies like PayPal and Facebook would add crypto capabilities to their services by early 2021. Part of that prediction has come true. Facebook’s ambitions to have a native payments network are still in the pipeline, while PayPal is making rapid strides to enable its 300 million users to trade cryptocurrencies.

The report also predicted that digital central bank currencies (CBDCs) would become more important. With the digital yuan in an advanced testing phase, other countries have accelerated efforts to develop their own digital currencies. This will have an impact on the regulation of the crypto space in 2021, the report predicted for the current year:

Using cryptocurrencies for payments will accelerate (…). Central bankers and policymakers will react by speeding up their existing research and launching pilots. China is likely to continue to dominate the race. In the long run, CBDCs will displace private cryptocurrencies and become the norm.

Whether the latter prediction will come true remains to be seen. A survey by the banking institution found that there is still a large percentage of companies in Europe that show resistance to accepting cryptocurrencies as a means of payment in the next year and a half. Among the companies surveyed, German firms are the most willing, followed by companies in Italy and Portugal, as the following image shows.

Recommended for you:

- Buy Ripple (XRP) Guide

- Ripple XRP Wallet Tutorial

- Check 24-hour XRP Price

- More Ripple (XRP) News

- What is Ripple (XRP)?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.