- A study shows that the use of XRP is many times more environmentally friendly than using Bitcoin (BTC), Ether (ETH) or Visa (USD) as a means of payment.

- XRP is clearly superior even to traditional means of payment such as Visa or credit card.

According to the World Wildlife Foundation, factories around the world produce more than 400 million tons of paper. A lot of forest is cut down every year, so that valuable habitat on our planet is dying. Experts estimate that the average lifespan of a $5 bill is just under 16 months. Furthermore, the US Mint estimates that more than 40,000 tons of metal are used to produce coins.

It takes about 4.25 grams of oil to produce a credit card, which is equivalent to about 79,000 barrels of oil for 2.8 billion credit cards worldwide, not counting the numbers of plastic-based means of payment such as gift and discount cards. Whether paper or metal, digital currencies such as XRP, Bitcoin or Ethereum are much more environmentally friendly, although there are also big differences between cryptocurrencies.

XRP consumes significantly less energy than Bitcoin and Ethereum

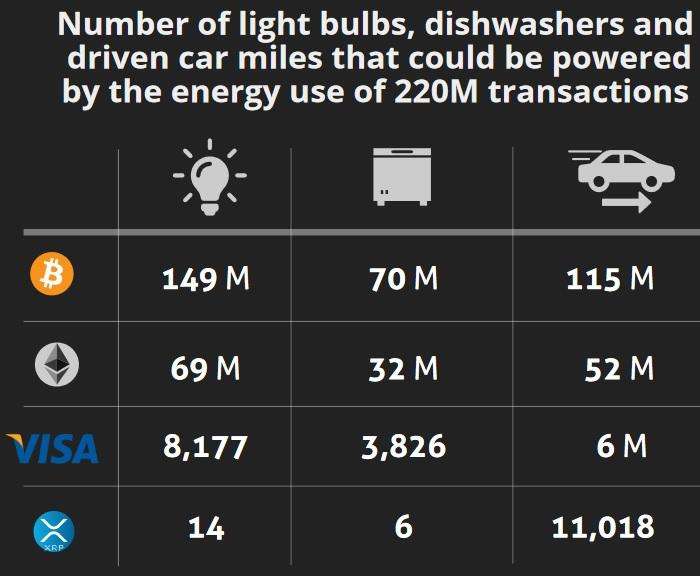

A study conducted by Stanford University Stockholm on the carbon footprint of cryptocurrencies and Visa found that Bitcoin and Ethereum are two of the most environmentally damaging currencies available in terms of annual electricity consumption. To conduct 220 million Bitcoin transactions per year (the theoretical maximum according to the study), 149 million light bulbs could be used.

With the energy consumed by the XRP Ledger, 14 light bulbs could be powered for one year. These figures show that XRP is one of the most environmentally friendly currencies, whether crypto or fiat currency. The study further states that each Bitcoin transaction releases 144,2029 Lbs (pounds) of CO2, while Ethereum comes to 20,003 Lbs, Visa (USD) to 0.00794 Lbs and Ripple (XRP) to 0.0000138 Lbs.

Unlike Bitcoin and Ethereum, XRP does not have to be created by mining, because all XRP already exist. According to the study, for every Bitcoin mined, almost four US households could be supplied with electricity for one day. The study also says:

Running a validator (server) on Ripple’s network does not re-quire any fees and it is comparable in cost in terms of electricityto running an email serve. The value of Ripple’s XRP lies in its ability to handle trans-actions and payments at a lower electricity cost and thereforelower CO2 emissions combined with lower trade fees.

The study concludes that XRP is far ahead of its competitors in this investigated frame of reference, but that the current purpose of use must always be taken into account. XRP was created with the primary purpose of making the transfer of digital assets as fast and cost-effective as possible for banks, financial institutions, payment services, vendors and enterprises.

Ripple (XRP) increases interoperability

In addition to the transmission of digital values, Ethereum offers many other functions such as the execution of smart contracts and the creation of decentralized applications (dApps). Ripple is also working on expanding the interoperability between XRP and ETH, as only then can the growing market of decentralized finance be reached with XRP:

We think the XRP to ETH and ERC-20 tokens bridge is important since XRP is one of the most liquid cryptocurrencies in the world, but doesn’t have a compute layer to support complex smart contracts for the growing Decentralized Finance (DeFi) market on Ethereum.

The price of XRP follows the current market trend and shows a slight increase of 0.58% to $0.1867. With a market capitalization of almost $8.22 billion, XRP continues to rank third among the largest cryptocurrencies worldwide.

Follow us on Facebook and Twitter and don’t miss any hot news anymore! Do you like our price indices?