- Ripple’s Navin Gupta has confirmed the company’s plans to introduce an On-Demand Liquidity payment corridor for India.

- Ripple has proposed a public consultation to define its policy on cryptocurrencies.

Ripple‘s Managing Director for South Asia and MENA, Navin Gupta, has revealed more details about the company’s plans for India. In an interview with local Indian media, Gupta confirmed that Ripple plans to create a corridor for India.

With a 3-year presence in India, Ripple began operations in Bangalore and Mumbai, according to Gupta. Since then, the company has managed to grow and offers its services to 5 major banking institutions: Kotak Mahindra Bank, IndusInd Bank, Yes Bank and the Federal Bank.

Details about Ripple’s corridor for India

Despite the growth in India, Ripple has not yet implemented its payment solution with the digital asset XRP, On-Demand Liquidity. In this regard, Gupta described the country as a fast growing market, and with a population of 35 million Indians living outside the country, as an attractive location for implementing Ripple’s cross-border payment solution.

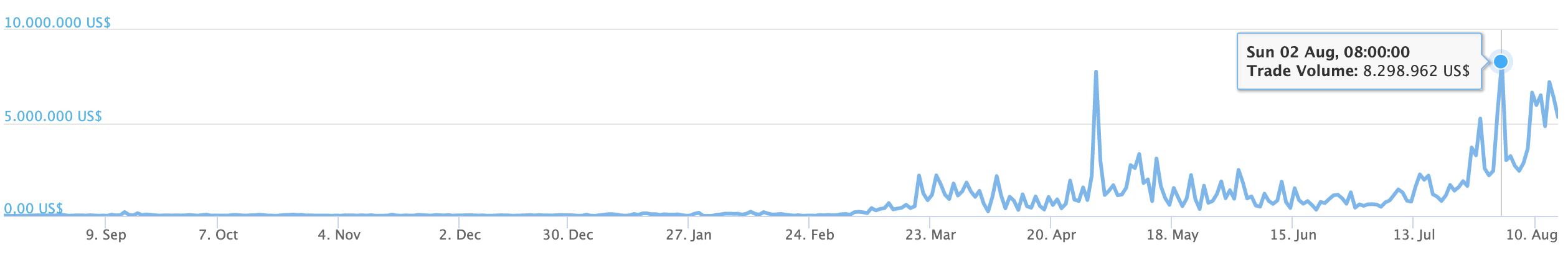

Data from CoinGecko shows that the trading volume on the major crypto exchanges in India has been steadily increasing in 2020. The lifting of the ban on crypto trading by the Indian Supreme Court in early March has had a visible impact.

On the exchange WazirX, the trading volume has reached an annual high of $12 million. Furthermore, the trading volume for Zebpay peaked on August 2 with $8 million in total, demonstrating the growing adoption of cryptocurrencies in India and the market’s potential for solutions like those offered by Ripple.

The Ripple executive said that of the total remittances sent to India from abroad, 7% of the total value is lost due to fees. In this regard, Gupta stated the following:

Ripple is keen to introduce the ODL (On-Demand Liquidity) solution to the India market to make remittances faster, easier, better and cheaper through the use of digital assets.

However, Ripple has one major concern and that is the lack of clear regulation and a robust legal framework to support operations with digital assets and cryptocurrencies. However, Gupta also said the company is optimistic about India’s progress in this area.

As reported by CNF, Ripple has proposed to the Government of India a model legal framework. Presented in late June 2020, the framework proposes policies that will enable the country to benefit from blockchain technology and crypto trade. However, there has been no affirmative response from the government.

On the contrary, new rumors have arisen about the possible reinstatement of the ban on trade of Bitcoin and other cryptocurrencies. On this possibility, the Ripple executive said the solution has to be regulatory. He stressed that instead of banning trade and stifling innovation, the government has to promote a legal framework that incorporates all actors in the financial ecosystem:

(…) we urge India’s policymakers to initiate a process of public consultations in connection with any proposed policy action touching upon digital assets in India. If the government takes the lead in enacting positive policy changes, it will initiate an opportunity for Indian businesses, entrepreneurs, innovators and consumers to benefit from digital assets in a safe and meaningful way.