- Ripple expands its regulatory compliance capabilities through the acquisition of Standard Custody, enhancing its position as a leader in providing enterprise blockchain and cryptocurrency solutions.

- Despite Ripple’s strategic advancements, XRP struggles to overcome resistance at the $0.53 mark, maintaining a sideways trading pattern.

On Tuesday, February 13, Ripple, a leading provider of enterprise blockchain and cryptocurrency solutions, announced its acquisition of Standard Custody & Trust Company, an enterprise-grade platform regulated for digital assets.

The surge in institutional adoption of cryptocurrency and blockchain technologies is driven by the availability of more sophisticated and highly secure products in the market, that adhere to regulatory standards. Through this acquisition, Ripple aims to bolster its regulatory compliance capabilities by leveraging Standard Custody’s limited purpose trust charter and its money transmitter licenses.

This strategic move adds to Ripple’s existing array of regulatory licenses, which includes a New York BitLicense, nearly 40 money transmitter licenses across the United States, a Major Payment Institution License from the Monetary Authority of Singapore, and a Virtual Asset Service Provider registration with the Central Bank of Ireland.

Speaking on the development, Ripple President Monica Long said that Ripple and Standard Custody will enable enterprises in order to reap the benefits of blockchain across financial use cases. “We will continue to leverage our strong financial standing to expand our product offerings, support new initiatives on the product roadmap and serve a broader segment of customers,” she added.

Ripple Expands Global Presence

Ripple continues to assert its global influence in the fintech sector, unveiling its latest move with the acquisition of Standard Custody. This strategic maneuver follows the previous acquisition of Metaco, a custody solution renowned for its adoption by international banks.

In addition to bolstering its custody capabilities, Ripple has inked significant partnerships with major financial institutions like HSBC, BBVA, and Zodia Custody. These collaborations signal Ripple’s commitment to providing top-tier custody solutions and expanding its Ripple Payments offering into new markets, notably Africa.

By doubling down on its core businesses in Payments and Custody, Ripple now boasts live commercial custody offerings in 20 regulatory jurisdictions and facilitates payments to 70 countries worldwide, solidifying its position as a global leader in the fintech landscape. Commenting on the development, Jack McDonald, Standard Custody CEO said:

“Standard Custody provides financial institutions with the confidence and platform to safeguard their digital assets. Ripple continues to lead the industry with its deep crypto expertise, relationships with financial institutions and strong product offerings, across both payments and custody. Together with Ripple, we will further innovate and extend our leadership position in providing crypto infrastructure”.

XRP Struggles to Overcome Resistance

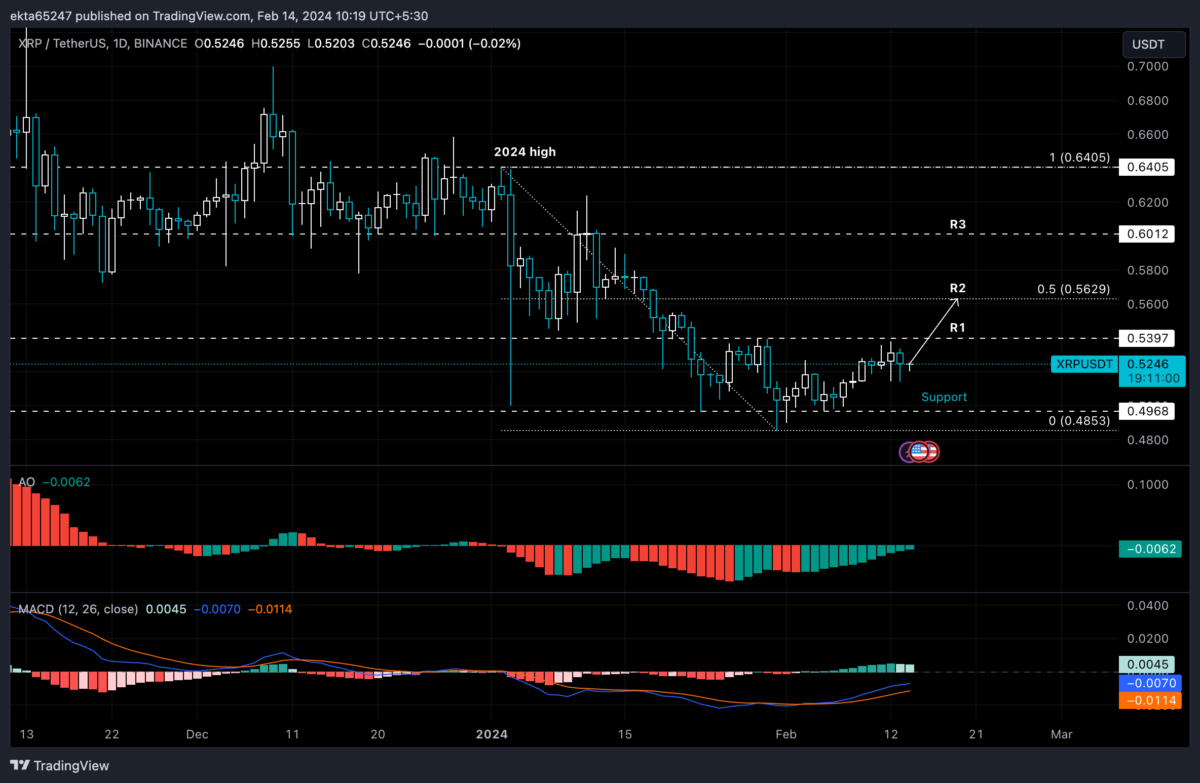

The price of XRP continues its sideways movement, encountering resistance as it aims to breach the $0.53 mark and reach its target of $0.56.

Since hitting a low of $0.4853 on January 31, XRP has maintained a sideways trading pattern, oscillating between resistance at $0.5397 and support at $0.4968. On Wednesday, the altcoin saw a slight decline to $0.5246 on the Binance exchange.

Immediate resistance for XRP lies at R1, marked at $0.5397. Beyond this, the altcoin faces further hurdles on its path to surpass its 2024 high, including resistance levels at the 50% Fibonacci retracement of its decline from the January peak, positioned at $0.5629, and at $0.6012, which served as a barrier throughout January.

A daily candlestick close below the support level of $0.4968 could undermine the bullish outlook for XRP and potentially lead to a retest of the January 31 low of $0.4853 before any substantial recovery is observed.

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.