- Tesla’s Q1 revenue missed expectations at $19.34B, with vehicle deliveries down 13% and stock plunging 41%.

- Despite market volatility and a 12% Bitcoin drop, Tesla held its 11,509 BTC, signaling long-term crypto confidence.

2025 starts as a tough year for the electric vehicle giant, as Tesla’s quarterly report shows revenue decline for Q1. According to the report, Q1 has marked the $19.34 billion revenue that falls short of Wall Street’s projection of $21.37 billion. That’s not only where the fall comes from, as the Tesla stock has also faced a 41% drop since January amidst the political controversies surrounding Elon Musk and persistent worker protests.

Amidst the declining trend, one element of the report remained unchanged: Tesla’s Bitcoin position. As of March 31, 2025, Tesla still holds 11,509 BTC. The decision not to sell even a fraction of this reserve came despite the coin’s 12% price drop during Q1, which briefly shrunk the stash’s value from $1.076 billion to around $951 million.

The crypto market didn’t stay down for long. Bitcoin has since bounced back, rising 10% and pushing Tesla’s holdings back above the $1 billion mark. This resilience shows Tesla’s commitment to its long-term investment approach, keeping Bitcoin as a strategic asset despite market volatility.

Tesla’s Bitcoin Confidence Holds Steady While Q1 Deliveries Down 13%

Tesla’s core auto business has stumbled. Q1 saw a 13% slide in vehicle deliveries and a 16% drop in production. This resulted in a 20% year-over-year fall in revenue from the company’s main segment. While the EV slump grabbed attention, the tech crowd focused on something else — Tesla’s crypto stance.

Unlike previous quarters, Tesla made no Bitcoin-related transactions. The company first entered the Bitcoin scene in February 2021 and sold off 75% of its holdings in July 2022. Since then, the stash has remained intact. Tesla’s choice to hold is seen as aligning with new accounting rules by the Financial Accounting Standards Board, which require companies to mark digital assets to market each quarter.

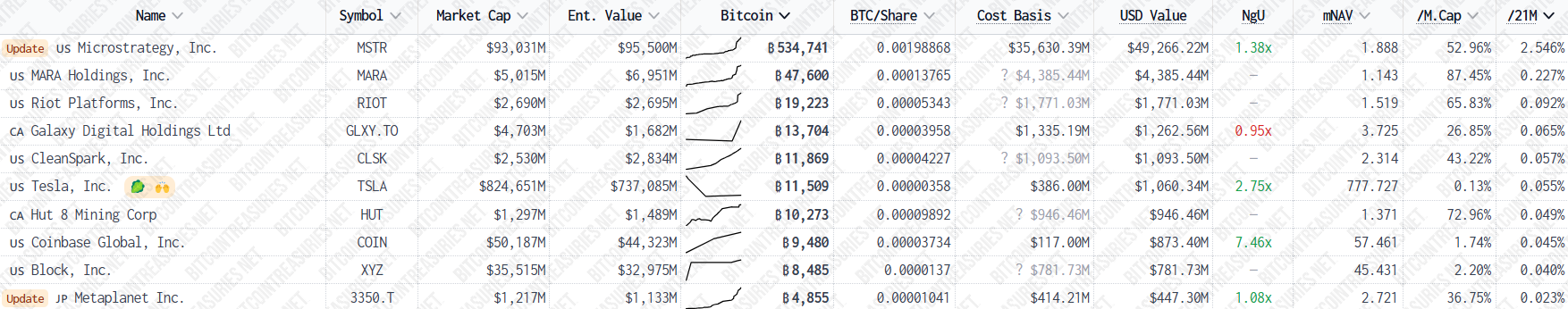

These changes impacted how Tesla reported value in the past, including a $600 million gain in Q4 2024 thanks to a Bitcoin rally. No such swing occurred in Q1 2025, but the position remained firm, reflecting confidence in crypto’s long-term performance. Other large firms, including Strategy and Metaplanet, are also adopting similar hold strategies.

Musk Keeps the Faith, Despite Financial Firestorm

With Tesla’s outlook uncertain and EV demand softening, Elon Musk appears unshaken in his cryptocurrency convictions.

“Not stepping down, just reducing time allocation now that DOGE is established,” Musk recently said.

Still, outside pressures are building. Analyst Dan Ives of Wedbush labeled the current moment a “code red situation” for Tesla. If Q2 brings no improvement, Musk may need to rethink Tesla’s broader financial setup, possibly including the Bitcoin holdings that have so far stayed off-limits.

The broader crypto market may lend support. Analysts expect ongoing turbulence until mid-May due to economic strains and uncertain trade policies. However, stronger growth is forecast in Q3, with tailwinds from institutional adoption, post-halving effects, and evolving US regulations.