- Based on four key figures, the German analysis company Blockfyre concludes that Ethereum (ETH) is “significantly undervalued.

- Mythos Capital founder Ryan Sean Adams shared an analysis of Gas usage, according to which the ETH price is at least 50 percent too low.

The vast majority of altcoins are still far from reaching their all-time highs, which they reached during the 2017 bull run. While Bitcoin is only about 55 percent away from its all-time high of nearly $20,000, the altcoins are well behind. Even Ethereum (ETH) has not been spared this trend and is around 85 percent behind its all-time high of USD 1,448.

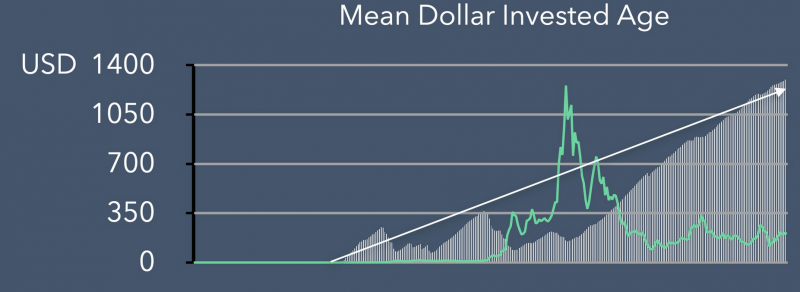

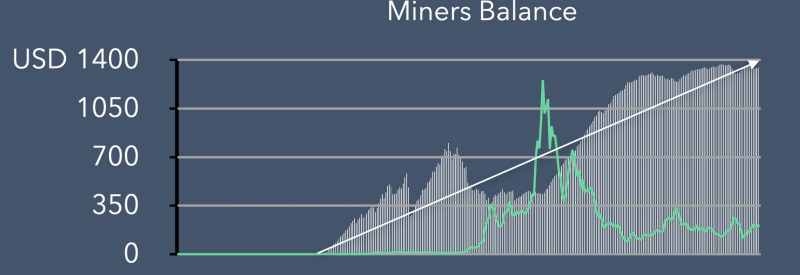

However, according to the research company Blockfyre, Ethereum (ETH) is “clearly undervalued”. Blockfyre yesterday published an analysis that assesses this based on four key indicators of the Ethereum ecosystem: developer activity, gas consumption, miner’s balances and the average age of investments. As the analysis company explains, the positive trend in all four metrics is a strong argument that Ether (ETH) is undervalued at the current price of around $200 and could be heading for a price increase.

As Blockfyre notes, the Ethereum Foundation and its developers have steadily increased development activities for the network since 2014, regardless of the price. According to the company, this indicates the health of the network and its great potential.

Another reason to be bullish on Ethereum, according to Blockfyre, is the metric of the “age of the dollars invested” which shows how long ETH has remained on addresses without being moved. This metric has risen steadily since 2018 and has recently recorded all-time highs. According to Blockfyre, this indicates that investors prefer to accumulate and hold ETH at the current price.

The amount of Gas used also speaks for the health and growing adaptation of the Ethereum network. The quantity is also constantly increasing and is currently reaching new highs.

Even more interesting, according to Blockfyre, are the ETH holdings of the miners of the Ethereum network. These are also rising steadily, indicating that even miners who have to sell their mining fees to cover their expenses prefer to keep ETH at the current price level.

Experts agree: Ethereum is undervalued

Currently, Blockfyre is not the only one who shares the opinion that Ethereum (ETH) is undervalued. The founder of Mythos Capital, Ryan Sean Adams, also shared this view the day before yesterday, independently of Blockfyre. In a blog post, Adams described that the ETH price could increase by at least 50 percent if the historical correlation between the price and the transaction fees continues to exist.

In support of his thesis, Adams shared a graph showing that over the past four years, the price of ether has been closely correlated with the transaction fees paid by Ethereum users for processing their transactions. Due to increased market activity, record volumes for stablecoins, especially Tether (USDT) and smart contracts for e.g. DeFi applications, fees have skyrocketed in recent weeks. In contrast, the price of Ethereum (ETH) has stagnated. Therefore, if the historical relationship holds, ETH is prepared to increase at least 50 percent, according to Adams.

In addition to Adams and Blockfyre, Santiment and Skew have recently made bullish comments about Ethereum. Su Zhu, CEO of Three Arrow Capital, spoke of an impending supply shock caused by the upgrade to the proof of stake. This view was shared by Adam Cochran, former marketing director of Dogecoin. He explained that Ethereum 2.0 will be the engine of unprecedented “economic change” as soon as it is launched.