- Mantra (OM) has grabbed headlines after losing 90% of its value in just 24 hours in a style similar to the UST crash.

- An analyst has noted that this significant price drop occurred soon after a Mantra-linked address had deposited 3.9 million OM on the OKX exchange; however, the protocol’s co-founder blames something else.

Just days after Mantra fuelled $1 billion asset tokenization for UAE’s DAMAC ventures, as we previously explored, its native token (OM) has suffered a devastating fall from $6.3 to $0.42 on Sunday evening, April 13. According to our market data, the asset lost almost 90% of its value within the period, “dragging” its market cap, which once peaked at $9 billion, to just around $765 million at press time.

What Could Be the Reason?

In our quest to find the possible reason for this UST-style crash, we found one interesting finding from an analyst called Max Brown. In an X post, Brown outlined that the whole crash started with a 3.9 million OM deposit on the OKX exchange from a team wallet. According to him, it was no secret that the Mantra team holds 90% of the total supply; henceforth, it could only be “reasonable” to focus the investigation on their recent activities.

Brown also made some interesting claims, including the active use of Market Makers (MM) to artificially inflate the price of OM. However, this is not even the main cause for alarm. The analyst claims that OM sales in large quantities started soon after depositing on OKX. Meanwhile, there is another twist. It was reported that the 90% crash was primarily triggered by Over-The-Counter (OTC) deals. According to Brown, an attempt to execute this deal with at least a 50% discount consequently forced a 50% drop in whale holdings, causing panic withdrawals.

Dismissing this and several other circulating rumors, the Mantra communication team on X called for calmness, as they claimed the token is fundamentally strong enough to come back. In their post, Mantra linked the market crash to “reckless liquidation,” which has nothing to do with the project or the team.

Mantra’s (OM) Co-Founder Clears the Air

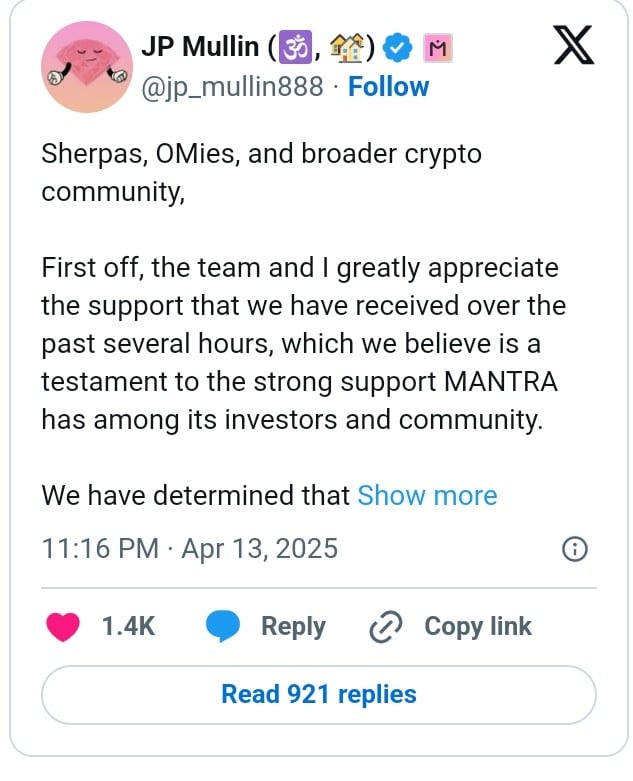

The co-founder and CEO of the protocol, JP Mullin, did not also remain silent. He explained that the “reckless liquidation” cited in their earlier update came from centralized exchanges, and was initiated on OM account holders.

Shedding more light on this, Mullin highlighted that all indications show that there was not enough warning or notice on the “sudden closure of accounts” looking at the timing and the degree of the crash. Above all, he claims that this could also be a coordinated or even intentional market positioning taken by the centralized exchanges. Meanwhile, he did not rule out the possibility of negligence, as this happened when liquidity was extremely low on Sunday evening.

The co-founder also dismissed all possibilities of rug-pull by claiming tokens are locked and subjected to vesting periods which are publicly available for reference. Concluding his update, Mullin cautioned investors to avoid clicking on scam links but instead rely on official accounts for updates.

In the coming hours, we will host a community connect on X, to discuss these events further. Please do NOT click on any scam links or accounts pretending to be affiliated with MANTRA. All official communications will ONLY come from my personal account or the main MANTRA X account.

Mantra’s price crash came unexpectedly as it recently launched a $108,888,888 million investment fund to improve Real-World Asset (RWA) adoption, as noted in our earlier post. In our previous update, Mantra was also found to be one of the most resilient assets as it stood strong in the face of the broad market chaos that brought Bitcoin to its lowest.