- Litecoin, in anticipation of its halving event, may be poised for a downturn similar to that of 2019.

- Potential short-trade opportunities can be identified using Fibonacci retracement levels.

The realm of cryptocurrencies is fraught with uncertainties. With the Litecoin halving event just around the corner, speculations are rife about its future trajectory, recalling the year-long downtrend experienced in 2019. Litecoin, the 12th largest cryptocurrency by market cap, showed strong bullish behavior early this year, although it was overshadowed by a firm bearish bias as we stepped into Q1.

The higher timeframe structure has consistently favored sellers, illustrated by Bitcoin’s recent plunge that galvanized the bears in the altcoin market, pushing prices lower. Despite this bearish trend, Fibonacci retracement levels offer potential for decent short-trade opportunities.

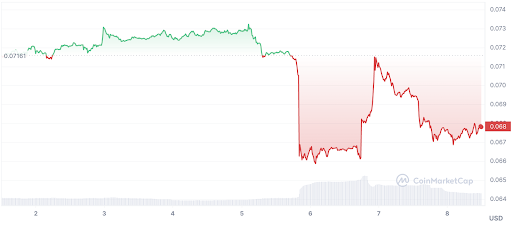

However, it was the unexpected push towards $100 in early June that the market dynamics took a turn for the worse. The uptrend ceased abruptly in mid-April and, at the time of writing, the dip below $75.27 signified a bearish structure in the 1-day timeframe. The H4 structure turned bearish on 5 June when Litecoin dipped below the higher low at $87.5.

Following the southern movement, Litecoin bounced back to $91.3, only to embark on a downward journey once again. The Fibonacci retracement levels marked that this downturn succeeded the retest of the 50% retracement level.

Similarly, the recent move downwards has its 50% retracement level at $75.2. This level closely aligns with the significant $75.27 level on higher timeframes, indicating a potential to short Litecoin at this point. Bearish targets include the March low at $65 and December 2022 low at $61.04.

Litecoin’s fate has been directed by sellers for the past week, backed by the spot CVD of Litecoin which demonstrated earnest selling activity. Notwithstanding, the minor bounce from $74 to $78 witnessed a marginal increase in Open Interest, which was comparatively trivial against the fall in OI during the sharp drop in prices.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.