- Solana is rapidly catching up to Ethereum, generating 50% of Ethereum L1 fees in the last 90 days.

- Solana outperformed Ethereum’s top L2s, generating 35% more fees over the last year.

Ethereum and Solana have been at the forefront of the blockchain ecosystem, constantly pushing the limits of what decentralized networks can accomplish. Michael Nadeau, the founder of The DeFi Report, recently discussed the performance differences between these two networks.

Ethereum fees are down 99% since March.

Yet the network has still done 7x the fees of Solana over the last year.

But how should the two networks be compared?

Should we include L2s?

And how does Solana stack up against all of Ethereum's L2s combined?

A quick 🧵analyzing… pic.twitter.com/YICgvH3Psl

— Michael Nadeau (@JustDeauIt) September 12, 2024

Ethereum Fee Dominance and the Role of Layer 2 Solutions

According to Nadeau, Ethereum fees have dropped by an astounding 99% since March. Despite this decline, Ethereum has generated seven times the fees of Solana in the previous year, cementing its position as an industry leader.

However, one critical question remains: how should these networks be compared? Should we consider layer 2 (L2) scaling solutions? And how does Solana compare to Ethereum’s L2s?

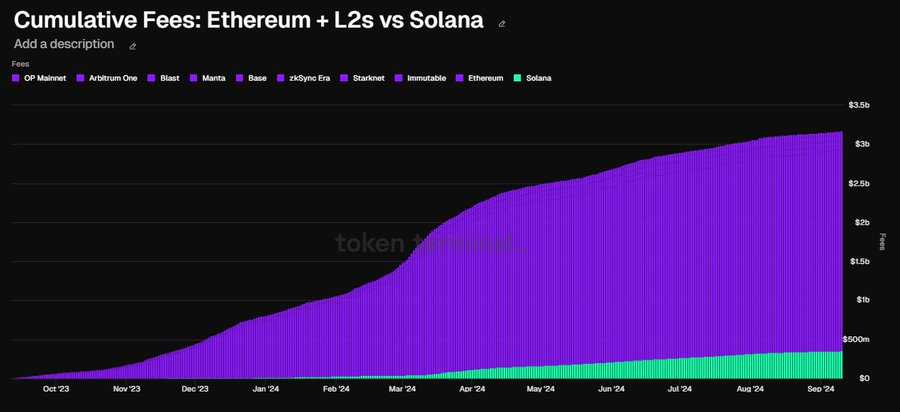

When we look at the big picture, Solana is quickly catching up. In the last 90 days, Solana has generated 50% of the fees collected by Ethereum’s Layer 1 (L1). This is an impressive feat; however, the situation changes when Ethereum’s L2 networks are included.

Logic says that L2s fuel demand for Ethereum; therefore, they should be included in any comparison. When L2s are taken into account, Ethereum greatly surpasses Solana, producing nine times the fees over the last year.

This striking contrast demonstrates Ethereum’s broader network effect and the relevance of its L2s in preserving its dominance.

Recent data show an interesting pattern. In the previous 90 days, Solana has generated 30% of Ethereum’s L1 and top L2 fees. This is a strong indication of Solana’s increased competitiveness. However, when we compare Solana to Ethereum’s top L2s, the comparison becomes even more remarkable.

In this example, Solana surpasses the combined L2s, generating 35% greater fees in the past year. This data highlights Solana’s growing importance in the blockchain world, particularly in terms of fee generation, which is a strong indicator of network activity and demand.

Nadeau’s examination of Token Terminal’s new dashboard feature gives significant context to the ongoing argument between Ethereum and Solana. It demonstrates that, while Ethereum, with its L1 and L2s, continues the lead in terms of overall fees earned, Solana is making tremendous progress.

Solana’s ability to catch up to Ethereum’s L1 and even outperform its L2s demonstrates that it is a strong competitor in the blockchain ecosystem.

At the same time, the overall financial environment is changing as large traditional financial institutions embrace digital assets. According to CNF, Standard Chartered has acquired approval from the Dubai Financial Services Authority to provide custodial services for Bitcoin and Ethereum.

Bill Winters, Standard Chartered’s CEO, underscored the bank’s trust in the revolutionary power of digital assets in the financial system. This move represents an increasing acknowledgment of cryptocurrency by traditional financial institutions, showing that the adoption curve is steepening.

Meanwhile, as we previously reported, the Ethereum whales have changed their behavior. Since early July, these significant holders have shifted from increasing to transferring their Ethereum holdings.

This change in conduct could suggest a shift in market sentiment, as well as a redistribution phase that could result in more market activity. At the time of writing, Ethereum is trading at $2,346.09, down 0.29% over the last 24 hours.

Meanwhile, in the same period, the SOL token was trading at around $134.54, down 0.24% with a daily trading volume of $1.33 billion.

Recommended for you:

- Buy Ethereum Guide

- Ethereum Wallet Tutorial

- Check 24-hour Ethereum Price

- More Ethereum News

- What is Ethereum?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.