- The data analysis company Glassnode revealed that 60% of the Bitcoin (BTC) supply remained static for a year, a figure that preceded the legendary bull run in 2017.

- Analyst Dave the Wave predicts a correction of the Bitcoin price to $6,700 unless the cryptocurrency rises above $9,800.

The data analysis company Glassnode has revealed an indicator that preceded Bitcoin‘s price rally in 2017. At that time, Bitcoin’s price entered a bull market that led to Bitcoin reaching its historic high of $20,000. This rally was accompanied by strong “hodl” behavior from investors. Glassnode now notes that the figure of Bitcoin hodlers is back at the 2017 level for the first time.

At the time of publication, Bitcoin’s price was $9,554, with an increase of 1.08% in the last 24 hours.

Behavior of Bitcoin investors points to new rally

As can be seen in the graph below, Glassnode has determined the behavior of Bitcoin investors since 2010. In this context, the data analysis company concludes that 60 percent of Bitcoin’s supply has not moved, i.e. has not been transferred, in the last year. This represents the first time since the bull run in 2017 that this figure has been at such a high level, suggesting a “hodl” behavior of investors and a possible rally, Glassnode stated. The figure is also significantly above that of 2018, when only 40% of Bitcoin supply was not moved.

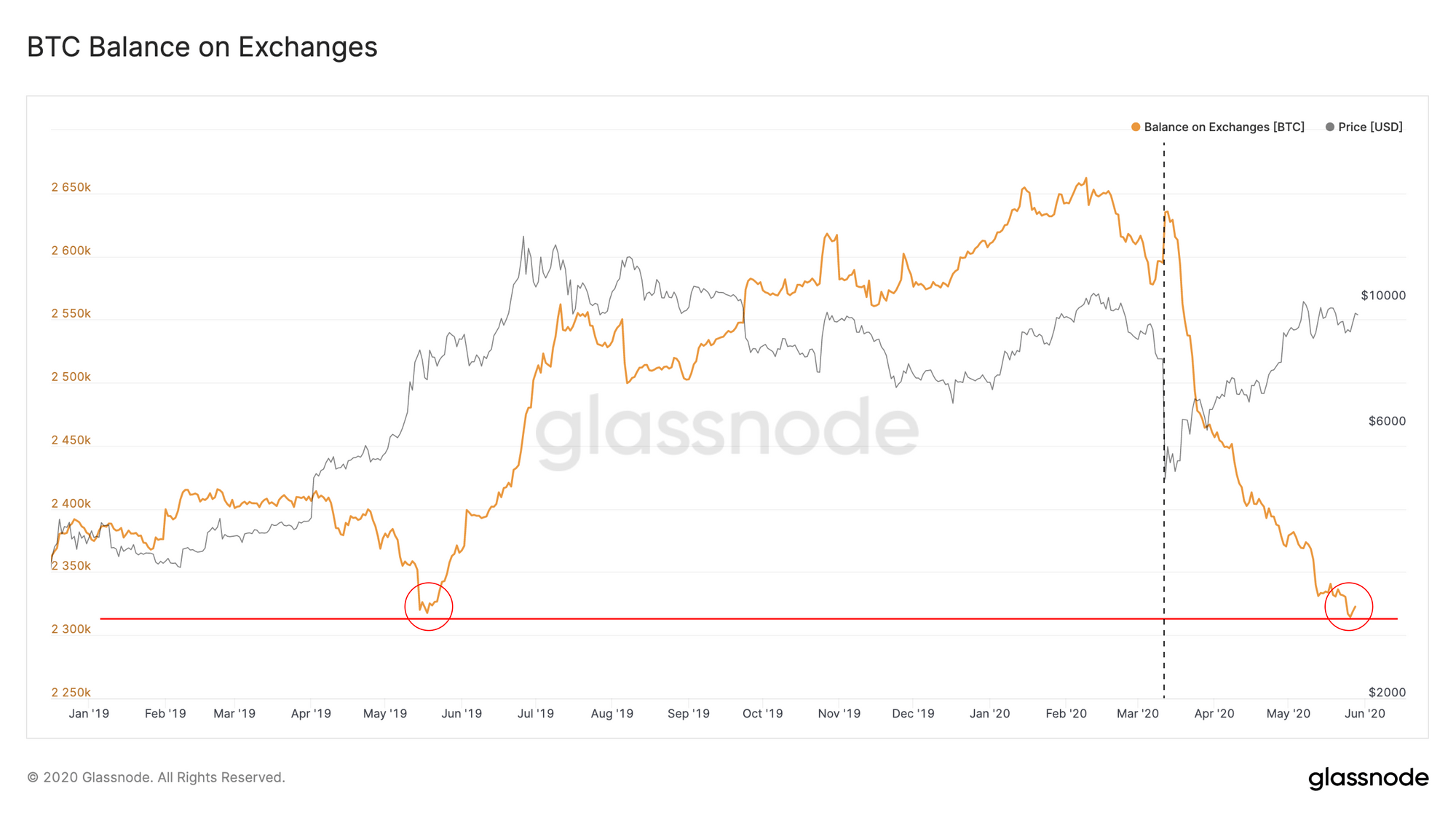

This indicator is supported by the Bitcoin balance on exchanges. According to Glassnode the amount is at its lowest level in a year and has been declining since “Black Thursday” when the Bitcoin price fell to under $4,000. Glassnode claims that this is a bullish indicator for Bitcoin. As can be seen in the chart below, the amount of Bitcoin on the exchanges is currently on the level of May 2019 just before Bitcoin reached its yearly high of about $14,000.

However, the research firm points out that the reduction in the amount of Bitcoin has not been the same for all exchanges. Bitfinex and BitMEX are the platforms that have the highest loss in the amount of Bitcoin they hold with -66% and -35.6%. In contrast, exchanges like Coinbase, Binance and Bitstamp have maintained and slightly increased their Bitcoin balance for the same period.

Glassnode attributes the above phenomenon to a loss of confidence, market forces, and a shift of funds storage to cold wallets. BitMEX, for example, experienced a DDoS attack that prevented its users from withdrawing their funds during the Black Thursday crash. The research firm claims that investor behavior responds to many factors. In that sense, Glassnode stresses that the information it has gathered does not indicate an imminent rally.

Other analysts, such as Dave The Wave are rather bearish about the BTC outlook. The analyst said that the cryptocurrency has yet to break the significant barrier of $9,800 to confirm an upward trend. Otherwise, the analyst expects the BTC to fall back to the $6,700 mark in the next two months. The analyst stated the following about the BTC price in the short term and shared the chart below:

Has anyone drawn a descending triangle yet? This would double up nicely with the .38 fib [just taking price into the 6K range], and triple up with the larger reverse head and shoulders drawn a month ago above.