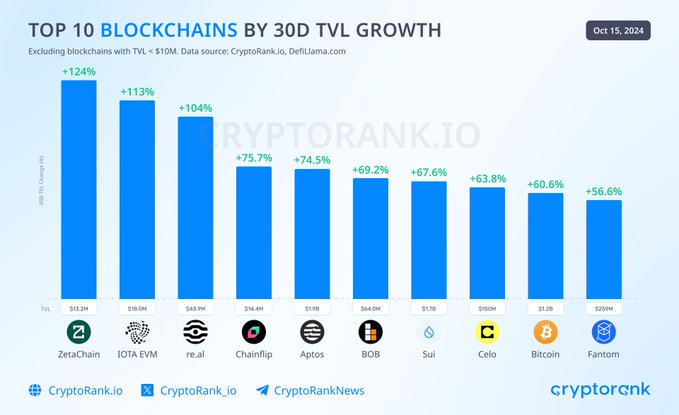

- IOTA EVM has climbed the ladder to become the second-highest performer in the Decentralized Finance industry with a Total Value Locked (TVL) growth of 113% in the last 30 days.

- The top performer within the industry was ZetaChain with a $124% growth within the period under review.

IOTA EVM has emerged as one of the top contenders in the Decentralized Finance (DeFi) industry with a staggering growth of 113% in Total Value Locked (TVL) to reach $18 million in the last 30 days according to data from research and analytics platform CryptoRank.

Analyzing the list of top ten performers, we discovered that IOTA was second behind ZetaChain which recorded an impressive 124% in just 30 days to record a TVL of $13.2 million. The third position was occupied by Re.al, with a growth of 104% to reach $43.9 million, followed by Chainflips Labs, which recorded a surge of 75.7% to hit a TVL of $14.4 million.

The remaining projects on the list were Aptos (74.5%), BOB ($69.2%), Sui Network (67.6%), and Celo (63.8%). Bitcoin and Fantom Opera occupied the ninth and tenth positions with 60.6% and 56.6% growth respectively.

Commenting on this, Web3 builder and Venture Fund Nakama Labs pointed out that the incredible growth margin of IOTA EVM within the period underscores its expanding use cases and the growing trust in decentralized solutions on the network. According to him, such a level of growth could be a “pulling point” to attract a broad number of developers and users to the network.

IOTA EVM’s Journey So Far

On September 4, CNF announced that IOTA’s TVL was quickly surpassing a historic milestone of $5 million. Fascinatingly, the project’s co-founder, Dominik Schiener, boasted that the unexpected rising level was achieved organically with no marketing or calculated incentive campaign. On October 14, it was announced that the IOTA EVM had reached $15 million in TVL. This implies that it took just three days to record an additional $3 million to reach the current level of $18 million. Meanwhile, the project’s native token has barely made any laudable move in the past couple of weeks.

According to our market data, IOTA’s price has managed only a 0.81% surge in the last 30 days despite the broad market mini-rally. In the last seven days, IOTA has surged by 1.9%. However, its 24-hour performance has been negative with a 3.98% decline. At press time, the asset was trading at $0.1237.

Meanwhile, IOTA has been actively deploying cutting-edge solutions and developmental initiatives, including the recently announced new IOTA Labs account. As we reported, this is expected to operate as an independent ecosystem arm to turn impressive ideas into solutions. To experts, this could, in the long run, fuel growth and adoption and subsequently have a significant effect on its price.

iotalabs🧩 is live! Meet #IOTA‘s new, independent ecosystem arm to accelerate and empower growth & drive adoption. #iotalabs🧩 is where raw potential meets a catalyst to turn bold ideas into solutions that elevate growth & redefine what’s possible. 🔗 https://t.co/6Gyf3sXPe6 pic.twitter.com/lSl9kPSumq— iotalabs (@iotalabs_) October 15, 2024

For the start, IOTA Labs has put $2 million in incentives to support the initiative over a period of six months for the benefit of users and developers within the entire ecosystem.