- The Bitcoin price recorded a strong rebound after the crash to $8,900 and has risen again to $ 9,485 at the time of writing.

- The technical analysis shows that the short-term downward trend of Bitcoin has not yet been stopped, but the impulse from the stock market could initiate a new test of the $10,000.

After it looked like the bears were gaining the upper hand on the crypto market yesterday, Bitcoin posted a strong rebound from the fall to $8,900. Within the last 24 hours, the Bitcoin price climbed again to $9,595, but was initially rejected at this level. At the time of writing, Bitcoin was trading at $9,485, and recorded a gain of around 4.5%.

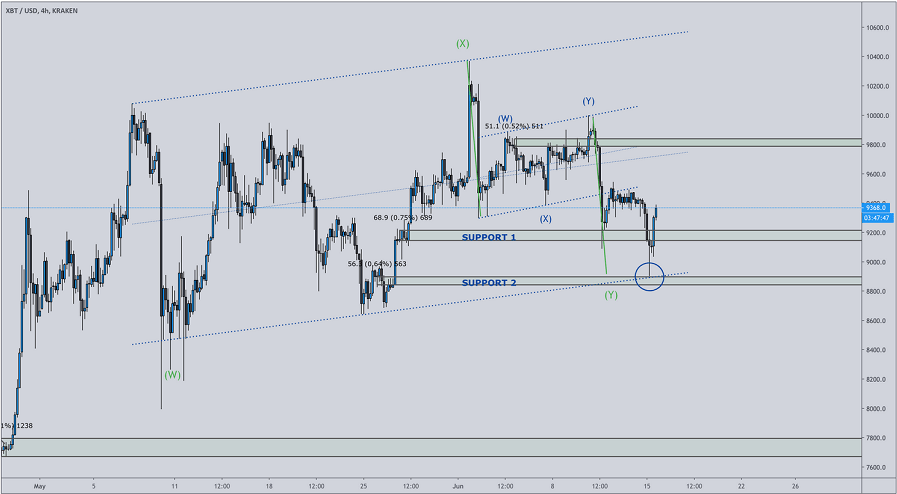

As we reported yesterday, Bitcoin broke through the currently important support level below $9,200. This brought the support zone at $8,800 into play, which, if breached, would have made a major correction likely. However, as the anonymous trader “Credible Crypto” noted, this enormously important support could be maintained.

The Bitcoin price has only briefly scratched the support zone, as can be seen in the chart below, and then bounced off it. This level thus solidifies as a very strong support level.

However, because the Bitcoin price was initially unable to recapture the $9,550 mark permanently, it appears to continue to trade in a critical range. As Josh Rager analyzed and explained to his 73,000 followers on Twitter, the aforementioned mark and then $9,800 must fall to stop the downward trend:

To maintain a bullish perspective price must reclaim $9550. Then reclaim $9800+. Until then, personally feel like the downtrend can continue.

What was striking about the downward trend that lasted until yesterday and the subsequent rise of Bitcoin was, as some analysts discovered, that the trend once again coincided with that of the stock market and especially that of S&P500. Like Bitcoin, the S&P500 suffered a sharp drop last Thursday that lasted until yesterday. Yesterday, however, the S&P500 made a turnaround, which some mainstream media analysts described as the biggest reversal in 3 months.

One reason for this, as Charles Edwards of Capriole Investments noted, was certainly the announcement by the US Federal Reserve (FED) for further measures to support the financial market. The FED stated that it would buy corporate bonds from the primary and secondary markets. Edwards was very critical about this move:

The stock market corrects by -9% in one week, so the Fed announces that it is now buying up corporate bonds… You might as well throw all traditional valuation and technical techniques out the window at this point.

The free market is dead. Long live the zombies.

Either way, the monetary policy of the FED once again seems to be a driving factor for the Bitcoin price. Numerous experts, such as Mike Novogratz and Arthur Hayes, have already shared this analysis in the past. The BitMEX CEO recently stated that Bitcoin will reach a price of $20,000 by the end of the year, as demand will increase due to the inflationary policy of the FED:

I will reiterate, that is inflationary because more fiat money will chase a flat to declining supply of real goods and labour. There are only two things to own during the transition to whatever the new system is, and that is gold and Bitcoin.

In contrast to the Bitcoin market, some technical indicators in the stock market, such as the Relative Strength Index (RSI), show that stocks are overbought. Thus, it could be heading for a negative correction, while Bitcoin’s RSI is in neutral territory and the FED’s stimulus could be building momentum for a rally above the $10,000 mark.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.