- Amid economic turmoil, Bitcoin, often termed “digital gold,” mirrors gold’s resilience during 1970s stagflation conditions.

- Tariffs and inflation may weaken traditional markets, while Bitcoin thrives as a risk-adjusted alternative investment.

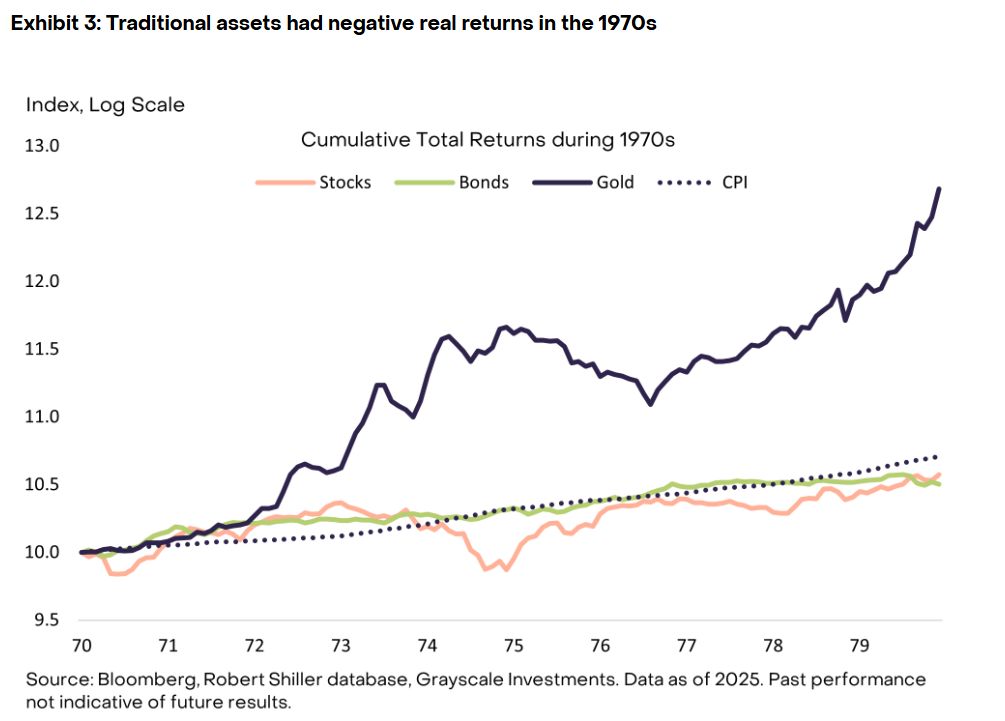

When inflation starts burning holes in traditional assets, investors begin searching for alternatives. Grayscale Research has drawn a striking parallel between Bitcoin’s recent behavior and gold’s dramatic rise during the 1970s stagflation era. The U.S. economy then faced sky-high inflation, sluggish growth, and weak returns from mainstream markets.

Grayscale Research points out that continued inflationary pressures in the coming period may be beneficial to scarce commodities such as Bitcoin and gold. Like gold in the 1970s, Bitcoin now has a rapidly improving market structure, which is supported by changes in US government…

— Wu Blockchain (@WuBlockchain) April 13, 2025

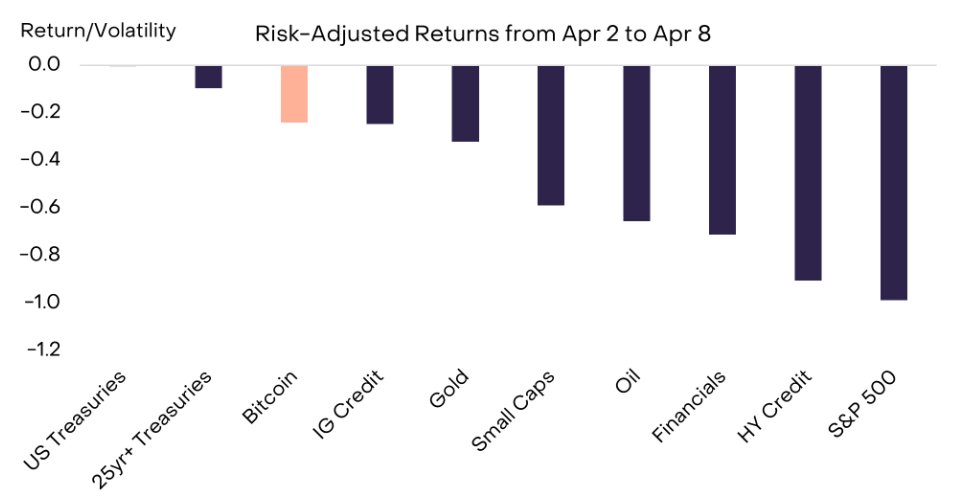

The April 2 tariff announcement from the White House triggered a swift market reaction. Nearly every asset class felt the pressure. By April 8, the S&P 500 had plunged about 12%. But Bitcoin held its ground better than expected, dipping just 10%. That’s despite Bitcoin being three times more volatile than equities. If it followed equity movements exactly, its drop should’ve been closer to 36%.

Bitcoin’s price volatility is typically around three times higher than the S&P 500. Therefore, if Bitcoin had a 1:1 correlation with equity returns, the decline in the S&P 500 would have implied an 36% drop in the price of Bitcoin,

A few days later, on April 9, came a temporary reprieve—tariffs not involving China were paused for 90 days. Markets bounced slightly. Even so, both Bitcoin and the S&P 500 remained about 4% lower than before the tariff drama began.

Trade, Tariffs, and a Weakening Dollar

Tariffs can act like slow poison for economies. Prices rise, growth slows, and foreign investment gets shaky. Economists expect these new tariffs to weigh on the U.S. economy for at least a year. The White House aims to shrink trade deficits, but that goal might come at a cost. As imported goods become more expensive and the economy slows, stagflation looms large.

Grayscale notes that this mix of inflation and stagnation benefits assets that are hard to come by—like gold was in the 1970s, and Bitcoin might be now. Back then, while inflation soared to an average of 7.4%, U.S. stocks and bonds returned just 6% annually. Gold, however, shot up by 30% each year.

Bitcoin, now labeled digital gold by many, shows signs of similar potential. Despite current volatility, its performance has surpassed equities on a risk-adjusted basis. And while trade tensions weigh heavily on traditional markets, they may actually lift Bitcoin over time.

History Echoes Through Crypto

If trade talks stall and tariffs deepen, the U.S. Dollar might take another hit. Already overvalued, the Dollar’s global dominance could shrink. The share of the Dollar in global currency reserves far exceeds America’s slice of global output. A weaker Dollar, paired with falling trade volumes, might push central banks to explore other assets.

“Although near-term policy uncertainty is very high, in our view long-term oriented investors should position portfolios for sustained Dollar weakness and generally above-target inflation — consistent with how periods of severe U.S. trade frictions have been resolved in the past,” says Grayscale.

Gold’s breakout in the ‘70s wasn’t random—it happened as bonds underperformed, inflation surged, and traditional markets lost trust. Grayscale suggests that Bitcoin might benefit the same way in today’s economic storm. If stagflation sets in, it could mark a turning point for digital assets.