- The Ethereum Muir Glacier hard fork was successfully activated on 02 January, 8:29 AM (UTC).

- Until the time of the fork, major exchanges such as Coinbase, Bitfinex, Huobi and Poloniex have still not declared their support.

The ninth Ethereum hard fork, Muir Glacier, was activated a few minutes ago, on 02 January, 8:29 AM (UTC). This time, however, the hard fork is not expected to go quite smoothly. As CNF reported a few days ago, only a few exchanges had announced their support for the upgrade due to the holidays. Up to the time the hard fork was activated, the situation had changed only slightly.

So far, of the major exchanges, only Binance, Kraken, Bittrex and Bitso have declared their support for Muir Glacier. Other exchanges such as Coinbase, Bithumb, Huobi, Poloniex, Gemini and Bitfinex have still not issued any statement regarding the implementation of the new software. While support seems only a matter of time, it remains to be seen what the impact of the delayed implementations will be.

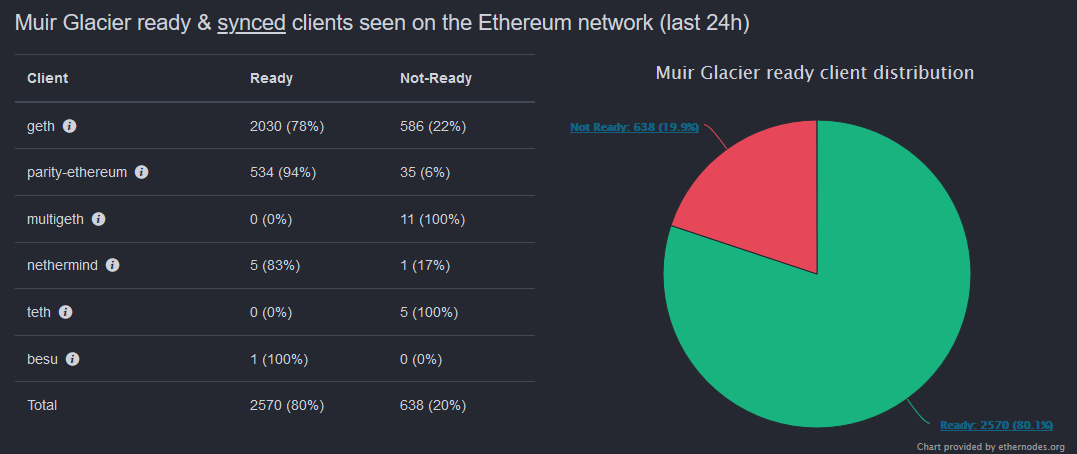

After all, around 80% of all ETH clients were updated at the time Muir Glacier was activated, as the data from Ethernodes shows. The last fork, Istanbul, was accepted much more slowly. At the beginning of December, only slightly more than 60% of all nodes were updated at the time of activation. The rest updated their software afterwards.

Muir Glacier is activated at block #9,200,000

According to various personalities in the Ethereum community, Muir Glacier was activated at Block #9,200,000, as Joseph Delong, Senior Software Engineer at the Ethereum incubator ConsenSys also reported. However, the fork did not run without problems. Delong also reported that Nethermind forgot to update its nodes, resulting in a “syncing” error.

Some one wake up @nethermindeth your nodes are rejecting blocks after the fork. pic.twitter.com/bzohAI1k6s

— joseph.eth (@josephdelong) January 2, 2020

According to Etherscan, the first Muir Glacier block was created by Spark Pool and a total of 132 transactions were included.

Why was Muir Glacier implemented?

Muir Glacier is also referred to as an emergency hard fork in the ETH community because shortly after the implementation of Istanbul, it became apparent that the Difficulty Bomb occurred earlier than expected. As a result, it was necessary to schedule another hard fork at short notice. With Muir Glacier, the Difficulty Bomb will shift by 4 million blocks, or about 1.7 years.

This mechanism was originally implemented by the developers at ETH, in addition to Difficulty Retargeting, as a deterrent for miners to force the transition from Proof of Work (PoW) to Proof of Stake (PoS) with Ethereum 2.0. The Difficulty Bomb increases the mining difference every 100,000 blocks using a complex algorithm. The increase is initially small, but increases exponentially. Thus, the effect is hardly noticeable at first, but then becomes very quickly noticeable.

Because of this the effect it was hardly visible before Istanbul. After it, the average block times increased continuously. While the average block time from March 2019 to the end of October was still around 13 seconds, it rose to over 17 seconds before the hard fork.

Despite the activation of Muir Glacier, the Ethereum price is still in crypto winter. Since the end of June 2019, the ETH price has fallen from over 330 USD to currently around 130 USD. An important step for Ethereum could be the launch of Ethereum 2.0. Phase 0 with the Beacon Chain is scheduled to start in the first half of 2020. In line with the general market sentiment, the ETH price is currently still showing a sideways trend of – 0.8% over the last 24 hours.

Follow us on Facebook and Twitter and don’t miss any hot news anymore! Do you like our price indices?

Recommended for you:

- Buy Ethereum Guide

- Ethereum Wallet Tutorial

- Check 24-hour Ethereum Price

- More Ethereum News

- What is Ethereum?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.