- Ali Martinez predicts that a breakout above $0.58 could trigger a rally toward $1.80 or $5.80, potentially elevating Dogecoin’s market cap to $860 billion.

- The U.S. SEC’s recognition of Grayscale’s Dogecoin ETF proposal has sparked interest, raising hopes for institutional adoption.

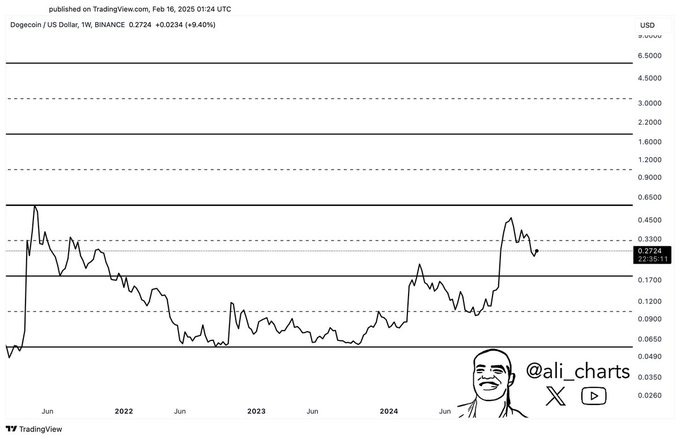

Dogecoin (DOGE) price appears to have the potential for a price breakout, with analysts targeting a critical zone that can push the meme coin to record highs. The meme token is presently trading slightly below $0.30. Meanwhile, technical signals are indicating that a breakout past this point may bring tremendous buying momentum.

Dogecoin Price Breakout Soon?

Dogecoin has been trading in a parallel channel, and a breakout at $0.58 may be an indicator of a significant rally, crypto analyst Ali Martinez said. “If Dogecoin is in a parallel channel, a breakout above $0.58 could lead to a move towards $1.80 or even $5.80,” Martinez wrote in an X post on February 16.

Martinez’s analysis suggests that DOGE’s short-term resistance is $0.33, and $0.58 is a critical level for bullish continuation. Historically, the Dogecoin price has been highly volatile, and breaking above these levels could result in significant price acceleration. If DOGE hits the $5.80 level, its market capitalization would potentially reach around $860 billion, which could place it as the second-largest crypto after Bitcoin if Ethereum sees minimal price appreciation.

To add to the positive sentiment, anonymous market analyst Trader Tardigrade noted that DOGE price’s momentum indicators indicate a possible rebound. In a February 16 post on X, the analyst noted that Dogecoin’s three-day Relative Strength Index (RSI) has moved into a rebound zone, a sign that has in the past led to huge price hikes, as mentioned in our previous article.

The analyst pointed to a pin-like candlestick pattern at a local low, along with a bullish RSI divergence. This occurred prior to significant DOGE price rallies in February and July 2024, when the RSI recovered from oversold levels, resulting in a move higher. The present market configuration resembles those previous occurrences, suggesting a possible price bounce.

Speculation Over Spot Dogecoin ETF

Apart from technical considerations, speculation about the potential for a spot Dogecoin exchange-traded fund (ETF) has driven investor attention, as noted in our earlier post. The likelihood of institutional funds flowing into the DOGE market increased after the U.S. Securities and Exchange Commission (SEC) recognized Grayscale’s proposal for a Dogecoin ETF.

SEC recognition prompted a 240-day evaluation period prior to final approval. In the event of approval, the ETF will provide institutional and retail investors with a regulated entry point to take exposure in DOGE, perhaps adding liquidity and demand.

At press time, Dogecoin price traded at $0.2671, up by 0.43% in the last 24 hours. However, on the weekly time horizon, the crypto has risen around 6%. Whilst, short-term indicators are bearish, with DOGE currently below its 50-day simple moving average (SMA) of $0.328. On a long-term basis, though, the asset is still above its 200-day SMA of $0.235 in a bullish setup.

Meanwhile, according to TradingView data, the Relative Strength Index is at 41.39. Hence, since DOGE is not in an overbought situation, there is room for upward movement.