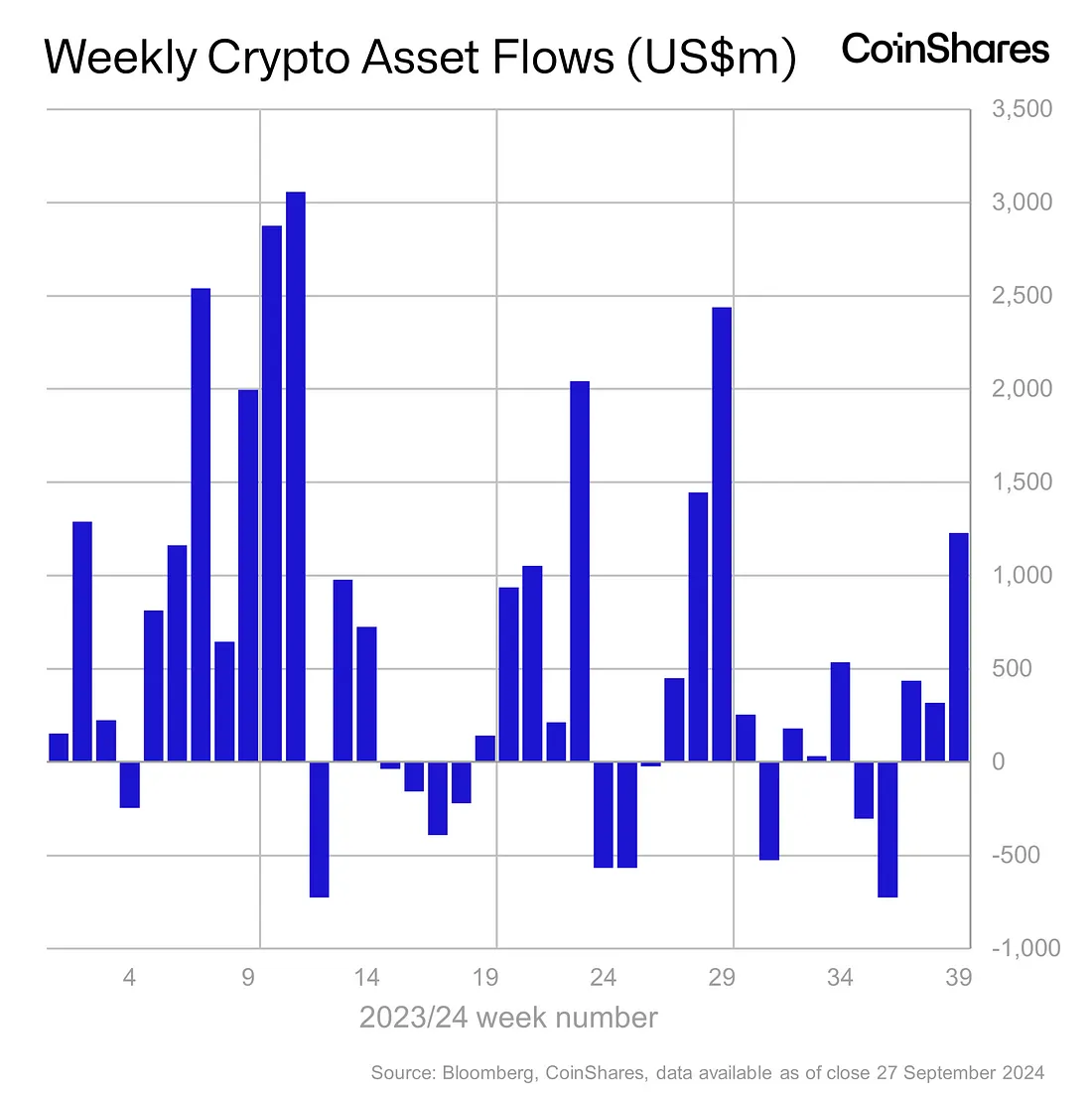

- Expectations of dovish U.S. monetary policy led to $1.2 billion inflows into digital assets in just three weeks.

- Bitcoin led inflows with $1 billion, while Ethereum reversed a five-week outflow trend with $87 million inflows.

According to the recent CoinShares Weekly Report, digital asset investment products have seen a spectacular third week of inflows, totaling $1.2 billion. This spike is largely due to the expectation that the US Federal Reserve will maintain its dovish monetary policy position, which has encouraged renewed interest and confidence in the digital asset market.

Investor optimism has grown, resulting in a 6.2% increase in total assets under management (AuM) last week. The acceptance of options for certain U.S.-based investment products has fueled this notion even further, while trading volumes have not increased in tandem, showing a nuanced and cautious stance by investors.

Digital Assets Gain Momentum as Bitcoin and Ethereum Attract Major Inflows

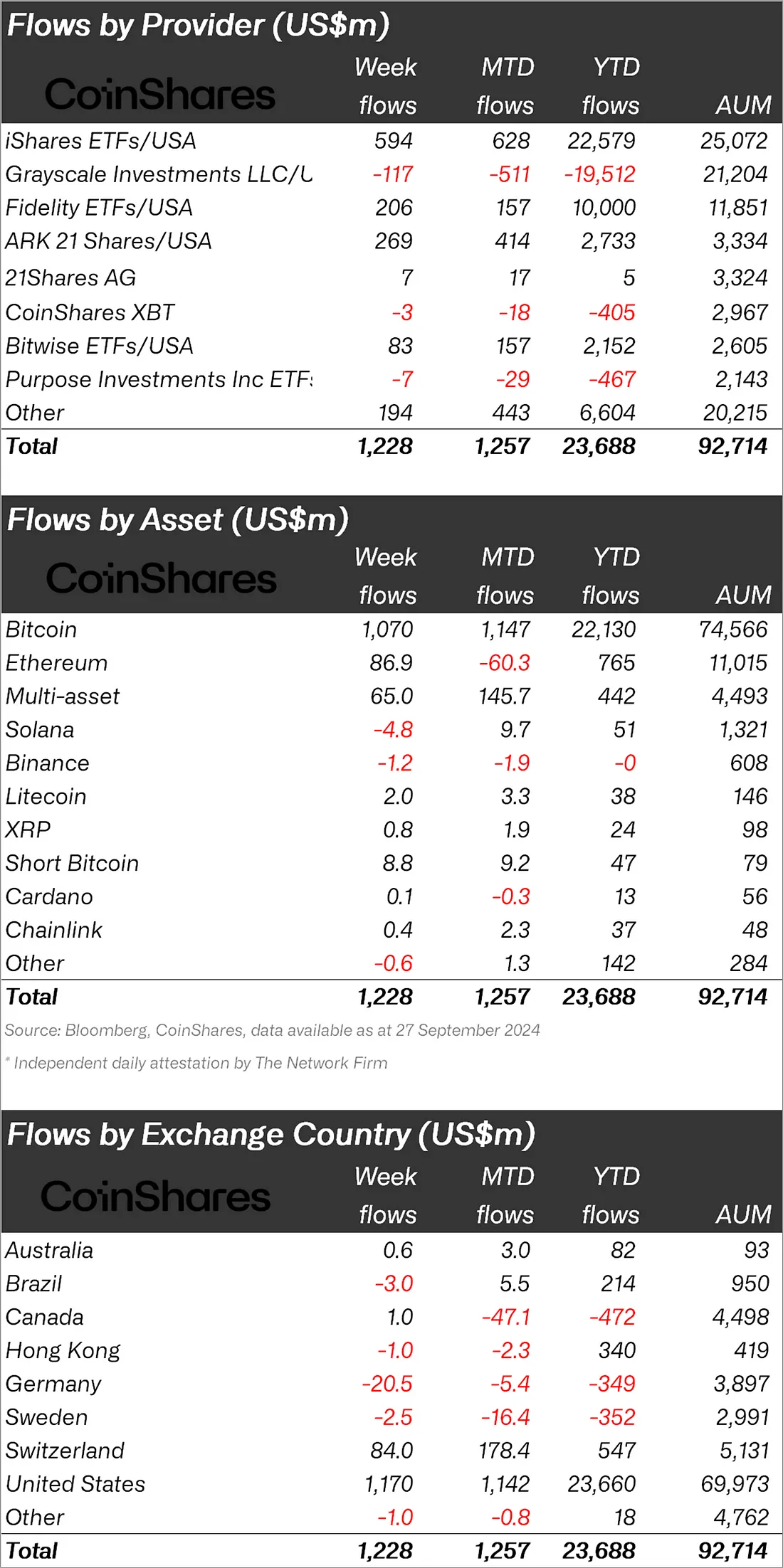

Bitcoin emerged as the biggest benefit, collecting $1 billion in inflows, highlighting the cryptocurrency’s market dominance.

This significant input into Bitcoin sparked interest in short-Bitcoin investment instruments, with $8.8 million inflows. Such a tendency indicates that, while confidence about Bitcoin is high, some investors remain cautious and are hedging their bets, anticipating potential corrections in the near future.

Ethereum, the second-largest cryptocurrency by market value, had $87 million in inflows, breaking a five-week downward trend.

This is a huge turnaround for Ethereum, as it is the first measurable inflow since early August. It represents a comeback of investor confidence in Ethereum’s prospects, which could be motivated by the expectation of impending improvements and advances within the Ethereum ecosystem.

Interestingly, the inflow patterns varied significantly between locations. The United States and Switzerland were the most significant contributors, with the former leading the way with $1.2 billion in inflows and Switzerland following with $84 million, its greatest influx since mid-2022.

In contrast, Germany and Brazil saw outflows of $21 million and $3 million, respectively, demonstrating the disparity in investor sentiment across markets.

The disparity between regional inflows and outflows points to a polarized outlook on digital assets, which may be a result of various regulatory frameworks, market maturity, and investor preferences.

The performance of altcoins was uneven. Solana experienced considerable issues, with outflows of $4.8 million, in stark contrast to Litecoin and XRP, which saw positive inflows of $2 million and $0.8 million, respectively.

Meanwhile, Binance Coin (BNB) and Stacks experienced $1.2 million and $0.9 million withdrawals, respectively, reflecting the cryptocurrency market’s continued uncertainty and volatility.