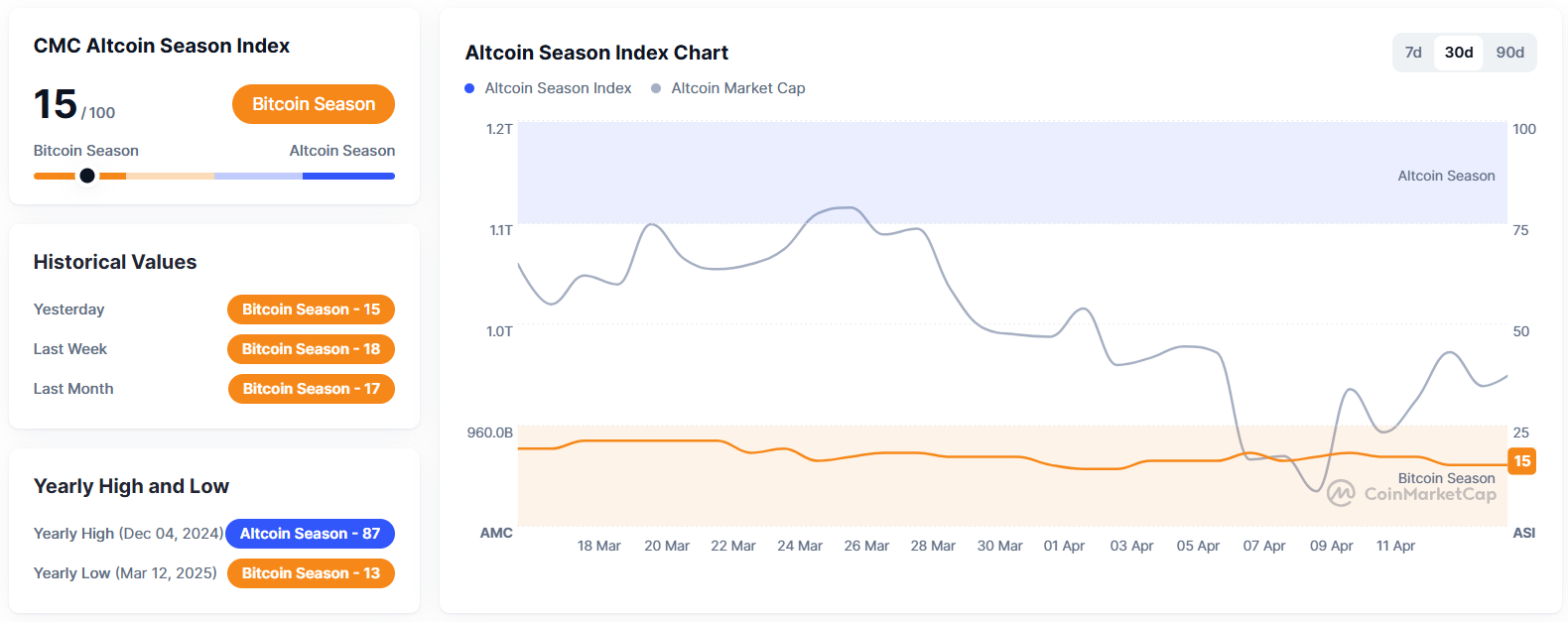

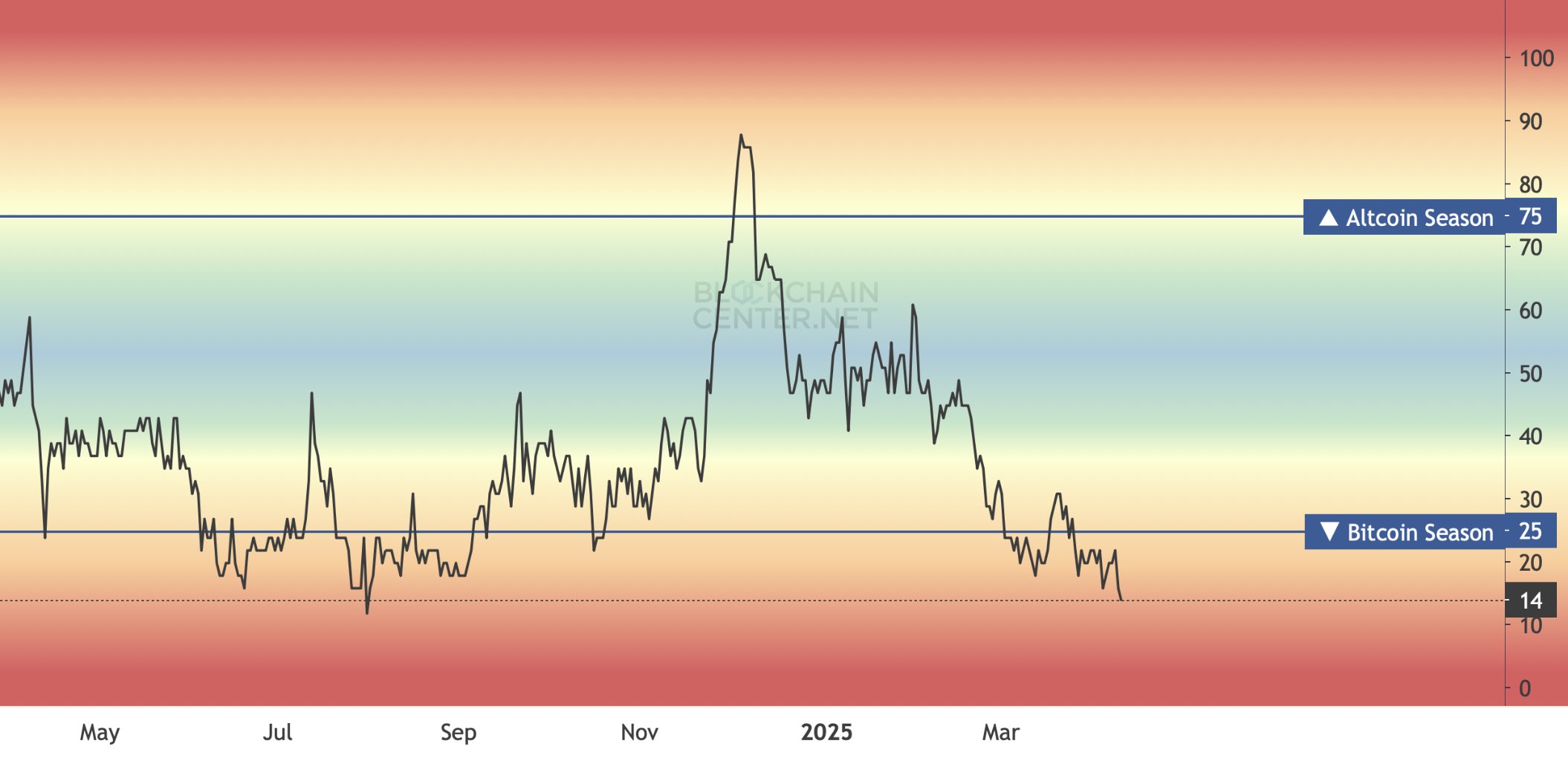

- The Altcoin Season Index’s drop to 15 signals potential rally, mirroring its 2024 plunge before a sharp 88-point surge in four months.

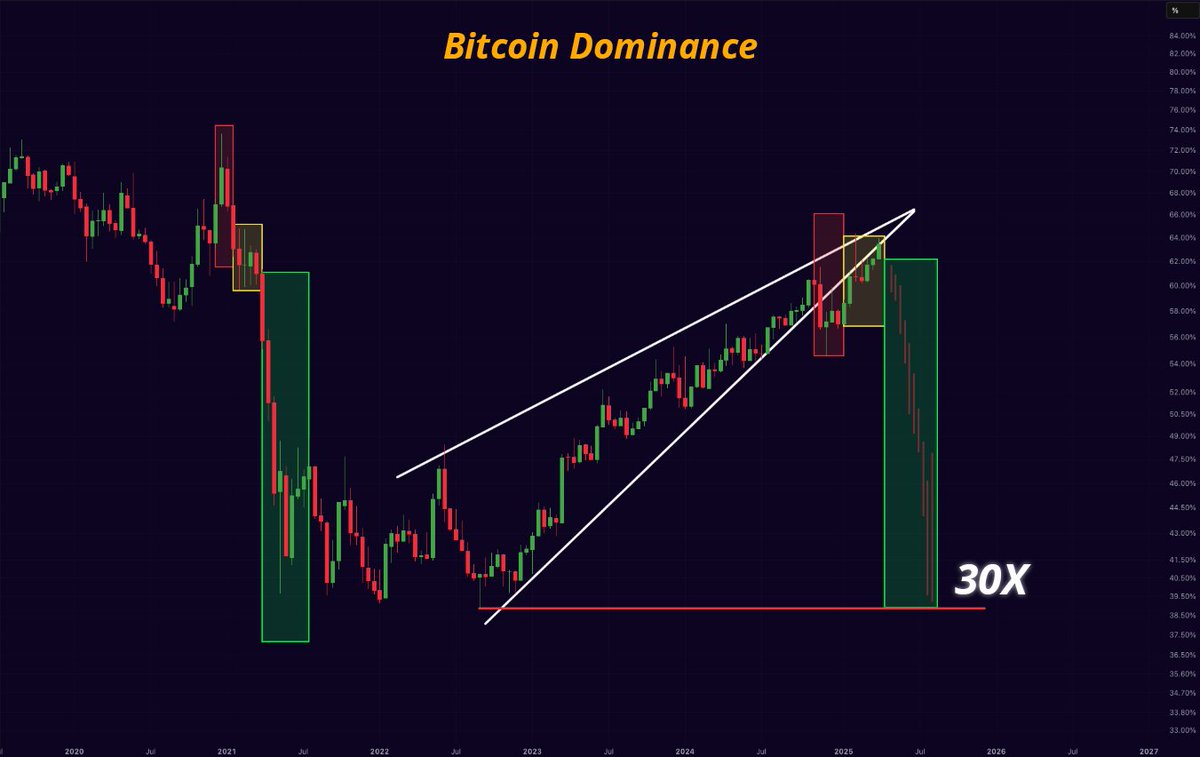

- Bitcoin’s dominance faces resistance amid a rising wedge pattern, sparking speculation of a shift toward altcoins ahead of a possible breakout.

The crypto market is hitting another shift as the Altcoin Season Index plunges to 15 — a level that previously marked the calm before the storm in 2024. When the index reached that same number last August, it was followed by a sharp rally that sent it soaring to 88 in just four months. That historical pattern has some eyes widening and fingers hovering over the “buy” button.

Bitcoin’s dominance in the market is now bumping into stiff resistance. The charts are drawing up what analysts call a rising wedge pattern, which typically hints at a slowdown or reversal. That’s got traders speculating whether we’re in for a shift in momentum away from Bitcoin and toward alternative coins — a setup that’s often the prelude to an altcoin breakout.

Looking closer, Mister Crypto, a known market voice, summed up the optimism in a post dated April 9, 2025:

Bitcoin Dominance will collapse. Altseason will come. We will all get rich this year!

Pressure Builds as Tariff Delays and Policy Moves Align

One of the key macro drivers behind the growing optimism is President Trump’s decision to delay tariffs by 90 days, which gave markets a breather and encouraged risk-on sentiment. This policy move is being viewed as a tailwind for the crypto space, especially for altcoins that often benefit when market appetite broadens beyond Bitcoin.

In addition, central bank strategies are under a microscope again. Crypto Rover weighed in on the monetary policy outlook with another bullish signal:

Once QE starts. Altcoin season will make a massive comeback!

If quantitative easing does kick in, it might inject fresh capital that spills into the digital asset sector — particularly non-Bitcoin tokens, which tend to respond more aggressively.

Yet, even with all this optimism and the charts lining up, there’s a growing sense that the game might be changing. Kaiko Research offered a more cautious perspective by suggesting that classic “altseasons” might not behave like they used to.

According to their analysts:

Altseasons may become a thing of the past, necessitating a more nuanced categorization beyond just ‘altcoins,’ as correlations in returns, growth factors, and liquidity among crypto assets are diverging significantly over time.

The overall takeaway from this evolving conversation is that while a surge could be coming, it may not lift every coin in the market. The tightening focus on Bitcoin and just a few high-performing altcoins has led to an uneven distribution of gains. That means any rally sparked by the low Altcoin Season Index could be more selective.

So while the index’s dive to 15 may be ringing some bells for seasoned traders, the landscape is different now than it was a year ago. With liquidity increasingly flowing toward tokens backed by strong fundamentals and real-world utility, picking the right altcoins might matter more than ever before.