- Crypto funds saw $240M outflows, with Bitcoin and Ethereum leading the weekly decline in investor interest.

- Despite outflows, total assets under management rose, showing digital asset resilience versus global equities.

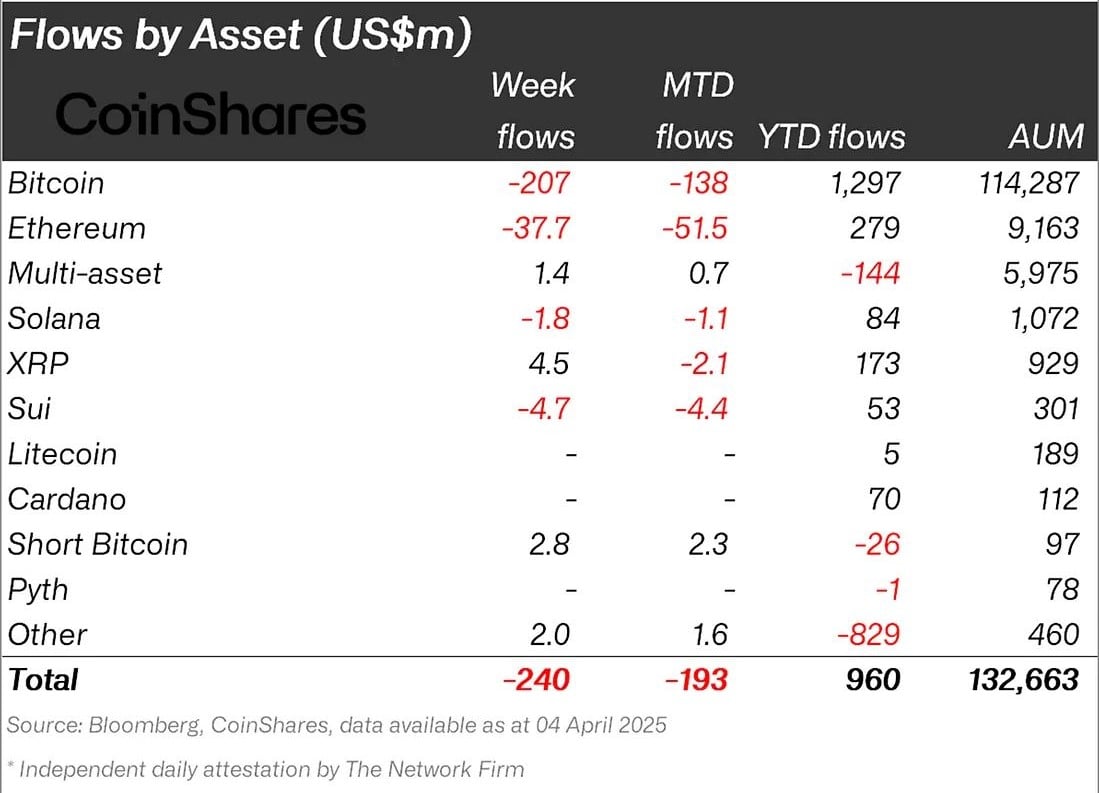

Last week, outflows from digital asset investment products reached $240 million. This figure seems to signal that market players are taking a step back. According to CoinShares, Bitcoin was the hardest hit, accounting for about $207 million of the total, followed by Ethereum with outflows of $37.7 million.

While altcoins such as Solana and Sui only recorded smaller numbers—$1.8 million and $4.7 million—the trend still shows a broader trend: many investors are taking a defensive position.

Interestingly, the main cause of the withdrawal of funds seems to be news of the new trade tariff policy from the United States government.

The policy has raised concerns that the rate of economic growth could slow, prompting investors to be more cautious. Although the crypto market is known to be risky, it seems that this time they are not immune to external pressures.

Digital Assets Stand Tall as Global Stocks Stumble

However, there is one rather surprising fact, where despite the large outflows, the total assets under management (AUM) of these products actually increased by 0.8% during the week, reaching $132.6 billion.

To put it into perspective, while global stocks included in the MSCI World category actually fell 8.5% during the same period, digital assets were able to survive and show an increase. It is like someone who remains standing strong even though they are hit by strong winds, while others have already been blown away.

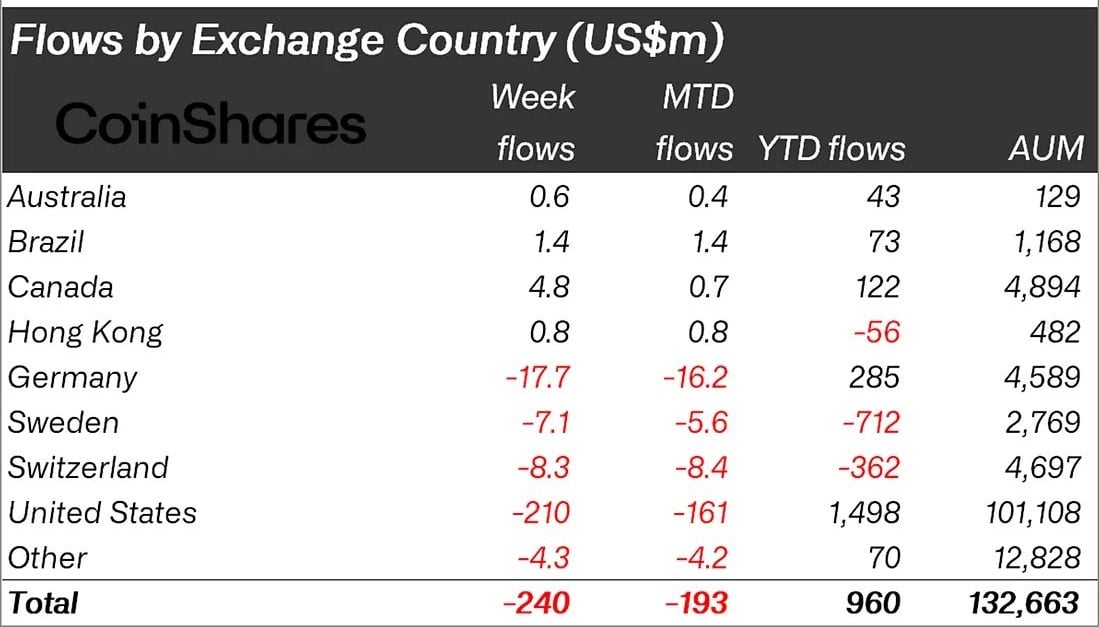

If you look at the global map, the largest outflows came from the United States and Germany—$210 million and $17.7 million, respectively. But on the other hand, investors from Canada saw this situation as an opportunity. They even added to their positions with a total inflow of $4.8 million.

It can be said that their approach is quite bold, like someone who keeps a shop open during a storm because they know that customers will still come.

Bitwise Bets on Income Amid Crypto Market Jitters

Furthermore, even though the crypto market is not very friendly, it does not mean that there are no new movements. CNF previously reported that Bitwise has launched three new actively managed ETFs.

These ETFs use a covered call strategy related to highly volatile crypto stocks such as Coinbase (COIN), MicroStrategy (MSTR), and Marathon Digital (MARA). These ETFs are here to create an income stream while still following the movement of stocks that are closely related to the crypto world.

This kind of strategy is actually nothing new in the investment world. But in the middle of this seesaw situation, an approach that focuses on passive income can be interesting. Especially for investors who are tired of token price volatility and want something “safer” but still within the scope of digital assets.

Galaxy Digital Expands Into London With FCA Approval

Meanwhile, Galaxy Digital—a crypto asset company owned by billionaire Mike Novogratz—has just received the green light from the UK financial authorities. They are licensed by the Financial Conduct Authority (FCA) to trade derivatives and provide financial advisory services from their London office.

Galaxy Europe CEO Leon Marshall cited regulatory clarity and London’s strategic position as a financial hub as the main reasons for the expansion.