- The total number of Bitcoin and Ethereum users has had a growth of almost 50% in the last year.

- BTC’s price rally has increased the pace of crypto market growth as well as institutional adoption fueled by MicroStrategy.

Crypto.com has released a report on the use and size of the crypto market and information about its users. Titled “Measuring Global Crypto Users,” the results were obtained from data on major exchange platforms and indicate an increase in global adoption.

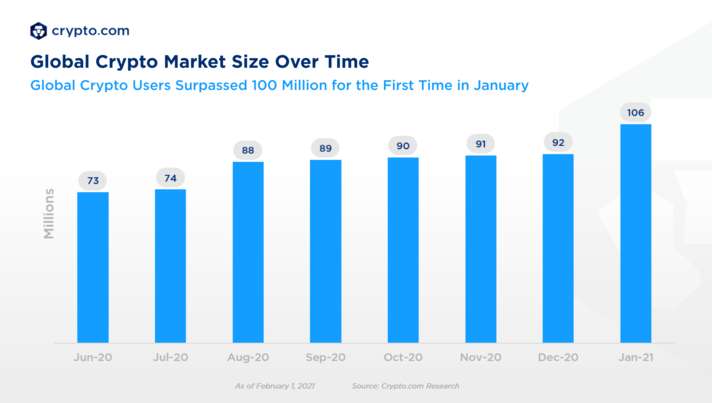

The total number of cryptocurrency users at the end of May 2020 was estimated at 66 million users. According to new results found by Crypto.com, the total population of crypto users has increased and reached a major milestone in 2021 with 106 million users.

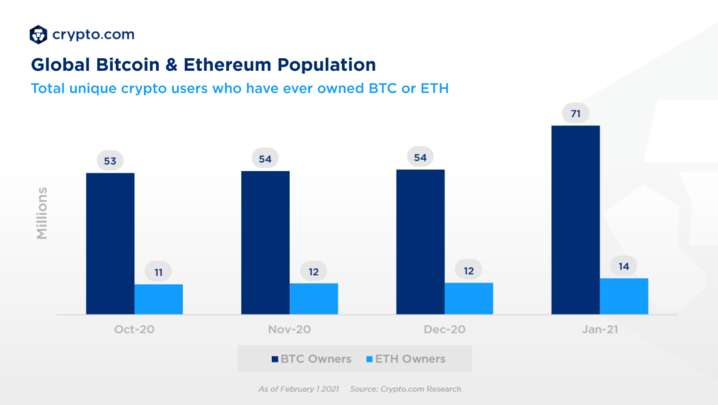

Of that total, 71 million are Bitcoin users and 14 million are Ethereum users with 25% of the figure owning both cryptocurrencies and 35% lacking funds in both. As the graph below indicates, August 2020 and January 2021 were the months with the biggest increase in the total size of the crypto market.

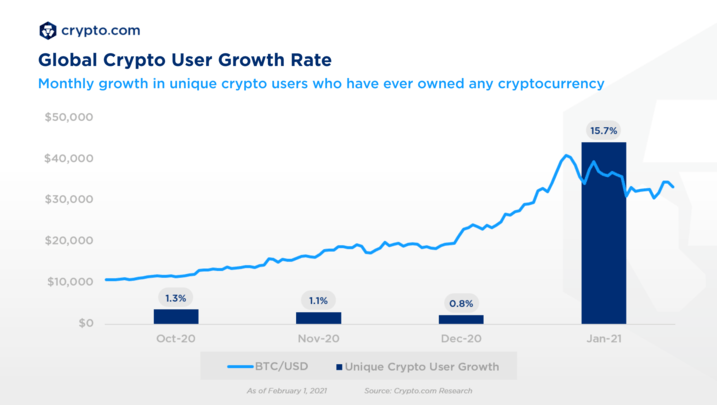

The report also shows that the growth of the market rises when the Bitcoin price is also going up. In this sense, the rally of the first cryptocurrency by market capitalization was driven by users already participating in the network and “supported by new users”, as shown below.

Remarkably the study found that Ethereum was the cryptocurrency that led the market growth during August 2020, in one of the strongest months – the reason: a boom in the DeFi space.

Reasons for the growth

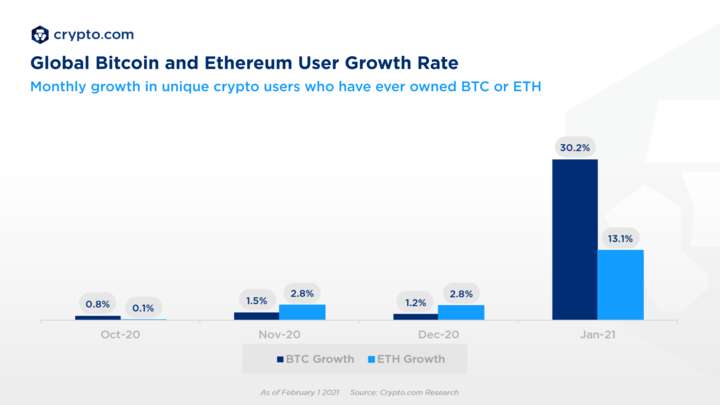

At the same time, January 2021 was the best month for Bitcoin in terms of an increase in users who have ever owned BTC with 30.2%. On this metric, Ethereum posted a 13.1% rise in the same period. That figure surged along with the sustained rally in Bitcoin’s price.

In January 2021, the deposit rate for Bitcoin users stood at 28% with a total number of non-overlapping addresses of 3,336,825 and a total number of addresses of approximately 20 million. Ethereum, meanwhile, recorded a deposit rate of 33% with 910 non-overlapping addresses and 4.7 million total addresses on select exchanges.

The study indicates that the increase in crypto adoption can be traced to 3 key events: the launch of PayPal‘s crypto offering, the announcement of MicroStrategy‘s treasury strategy, and the participation of Grayscale. Thus, the study confirms the theory of the crypto community that Grayscale and MicroStrategy as a model for other companies have the greatest impact on the Bitcoin price.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.