- A U.S. district judge extended the Binance vs SEC lawsuit to 2026.

- The court approved the SEC’s motion to amend claims about Binance’s ICO, BNB sales, and its staking program.

The ongoing legal battle between Binance and the U.S. Securities and Exchange Commission (SEC) is set to extend into 2026, following recent orders from the district court. The judge has granted several important motions, including the one that allowed the SEC to revise the original complaint filed in the case, which remains one of the most high-profile in the industry.

SEC Granted Permission to Amend Complaint

The SEC has now been able to file an amended complaint against Binance, Binance.US, and Changpeng Zhao. The lawsuit, initially filed for unregistered securities sales, has expanded to encompass other complaints about Binance’s conduct. Judge Amy Berman Jackson granted permission to the agency to modify the complaint based on the fact that the SEC has been using the term ‘crypto asset securities’.

This approval has come under the backdrop of criticism from the crypto community. Ripple’s Chief Legal Officer Stuart Alderoty said that the term “crypto asset security” is an invention, and the SEC is trying to twist the language.

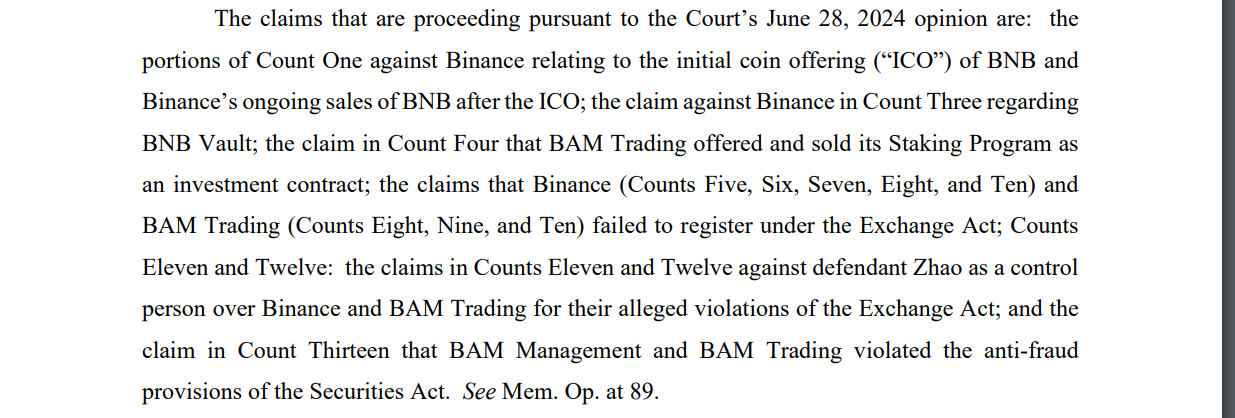

As a result of the amended complaint, the court has identified the main allegations that will be considered. Among these are claims that Binance’s initial coin offering (ICO) of its native token, BNB and the ongoing sales of BNB are securities sales. The SEC has also questioned Binance.US’s staking program for offering unregistered investment contracts, according to the complaint.

More claims are directed to Changpeng Zhao for his role as a control person of Binance and BAM Trading in connection with the alleged violations of the anti-fraud provisions of the Securities Act. The court has allowed these claims to go to discovery but has also declined some of the allegations, including those that concern secondary sales of BNB and the sale of Binance’s own stablecoin, BUSD.

The court has also stated that it will not be determining the status of tokens such as SOL, ADA and MATIC as securities in this case because the tokens are not named defendants in the case.

Timeline Extended to 2026

The recent scheduling order by the court provides a new time frame for the lawsuit. The discovery process will likely be protracted since fact discovery is slated to conclude in November 2025. The document production and interrogatories must be served by July 2025, and deposition and expert discovery by March 2026.

Key deadlines include the exchange of the initial disclosure by October 25, 2024, and the responses to the amended complaint by November 4, 2024. The court has offered a very elaborate program on how the matter is to be addressed and this in fact extends the time frame. The case is now expectedto continue until 2026, making it a long-drawn-out legal battle that might set the pace for future crypto regulations in the U.S.

In June 2023, the SEC charged Binance with operating as an unregistered exchange, broker, and clearing agency, thus violating federal securities laws. The SEC seeks to ban Binance from these activities unless registered and further wants the company to surrender “ill-gotten gains” and pay civil fines.