- Cardano’s (ADA) Charles Hoskinson has announced that he will unveil the project’s roadmap at the upcoming Buenos Aires Cardano Summit on October 19.

- Meanwhile, ADA has been predicted to continue its bearish run as traders congest the $0.388 and $0.4 price range with short positions.

Cardano (ADA) lost grounds to fall outside the top ten largest-ranked cryptos after a mini “headwind” blew across the market to push the broad market into consolidation. According to our market data, ADA was down by 1.48% in the last 24 hours and trading at $0.38.

Interestingly, this decline occurs ahead of the growing reports that Cardano’s Charles Hoskinson is preparing to unveil a new roadmap in Buenos Aires, Argentina.

Speaking on this, Hoskinson disclosed that his appearance at the Cardano Summit implies that he would miss out on the Foundation Summit in Dubai. As a keynote speaker at the Summit on October 19, which would witness the participation of Argentina’s pro-Bitcoin president, Havier Milei, the Cardano co-founder has hinted that he would seize the opportunity to present on the project’s roadmap after Voltaire.

According to the existing roadmap, the Voltaire era began with the “Chang” hard fork, which is meant to make the network fully decentralized with the introduction of governance, as we formerly explained.

Cardano’s (ADA) Price Reaction

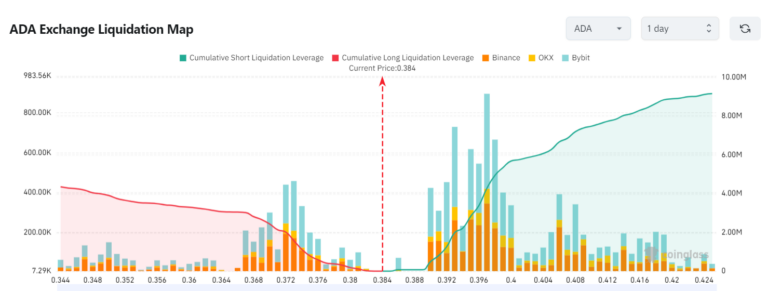

Unlike the typical bullish trend that follows such developments, ADA has abandoned the previously predicted breakout from a falling channel and taken a nosedive. Interestingly, data suggests that the bearish run could continue as most traders resort to short positions rather than long positions. According to Coinglass data, 9.16 million of the assets are currently in shorts, while 4.35 million are in longs. To analysts, this level is currently 18% below the current price and could position the asset to $0.31.

Taking a further look at the Coinglass data, it was observed that the majority of the shorts lie between the price range of $0.388 and $0.4. This implies that the asset could face serious resistance to breaking out of this range. According to analysts, this resistance is confirmed by the 200-day exponential moving average (EMA).

For now, investors hope hinges on the ability of the $0.36 price point to act as temporary support since this coincides with the 50-day EMA. If this happens, ADA could take a rebound to retest the 200-day EMA resistance. However, the failure of bulls to sustain the price above this level could see the asset decline to $0.31, as we stated earlier.

In the worst possible scenario, failure of the asset to break into the 200-day EMA after bouncing off the 50-day EMA could lead to the formation of a double-top bearish reversal pattern. This implies that ADA may fall to $0.25.

Another Analyst is Bullish on Cardano

Conversely to this position, a crypto analyst identified as TrendRider recently predicted that ADA could record a massive gain in the coming weeks against Bitcoin. According to him, the recently tested $0.398 zone coincided with the 21-day exponential moving average (EMA). This implies that the asset could take a bullish reversal if it manages to recapture the $0.39 zone.

Per his analysis, this thesis is also valid for other altcoins that bounced back from two significant corrections of 20% each on August 5 and September 6.