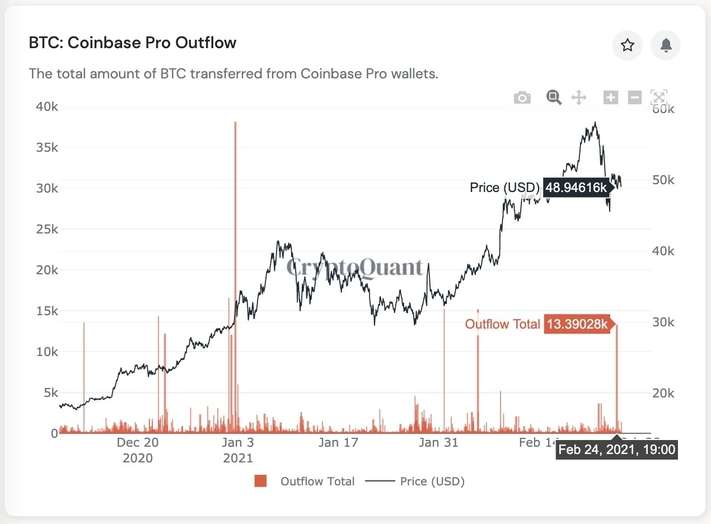

- CryptoQuant recorded an outflow of 13,000 bitcoin (BTC) from Coinbase, indicating a large institutional engagement.

- According to a report by Willy Woo institutions seem to favor a Bitcoin investment over gold since August 2020.

After several weeks of rallying, Bitcoin seems to have topped out, for the time being. The number one cryptocurrency by market cap has been hovering between $47,000 and $52,000 over the past few days. However, institutions seem to have added new fuel to the rocket that propelled BTC into uncharted territory over the past few months. At the time of publication, the BTC price retook $51,000.

CryptoQuant CEO Ki-Young Ju has reported a 13,000 BTC outflow from Coinbase. Known for being a favorite buying hub for institutions that seek to enter the market, Ju claimed that the BTC outflows went to “multiple custodial wallets” on the platform. A total of 7 wallets appear to have been involved with the withdrawals.

The largest transaction amounted for approximately 2,768 BTC with an estimated value of $139 million. Sharing the image below, Ju said:

US institutional investors are still buying Bitcoin at the 48k price. This is the strongest bullish signal I’ve ever seen.

Institutions absorb Bitcoin

As mentioned above, Coinbase is the most important platform when it comes to channeling institutional Bitcoin purchases. The exchange was in charge of the purchases made by MicroStrategy and Tesla. The outflow recorded by CryptoQuant has been one of the largest in 2021. Therefore, there is speculation that it could belong to one of these companies which continues to accumulate BTC or to some other player entering the game.

In support of the thesis that whales are still in a frenzy to buy Bitcoin at $48k, asset management firm Stone Ridge filed a document with the U.S. Securities and Exchange Commission (SEC) disclosing an investment in Bitcoin. The firm has created a new fund that will be added as a seventh investment product offered to its clients. The firm stated in the document:

Bitcoin seeks to generate returns by gaining exposure to the price of bitcoin by selling put options on bitcoin futures contracts. This strategy may also invest in pooled investment vehicles, such as registered or private funds, that themselves invest in bitcoin.

Square also recently announced that it added more BTC to its funds. Coinbase itself confirmed that it holds about $230 million in the cryptocurrency, and more institutions are expected to make an investment during 2021. As Rafael Schultze Kraft claimed, these purchases have had a strong impact on Bitcoin supply increasing the buying pressure.

The amount of illiquid #Bitcoin supply in the network has grown more than the circulating supply since 2017.

Meanwhile, liquid supply continues to see a steep decrease.

Pair this with the demand from MSTR, Square, Tesla, Grayscale et al., and understand how bullish this is. pic.twitter.com/wiZsswqXKp

— Rafael Schultze-Kraft (@n3ocortex) February 25, 2021

Another interesting fact is that institutions seem to favor a Bitcoin investment over assets traditionally known as a store of value, according to a report by Willy Woo. As the image below shows, the price of gold began to decline when MicroStrategy announced the integration of BTC into its treasury. Investor Marc van der Chijs said in response from the chart:

Digital Gold (BTC) is taking money out of ‘traditional’ Gold. Not a good sign for Gold investors & one of the reasons why I got completely out of Gold myself.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.