- Bitcoin reaches a new yearly high of $57,073, marking a significant bullish trend.

- The broader cryptocurrency market rallies, with a total capitalization hitting $2.12 trillion.

The cryptocurrency market leader, Bitcoin, has reached a new yearly peak, crossing the $57,000 threshold for the first time in over two years. This recent surge is part of a continuing bull run that began in early 2023, defying expectations and signaling robust market health.

Stabilized Trading Paves Way for Surge

The period between February 15 and 25 was marked by an unusual calm in Bitcoin’s price volatility. However, the last few days of this window saw a dramatic change in market dynamics. The price of Bitcoin on Binance soared to $57,073, underscoring a resurgence of buyer interest and market momentum.

This upward trajectory was further confirmed as Bitcoin’s price ascent contributed to setting a new yearly high, a feat not achieved since this bull run’s inception. The nearly 5% increase observed on Tuesday, followed by Monday’s 5% rise, were pivotal in breaching the $57,000 mark, reaffirming the cryptocurrency’s bullish trend.

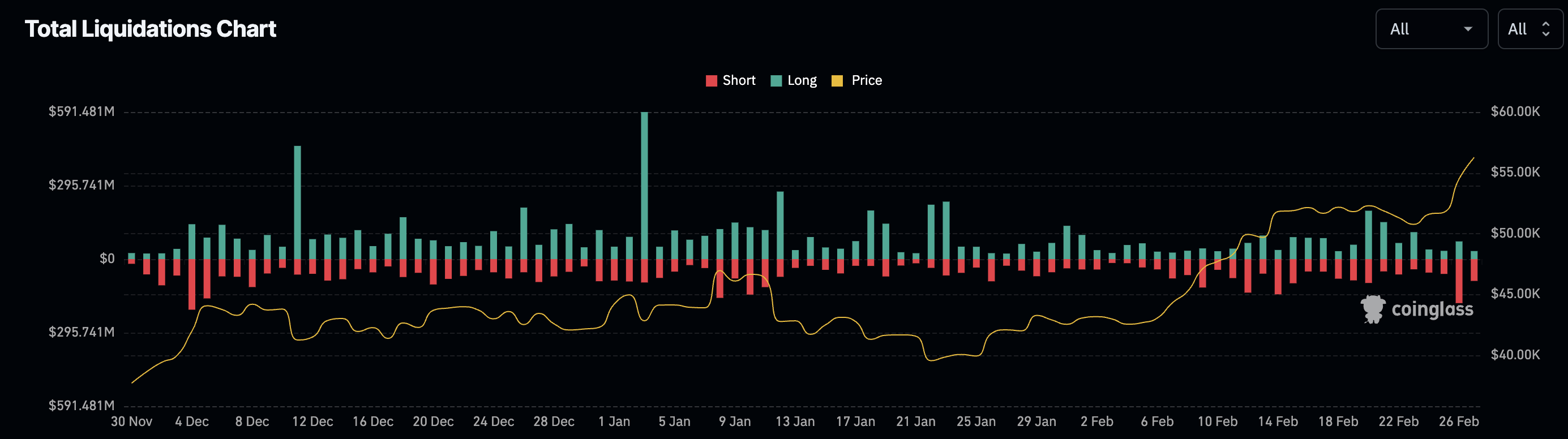

The rapid price escalation had significant repercussions, with CoinGlass reporting nearly $250 million in position liquidations on Monday alone, a testament to the move’s explosive nature. By February 27, an additional $120 million in liquidations were recorded, illustrating the high stakes involved in the volatile cryptocurrency market.

Broader Market Rally

The surge in Bitcoin’s value was not an isolated event but part of a broader market rally. The total cryptocurrency market capitalization witnessed a 6% increase, reaching an impressive $2.12 trillion. Bitcoin’s share stood at $1.10 trillion, highlighting its dominant position in the ecosystem.

This bullish sentiment was mirrored across the board, with significant gains observed in other major cryptocurrencies. Ethereum (ETH), Binance Coin (BNB), Solana (SOL), and Cardano (ADA) also experienced notable upticks, ranging from 4.5% to 7.7%, further buoying the market’s outlook.

Trading Volume and Market Dynamics

Leading up to this surge, the market experienced a period of horizontal trading and consolidation. However, a pronounced increase in trading volumes was evident during Monday’s trading period, coinciding with Bitcoin’s notable appreciation against the U.S. dollar. Over a 24-hour frame, Bitcoin’s value surged by 9.94%, with a 34% increase observed on weekly and monthly comparisons, sitting around $56,383.93.

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.