- Bitcoin’s breakout from a large triangle pattern signals a potential continuation of its bullish momentum in the long term.

- Increased long-term holder supply and easing restrictions for banks strengthen BTC’s position within traditional financial systems.

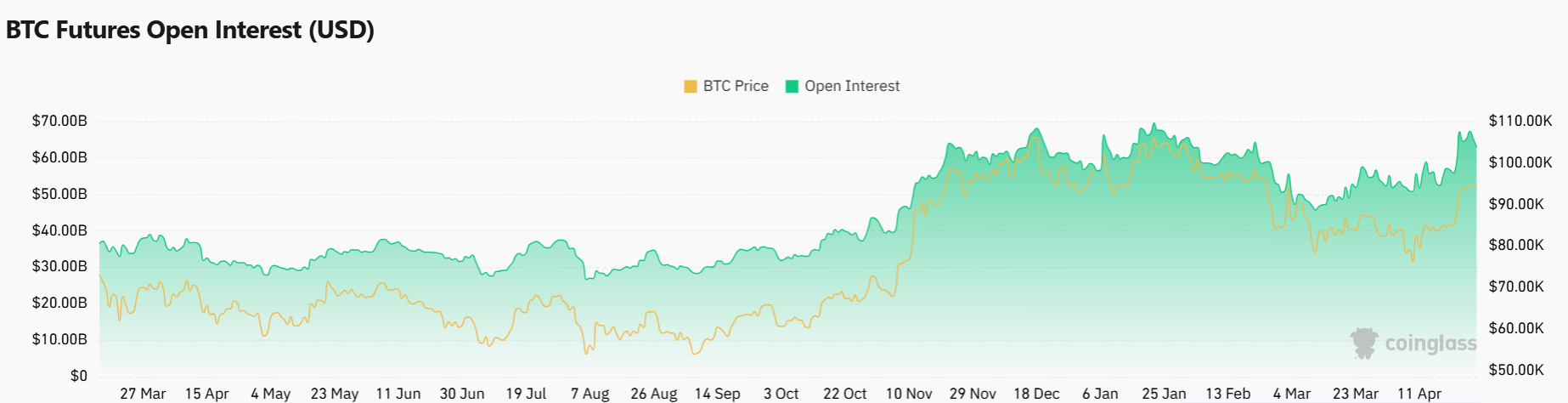

Looking at Bitcoin’s recent moves, many market participants are starting to wonder: is this the start of a major rally towards $100,000 or higher? The answer could be “yes,” given the recent indicators. According to CoinGlass data, crypto trading volumes jumped 15.16% to $64.66 billion.

This indicates that the market is on fire, not just rising because of “the wind.” However, Open Interest actually fell slightly by 1.04% to $63.87 billion, which could mean that some futures positions are starting to be closed, but market activity is still lively.

Options Market Heats Up Amid Lingering Caution

Furthermore, the options market is also heating up. Options trading volumes rose sharply by 49.26% to $1.57 billion. At the same time, Options Open Interest increased by 0.87% to $29.41 billion. This shows that speculation and hedging activity are getting busier.

However, there is one signal that traders should remain vigilant. On Binance, the long/short account ratio for BTC/USDT is at 0.6886. This means that more accounts are choosing short positions than long. It can be said that despite the high volume, many traders are still not fully convinced about the continuation of this rally.

If you think about it, the situation is like someone who has bought expensive concert tickets but is still hesitant about going or not because of the gloomy weather. That’s roughly the picture of the current market.

Bitcoin Gains Stronger Foothold in Traditional Finance

On the other hand, a big step came from the world of traditional finance. On April 24, 2025, the US Federal Reserve revoked its 2022 guidance that restricted banks from crypto activities. With this decision, US banks now have an open path to support Bitcoin and other digital assets.

Michael Saylor, a figure who has never been half-hearted about Bitcoin, said that this step will accelerate institutional adoption. Just imagine if big banks like JPMorgan or Bank of America start integrating Bitcoin into their services. The wave of adoption could be much bigger than expected.

It doesn’t stop there. According to CNF, Bitwise CEO Hunter Horsley believes that Bitcoin could one day reach a market cap of $50 trillion. Imagine that number in the real world, and it might feel like Bitcoin is becoming a supercharged version of “digital gold.”

This is in line with Bitcoin’s increasingly closely tied behavior to global liquidity cycles and economic fundamentals, making it increasingly embedded in the traditional financial world.

There’s also an interesting dynamic that often goes unnoticed. Analyst Charles Edwards notes that since the end of March, the supply of Bitcoin held by long-term holders has increased by about 4.2%. This means that more investors are choosing to hold onto BTC rather than quickly trade it. Typically, this pattern paves the way for a more stable rally as selling pressure is greatly reduced.

Furthermore, popular crypto analyst Lingrid asserts that Bitcoin has successfully broken out of a large triangle pattern with strong volume, and is now opening up a potential run toward $115,000 to $125,000.

With a strong rebound from the $72,000–$75,000 support zone and supported by a solid higher low structure, Bitcoin now looks set for a long journey up, although there may be a few short-term pullbacks along the way.

Meanwhile, as of press time, BTC is trading at about $94,747.81, up 0.57% over the last 24 hours and 8.20% over the last 7 days.