- A Glassnode report shows most of the short-term Bitcoin holders are underwater for the first time since the FTX implosion.

- Market intelligence platform Santiment noted that Bitcoin’s address activity has spiked to this year’s high amid possible price capitulation.

The rise in Bitcoin open interest and daily average traded volume has put more pressure on the supply-against-demand shock in the past few days, resulting in a price uptick. According to the latest crypto oracles, Bitcoin price scaled as high as $27.4k in the past 24 hours with the average traded volume up 33 percent to about $15 billion.

Bitcoin’s volatility is expected to remain high in the coming days, especially fueled by the high-impact news from the United States and the United Kingdom.

Notably, the United States Federal Reserve is expected to release the interest rates data on Thursday, which have historically had a significant impact on Bitcoin’s volatility. On Friday, the Bank of England (BoE) is expected to release the same data, that crypto investors and analysts use to identify the state of monetary policies and the future outlook on inflation.

State of Bitcoin Market Outlook and On-chain Insights

With about six months to the fourth Bitcoin halving, which will reduce its annual inflation from the current 1.7 percent to around 0.84 percent, speculation on the Bitcoin price action has significantly increased. As a result, the underlying Bitcoin volatility is expected to remain high amid a notable spike in daily active addresses.

According to an on-chain analysis conducted by Glassnode, most of the short-term Bitcoin holders are now underwater as the general sentiment shifts to negative. Interestingly, Glassnode noted that the short-term holders have been gripped by panic as much as the one caused by the FTX collapse.

With almost all #Bitcoin Short-Term Holders now underwater on their position, sentiment has shifted towards the negative.

In this report, we explore several measures to track investor sentiment. We develop indicators which assess divergences between the market and observed… pic.twitter.com/DcD5ULIPwy

— glassnode (@glassnode) September 18, 2023

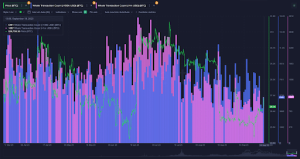

On the other hand, an on-chain report by Santiment noted that crypto whales continue to sit on the sidelines, perhaps waiting for clear buy signals. Furthermore, Bitcoin whale transactions exceeding $100k dropped by a margin of 50 percent in the past few months to around 5,491. Similarly, large whale transactions exceeding $1 million also dropped by more than 50 percent to about 1097.

The short-term market uncertainty has increased the activity in the stablecoins market, as traders take refuge from the high volatility. In the past 24 hours, about $1 billion was printed in the Tether USDT, signaling high demand for the stablecoins.

💵 💵 💵 💵 💵 💵 💵 💵 💵 💵 1,000,000,000 #USDT (1,000,719,999 USD) minted at Tether Treasuryhttps://t.co/NA4NnBjhyD

— Whale Alert (@whale_alert) September 19, 2023

BTC Price Action

Bitcoin price is facing immense selling pressure following a daily death cross between the 50 and 200 moving averages in the past few weeks. After rallying above $27k for the first time this month, against all odds of poor performance in September of the pre-halving years, Bitcoin bulls continue to struggle to push beyond $27.4k. From a technical standpoint, if the bull manages to push towards $28k and hold as a support level, $32k will be insight. On the contrary, a freefall towards $25k will result if the bears continue to pull the market down.