- Bloomberg Analyst Mike McGlone is not optimistic about the current Bitcoin rally.

- BTC and DOGE have charted new growth trends, defying bearish expectations.

Bitcoin (BTC) and Dogecoin (DOGE), two leaders in the crypto market, are showcasing a bullish performance, with their prices rising from earlier lower levels. Despite their positive price outcomes, Mike McGlone, a Senior Commodities Strategist at Bloomberg, says BTC and DOGE mirror bearish trends.

Bear Market Bounce on the Way

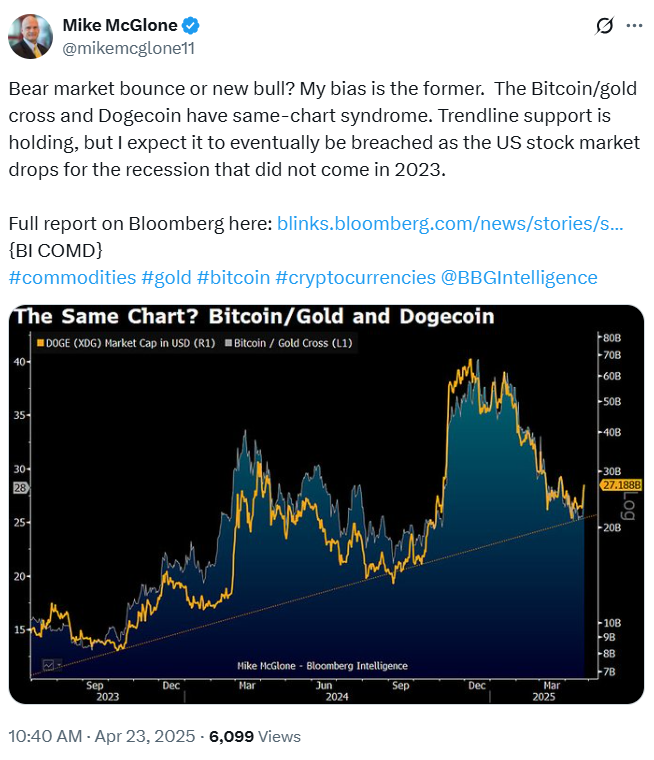

In its latest X post, McGlone released a chart showing DOGE and the “Bitcoin/gold” cross moving together. The “Bitcoin/gold cross” pattern, in this context, points towards some sort of variation of a traditional “golden cross” pattern based on the intercrossing metrics of Bitcoin and gold.

According to the Bloomberg analyst, this chart pattern usually results in a bear market bounce or a new bull run. McGlone believes the former is most likely to occur. He emphasized that the trendline support is still holding.

However, the analyst anticipates a breakdown since the stock market is plunging. To McGlone, the stock market drop is a resumption of the recession that failed to happen in 2023.

Simply explained, the analyst views Bitcoin and other cryptocurrencies as strongly correlated with the stock market and its leading indexes, such as the S&P 500, Nasdaq, and Dow Jones.

In a recent study we reported on, McGlone predicted that BTC could plummet to $70,000. He cited economic uncertainty and a possible turnabout in the recent surge in the U.S. stock market to back his forecast. In a more bearish forecast, McGlone said Bitcoin will likely collapse to $10,000.

Bitcoin Sees Fresh Revival

Contrary to McGlone’s predictions, Bitcoin has reclaimed previous highs as investors show more commitment to the flagship coin. Per Marketcap data, BTC was trading at $93,036, up 3.15% over the previous day.

Notably, BTC rallied to $94,346 in the early trading session. This growth comes after several weeks of consolidation, where the $87,000 price level formed a strong resistance. Investor activity remains strong, as seen by the surge in the trading volume. This metric spiked by 40% to $56.83 billion within 24 hours.

The spot Bitcoin Exchange-Traded Fund (ETF) market also witnessed a staggering netflow of $912.7 million daily. Such a huge inflow has not occurred in the market since January, further indicating BTC’s renewed momentum.

Many have attributed the bullish shift to expectations of favorable crypto regulations. As we discussed earlier, Paul Atkins, the new Chairman of the US Securities and Exchange Commission (SEC), has vowed to ensure the establishment of transparent crypto policies.

Like BTC and DOGE, the top memecoin forecasted to face a bearish rebound by McGlone has also rallied to new highs. As of this writing, DOGE price traded at $0.18, demonstrating a price increase of 6.5%. The trading volume also increased by 94.25% to over $2 billion.