- A new Coinshare report shows that China-based miners control up to 66% of Bitcoin’s global hashrate, giving them great power in the BTC network.

- Since June 2019, the share of Chinese miners has been rising steadily.

London-based CoinShares has published a new report showing that China controls up to 66% of the global hashrat in the Bitcoin network. Sichuan province alone is said to account for more than half of the hashrate. This imbalance in the network could be abused or lead to problems if China took tougher action against Bitcoin’s mining.

The BTC Hashrate continues to rise

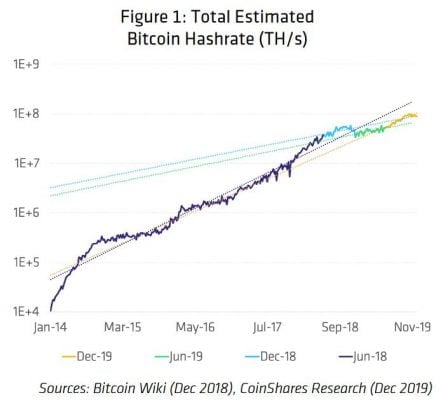

The Hashrate indicates the amount of computing power required to validate transactions on the Bitcoin blockchain. The greater the hashrate, the more secure the network. The report states that the global hashrate has risen by 80% since June to the present day and is thus showing steady growth. Since this date, the hashrate has increased from 50 EH/s to almost 90 EH/s and even to 100 EH/s at times.

The report states in detail:

During this period the Hashrate grew somewhat slower than the 5-year average — a period which roughly corresponds to the start of the ‘industrial era’ of Bitcoin mining — but significantly faster than both preceding 6-month period.

The share of Bitcoin miners from China has increased from 60% to 66%. Chris Bendiksen, head of research at CoinShares, says that this development may be due to the increased use of modern mining hardware in China. Chinese heavyweights in the mining industry, such as Bitmain and MicroBT, are among the world’s largest manufacturers of mining equipment.

At Bitcoin’s current price of just under USD 7,200, the miners produce Bitcoins worth just under USD 4.7 billion annually. The largest and most important mining areas in China are the Chinese provinces of Yunnan, Xinjiang, Inner Mongolia and Sichuan. The following map of the report shows where Hashpower’s strongest concentration is in the world.

However, China’s current monopoly position could decline if more next-generation devices are sold in other countries and markets, Bendiksen continues. Nevertheless, China’s low energy costs and pioneering role give it a clear advantage over its competitors:

This is beneficial to the Chinese mining industry [….] If you are the first to increase your proportion of the hashrate, and you can do that before your competitors, that’s generally good.

At the end of October we reported that a Chinese committee had declared that Bitcoin Mining in Sichuan Province would be promoted and further developed. The aim here is to create more business opportunities in the region on the basis of Bitcoin and blockchain technology. However, it remains to be seen whether China will be able to further expand its supremacy.

China’s digital yuan enters pilot phase

China announced a few days ago that the test phase of the digital yuan will start earlier than expected. The digital yuan will initially be tested in the cities of Shenzhen and Suzhou. Large companies such as China Telecom, which have direct access to a mass market, are involved in this test run.

According to media reports, the digital yuan will be integrated into real service scenarios such as transportation, education and healthcare, reaching end users and generating common everyday applications. The digital yuan is issued by China’s central bank, People’s Bank of China, making it the first digital currency to be issued by a central bank worldwide.

The actual impact on the economy, population and industry can only be expected at this stage.

Follow us on Facebook and Twitter and don’t miss any hot news anymore! Do you like our price indices?

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.