- The Bitcoin price is undergoing a consolidation phase after the recent price rally, with analysts dissenting on whether Bitcoin will continue to consolidate or sustain its upward trend.

- The data from the spot market points to a bullish momentum, as the influence of margin trading has decreased significantly.

After the massive price rally in the middle of the week, the Bitcoin price is currently in a consolidation phase. Yesterday, Bitcoin traded in a range between USD 8,580 and USD 9,070, with trading volumes continuing to decline in the hours prior to the editorial deadline, which also further reduced volatility. For the time being, BTC seems to have stabilized at around USD 8,800. At the time of going to press Bitcoin was trading at USD 8,812.

Despite the current calm on the market, further, larger price movements could be imminent in the coming days. However, analysts are debating whether the movement will be bullish or bearish. As CNF reported yesterday, the massive April 30th doji candle is currently causing great uncertainty among bulls on the daily chart. The doji candle is a technical chart indicator of indecisiveness on the market, and could currently indicate a return to a bearish trend.

The popular trader “MoonOverlord” shared a chart on Twitter that is supposed to show the historical accuracy of this indicator and commented on the chart saying “Will the halving solve the problem? The chart shows how Bitcoin showed a larger doji candle five times last year and then reversed the trend.

https://twitter.com/MoonOverlord/status/1256258877647212547

However, the chart should be viewed critically, as there have also been cases where a doji did not reverse the trend, for example recently when BTC broke through the $6,100 mark on March 21, drew a doji and still continued its upward trend. Popular analyst Josh Rager wrote via Twitter that he sees the bullish trend confirmed until Bitcoin breaks below $8,400:

Still above support at $8400 – though the ever so popular TD sequential indicator points out possible uptrend exhaustion with pullback soon I prefer to keep it simple with horizontals, break and close below $8400 and we’ll be seeing $7800.

In order to confirm another uptrend, Bitcoin needs to break through the resistance zone between $9,170 and $9,550 according to Rager. Should Bitcoin break through this level, the next target would be the February high of $10,500.

Arguments for a bullish Bitcoin market trend

Also, the current situation on the crypto market may not be comparable with the conditions of the last few months. On the one hand, this is obviously due to the Halving of Bitcoin, which will take place on May 11. Furthermore, the data from the spot market shows that Wednesday’s rally was almost exclusively driven by small investors who made purchases on the sports market.

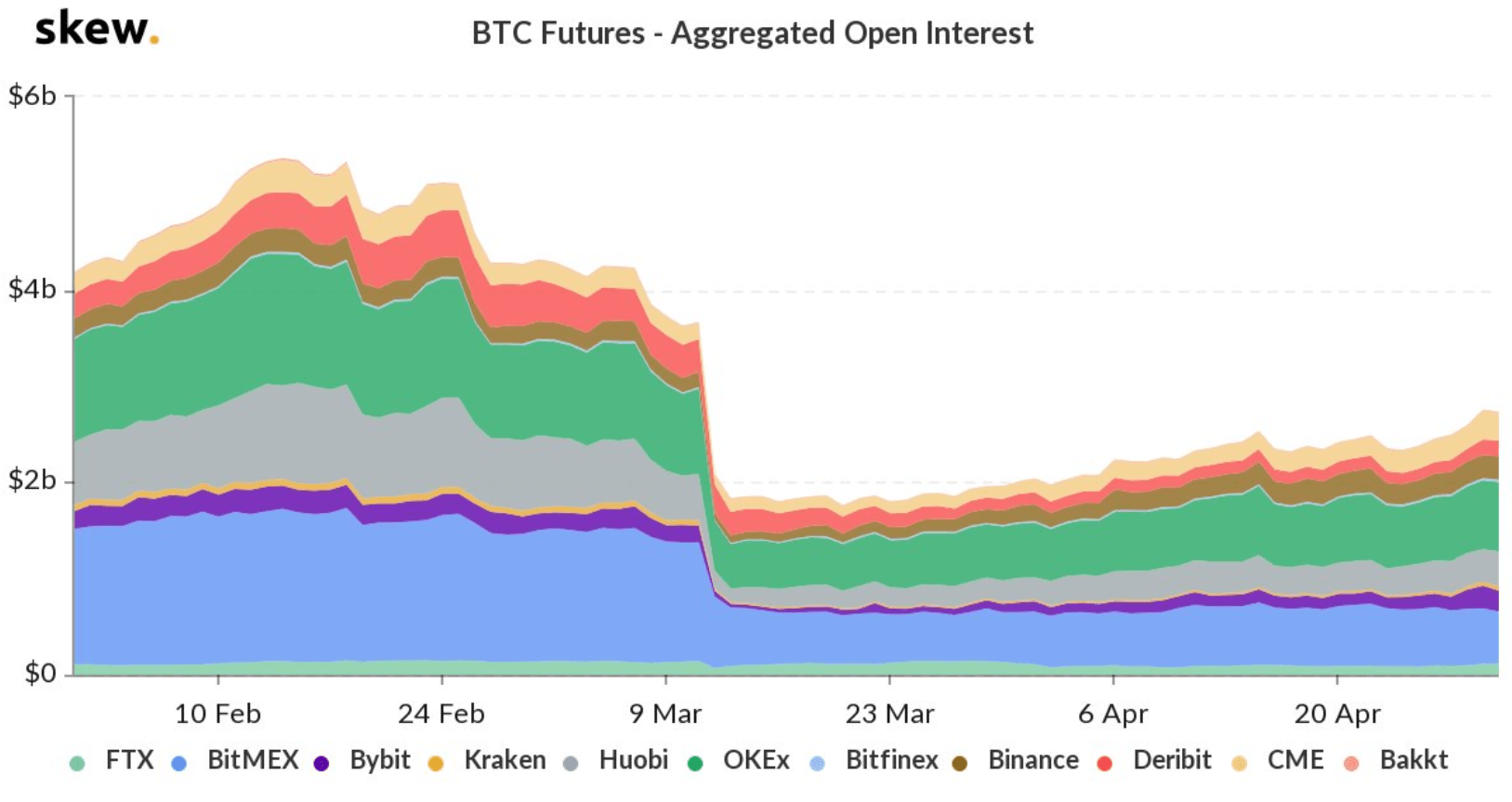

At the same time, margin trading fell sharply after the “Black Thursday” of mid-March and has not recovered since. As Skew noted yesterday in an analysis of the crypto market, futures traders suffered a massive blow from the crash to $3,800. Open interest in Bitcoin futures has not yet recovered from the crash, which may indicate that some traders have pulled out. Skew explained in a tweet

Futures open interest remains on average significantly lower than before the sell-off. A majority of longs were forced to exit on the 40%+ down day and can’t come back as fast.

The dominance of spot trading is a great similarity to the bull run of 2017, when Bitcoin reached USD 20,000. At that time, the rally was almost exclusively driven by small investors. The futures market was only new and, as some analysis suggests, only played a role in the crash of USD 20,000. On the other hand, the data from Skew shows that Bitcoin Options traders are expecting a sustained uptrend.

The price of puts relative to calls – has not returned to its structurally negative position. Expectations seem to be balanced into the halving, however the parameter has been moving rapidly in the last few days.

Ratio of puts to calls open has reverted to the same level. Open interest put / call ratio is structurally below 1 in bitcoin, investors are more interested to discuss and position for the upside.