- Binance founder CZ pledged 150 BNB, about $100,000, to victims of the LIBRA memecoin scam.

- LIBRA’s price surged after Argentine President Javier Milei endorsed it, but the token collapsed.

Changpeng Zhao (CZ), the founder of Binance, has committed to donating 150 BNB, valued at approximately $100,000, to assist victims of the LIBRA memecoin collapse. His pledge response is similar to that of another respondent, EnHeng, a college student who recently vowed to donate $ 50,000 and created a fundraising campaign.

A university student started it. I just followed. 😂

— CZ 🔶 BNB (@cz_binance) February 17, 2025

EnHeng explained their decision on X, stating that scams such as LIBRA also negatively affect finances and that students are often targeted. Their post received a lot of attention, and CZ was pleased to show his approval. In return, he also retweeted the post and said that he was donating 150 BNB in response to the student’s actions.

今天阿根廷总统发币Rug事件让不少人受到了伤害。作为一名大学生,我深知这种打击的感受。为了帮助受影响的朋友们,嗯哼决定捐赠 5万美元,并通过 BSC 地址接受捐赠款,用于发送嗯哼慈善晚餐赞助,为大家带来温暖和支持… pic.twitter.com/DsPlWZdcGj

— EnHeng嗯哼 (@EnHeng456) February 15, 2025

LIBRA Memecoin Collapse and Its Fallout

LIBRA’s downfall began after the president of Argentina, Javier Milei endorsed the project, and there was a quick rise in the value of the project, among others, according to CNF. However, it was said to have increased tremendously, but the token dropped soon after, incurring great losses. It has been estimated that 40,000 plus investors lost their investments valued up to $4.4 billion in the major sucking.

Analysts have labeled it as a co-ordinated rug pull. Data from blockchain reveals 24 wallets sustained losses of more than $1 million, of which 61 wallets lost over $500,000. One investor reportedly bought 2.1 million LIBRA tokens for $5.6 million and then sold them for only $430,000, thus losing $5.17 million in the process.

This has also led blockchain analysts to suspect that there could have been an inside job that saw this trader receive $5 million USDC compensation. According to the allegation, the LIBRA team covered the losses, which precipitated other fraudulent activities.

After the crash, Hayden Mark Davis, one of the prominent members of LIBRA, leveled serious allegations against President Milei, alleging that he pulled out his support to provoke a selling frenzy. Argentine attorneys have since reported Milei for fraud, criminal association, and nonfeasance of their public duties.

Political unrest has been boosted as many oppositionists demanded the impeachment of this man. Some critics have cross-sectioned the move as a pump and dump where the insiders falsely pumped the prices for their own benefit.

LIBRA’s Impact on the Crypto Market

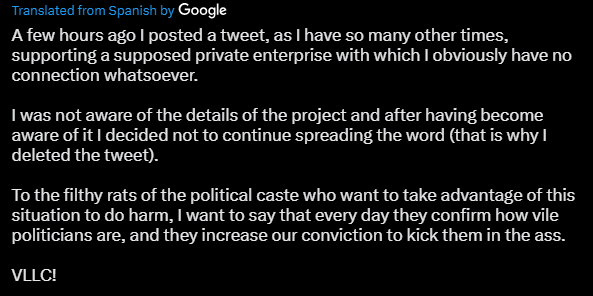

Milei’s endorsement of LIBRA caused further speculation about the government behind it, especially with the 3.8 million subscribers on his X account. In his now-deleted Tweet, he provided a direct link to the project, which many investors interpreted as an endorsement.

The recent collapse of LIBRA has further aggravated the shortage of liquidity in the altcoin market. Memecoins tend to drain liquidity from prominent projects when capital flows toward the viral tokens. Analysts also have pointed out that fresh capital in the market is usually managed by insiders who manipulate prices before the mob gets in. A similar pattern emerged with the TRUMP memecoin, which surged to a $75 billion market cap without increasing the overall crypto market value. The LIBRA token followed this trend.