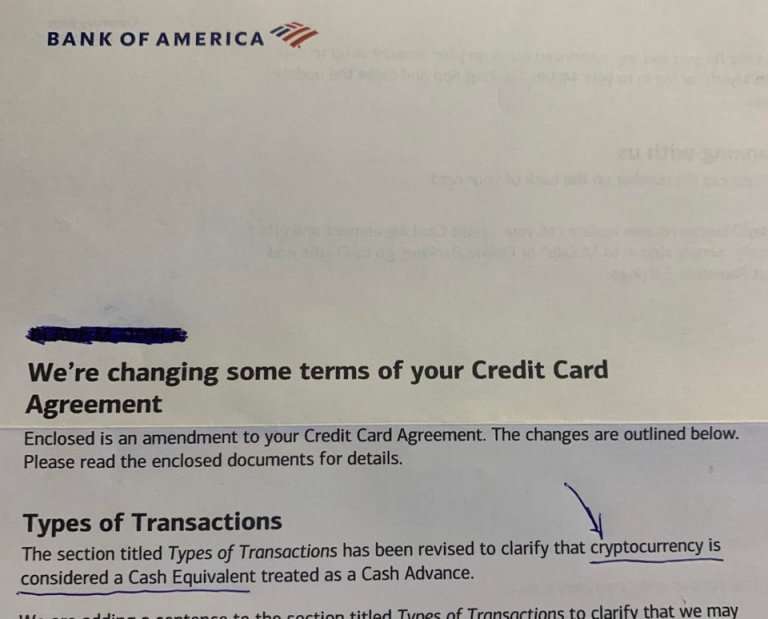

- A user of the social network Reddit has presented an image showing a possible change in the credit card terms of Bank of America regarding Bitcoin (BTC).

- The financial institution could start treating Bitcoin-related transactions as “cash advances” in order to increase its fee income.

The image uploaded to Reddit has started an intense debate in the crypto community. The letter of the Bank of America shows a change in the terms and conditions for the Bank of America credit card. According to the letter, all transactions related to Bitcoin, Ethereum, Litecoin and other cryptocurrencies could be treated as “cash advance”.

In other words, the Bank of America may consider Bitcoin and altcoins to be a cash equivalent, as shown in the image below. If the above applies, the Bank of America will begin treating these transactions as “Cash Advances” and will make an adjustment to the fees related to that category of transaction.

Why would the Bank of America treat Bitcoin (BTC) as cash?

Although an official announcement has not yet been made and the possible change has only been discussed on Reddit, some members of the crypto community have speculated about the reason for the changes. The main reason seems to be an increase in fees related to the type of transaction referred to. Transactions considered cash advances have an aggregate fee of approximately 5%.

Due to the low volatility that Bitcoin (BTC) has experienced during June, the Bank of America could be looking to capture fees on terms mostly applied to stable assets. Over the past month, the BTC price has moved in the $9,000 range. This is a relatively positive performance considering the global economic outlook.

Some users expressed dissatisfaction that the Bank of America and other major institutional players like JP Morgan and Goldman Sachs have an unclear position on Bitcoin (BTC). The complaint went in the direction that the narratives of the above-mentioned institutions change at their convenience:

(…) When it suits them. It’s a commodity when they want to tax capital gains, a cash advance when that costs you more, etc., etc. Pick one and stick with it. Let the chips fall where they may.

Meanwhile, Bitcoin continues to attract more institutional interest. Grayscale’s interest in Bitcoin has been particularly important. The institution has been in a “buying frenzy” for Bitcoin and has bought up to three times the amount of BTC produced by Bitcoin miners in the last week.