- Arcane Research, using the implied volatility, concludes that the Bitcoin price will not rise due to the Halving until after the event in May.

- From a historical perspective, Arcane’s statement is supported.

With only 5 months to go until Bitcoin Halving, the discussion in the community is seething as to whether the event is already reflected in the current price of Bitcoin. Based on the last two Halvings in 2012 and 2016, the Bitcoin spot price could undergo a massive rally before the block reward drops from 12.5 BTC to 6.25 BTC in May. Arcane Research is another analyst firm that does not support this thesis.

Research: Bitcoin price will only rise after the Halving

To assess whether the Bitcoin Halving has already been priced in, Arcane uses the implied volatility (IV), a measure often used to value option contracts. The value reflects the market’s view of the probability of price changes for a particular asset. It is also commonly used to predict future supply and demand.

Arcane Research concludes from the valuation of implied volatility:

As commented last week, one can get an indication of the market’s expectations of the movements in BTC. This is done by looking at the coming months and looking at the implied volatility of BTC option prices. While options prices suggested more volatility in March last week, this volatility top has now moved to June.

This may indicate that the market now is expecting changes in the BTC price after the halving in May, going into the futures expiry date in late June.

According to the analysis, the IV, which currently stands at 60 percent, will rise to 70 percent by June, before the increase flattens out and is expected to settle at over 70 percent by September 2020. Arcane Research deduces that the market, which is strongly influenced by the option prices of Bitcoin, does not expect changes in the Bitcoin price until after the Halving in May. According to Arcane, this also coincides with the expiry of the half-year and quarterly futures contracts in June.

In the previous week’s report, Arcane already wrote that the Halving will have little impact on the price in advance.

However, there is nothing indicating a spike in the BTC price in Q2 2020 for the halving event when evaluating the implied volatility term structure. ▪Options prices actually suggestheightening relative volatility in the month of March 2020 when we evaluate forward implied volatility.

This could mean the following: The halving event is priced in. The market expect a run up pre-halving (March). The effect will come later in 2020 (after June)

Bitcoin Halving is historically bullish

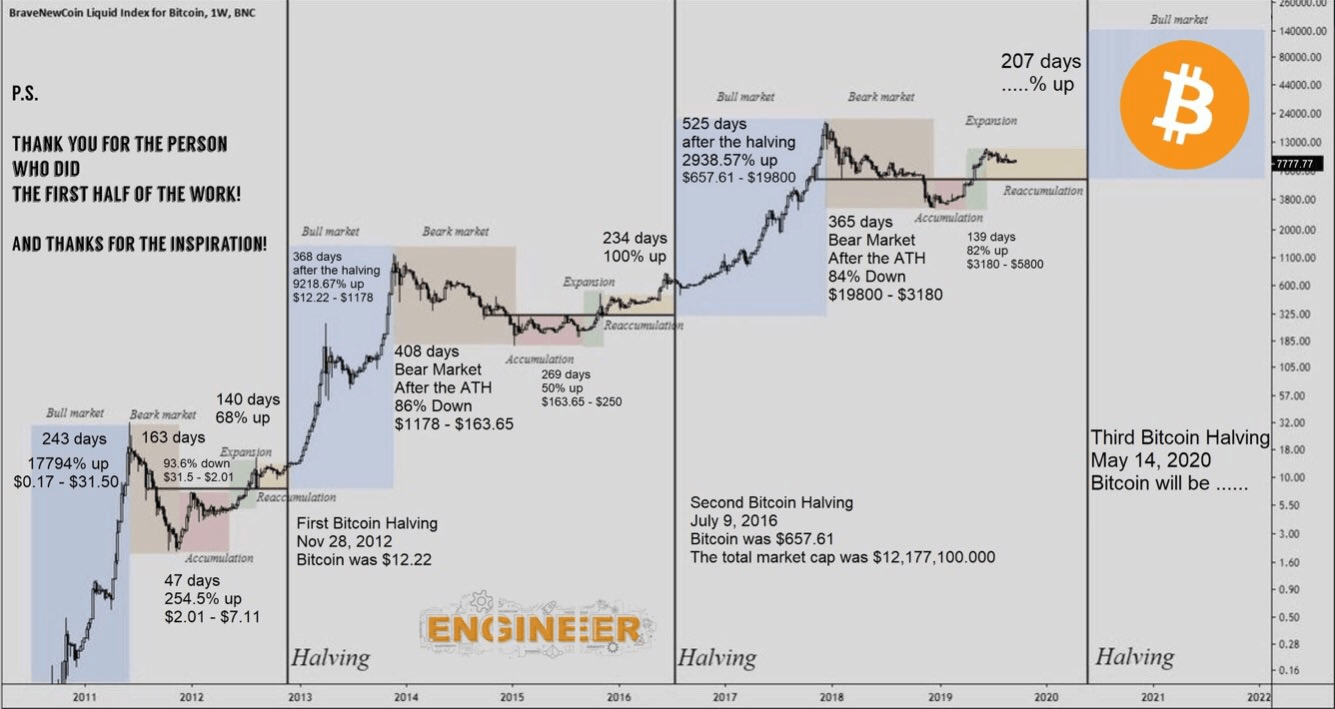

Historically, the assumption is confirmed by Arcane Research. The Bitcoin Halving is an extremely bullish event. As the following chart (Liquid Index) of BraveNewCoin shows, there was an accumulation phase before the Halving, in which the BTC price rose slightly. However, it was only after the Halving that BTC recorded a strong price increase.

Whether history will repeat itself remains to be seen. Melem Demirors of CoinShares, argues that the past two Halvings cannot be compared with the present one, as a robust derivatives market has been established. This decouples Bitcoin as an asset from the supply-demand economy.

At the time of writing, the Bitcoin price has stabilized at around 8,674 USD after the sudden crash of 400 USD.

Follow us on Facebook and Twitter and don’t miss any hot news anymore! Do you like our price indices?

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.