- The price of Bitcoin (BTC) has fallen by about $900 within an hour, from $10,177 to $9,290.

- The Altcoin market has followed Bitcoin, including Stellar, XRP and TRON, with Tezos being the only cryptocurrency within the top 20 to record gains bucking the trend.

Bitcoin investors were again surprised by a massive flash crash a few hours ago. For the fifth time this year, the Bitcoin price collapsed by several hundred dollars within an hour. On February 19, at 22:00 (UTC), Bitcoin fell by about USD 900, from USD 10,177 to USD 9,290. This was followed by a recovery to the USD 9,700 mark, with Bitcoin trading at USD 9,605 at the time of writing.

However, not only Bitcoin has experienced a sharp fall in prices, but also the entire Altcoin market. Ethereum (-6,8 %), XRP (-6 %), Bitcoin Cash (-8,2 %), Litecoin (-8,5 %), EOS (-11,2 %), Chainlink (-6,6 %), Stellar (-6,5 %), TRON (-8,5 %) and Monero (-9,6 %) have suffered even greater losses than Bitcoin within the last 24 hours. The only cryptocurrency that has continued its bull run is Tezos, which rose by 7.5%.

As a result of the recent flash crash, the total market capitalisation of the crypto market has fallen from just under USD 295 billion to USD 280 billion.

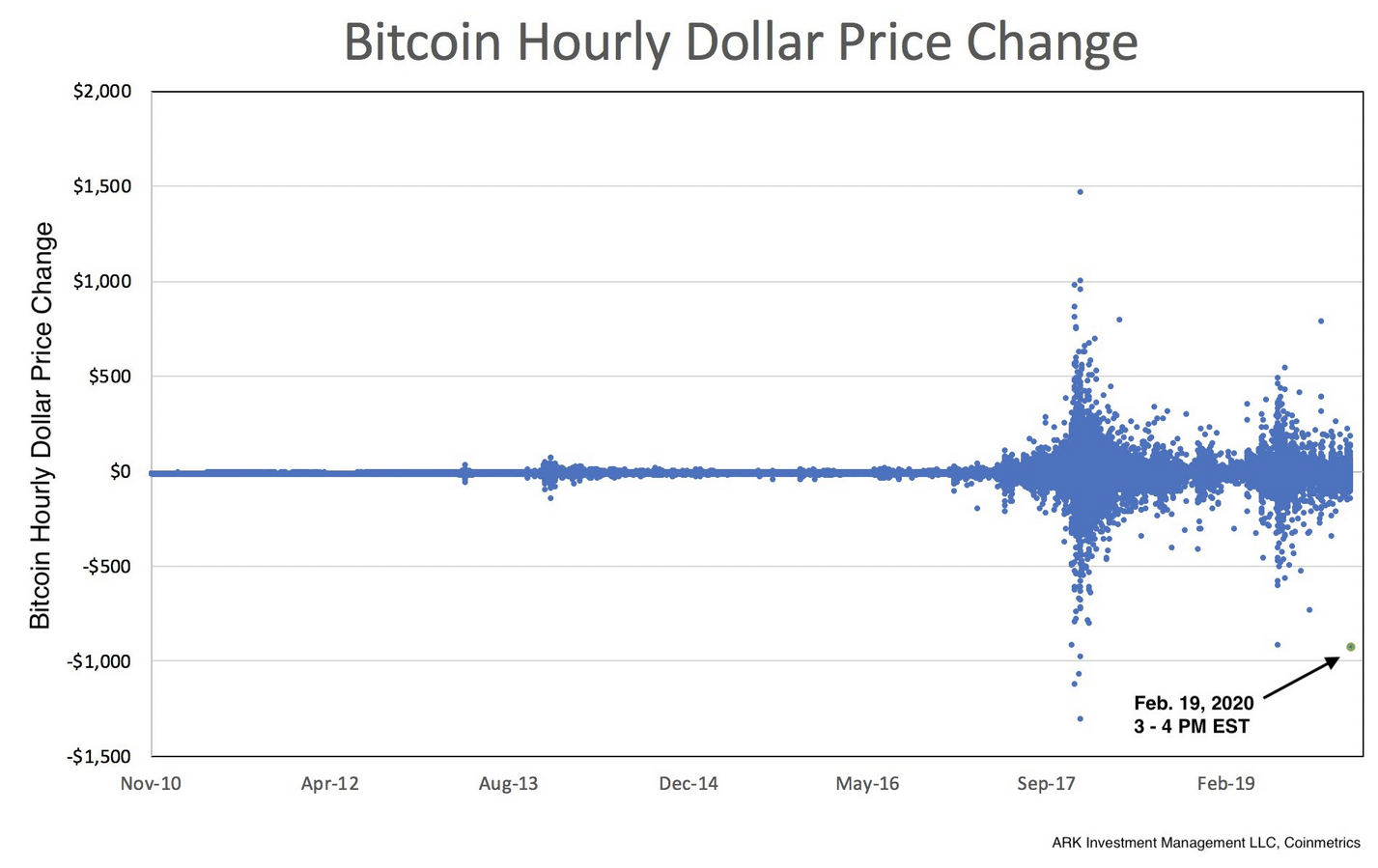

Fifth-largest crash in Bitcoin’s history

The crash is one of the biggest hourly price crashes in Bitcoin history. As Yassine Elmandjra, a crypto analyst at ARK Invest, reported in a tweet, it was the fifth largest crash. It was only during the legendary bull run in December 2017 that a larger drop in prices was recorded.

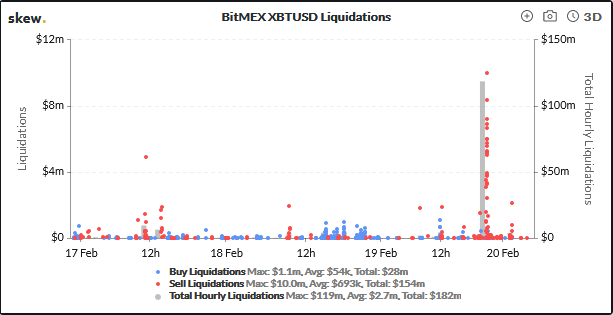

The price crash began at around 21:45 UTC. On the BitMEX exchange alone, long contracts worth more than 100 million dollars were liquidated during the crash. The popular crypto trader Scott Melker spoke on Twitter of an epic long squeeze, something that Joe Vezzani, the founder of LunarCRUSH, also agreed with.

Watched the entire thing unfold. Saw a couple 7-10M liquidated longs come through. Big boy squeeze.

— Joe Vezzani (@joevezz) February 19, 2020

A long squeeze occurs when the selling pressure in the market becomes so strong that it encourages other investors to liquidate their positions. Holders of long positions are forced to sell in order to protect themselves from a dramatic loss. A long squeeze therefore occurs when a cycle is created that stimulates a large price decline.

As the data from the analysis company Skew shows, this is exactly the scenario that has occurred. On BitMEX, over 119 million USD were liquidated in Bitcoin futures within one hour. On Bitfinex there were also massive liquidations.

Has Bitcoin’s bullish trend ended?

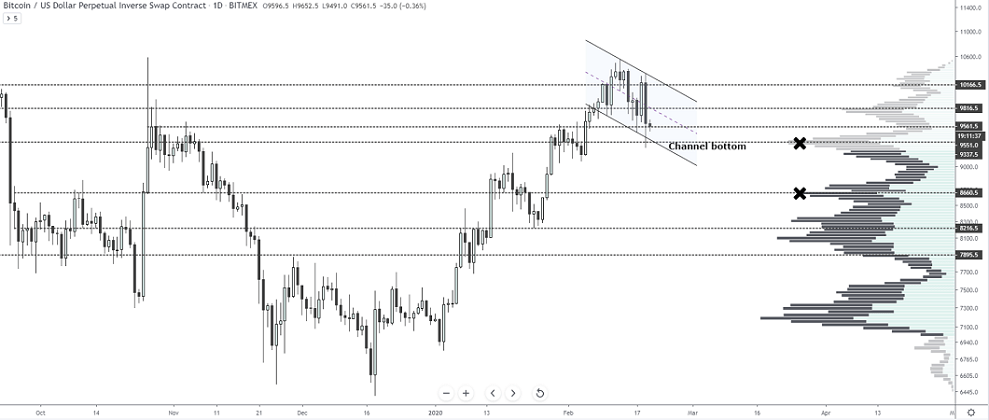

Despite the historical price crash, there is also a positive aspect. The bulls were able to absorb the selling pressure at the time of writing and stabilize Bitcoin at around USD 9,600. Numerous analysts still believe that the medium-term upward trend is intact.

In a tweet, veteran trader Josh Rager gave an outlook on which price levels are important for Bitcoin in the near future:

If price breaks and closes $9300, will likely make its way to $8600-$8700.

If price can make its way back above $9800 will be a good start for continuation to the upside.

Lower lows and lower highs starting to print in this downward channel. Take it level by level.

Follow us on Facebook and Twitter and don’t miss any hot news anymore! Do you like our price indices?

Recommended for you:

- Buy Bitcoin Guide

- Bitcoin Wallet Tutorial

- Check 24-hour Bitcoin Price

- More Bitcoin News

- What is Bitcoin?

Subscribe to our daily newsletter!

No spam, no lies, only insights. You can unsubscribe at any time.