What is BitShares?

According to the website, BitShares aims to

to extend the innovation of the blockchain to all industries that rely upon the internet to provide their services. Whether its banking, stock exchanges, lotteries, voting, music, auctions or many others, a digital public ledger allows for the creation of distributed autonomous companies (or DACs) that provide better quality services at a fraction of the cost incurred by their more traditional, centralized counterparts.

The Decentralised Autonomous Companies (DACs) are therefore intended to introduce a new paradigm for the organisational structure of companies where management does not require human intervention and control of the company is based on the Community and the incorruptible business rules of the Blockchain Protocol. Rather than trying to be a peer-to-peer currency, Bitshares strives to be an exchange platform tied to real assets.

BitShares focuses on decentralized financial services, especially decentralized exchanges and any kind of banking on the blockchain. The background is that several billion people in the world do not have access to financial services or to a bank account. BitShares wants to solve this problem and offer free access to financial services to all people worldwide.

The crypto currency behind the BitShares platform is called bitshares (lower case), abbreviated: BTS and serves as a kind of security for the multitude of decentralized financial services. Like Bitcoins, bitshares have a maximum supply of around 3.6 billion BTS with inflation decreasing over time. The BitShares themselves have a volatile price, but the BitShares system makes it possible to create stable BitAssets, such as BitUSD, BitEUR, BitGOLD or BitSILVER with BitShares as collateral, which support BTS and give the token its value. The BTS tokens can thus be converted into any type of BitAsset linked to real markets ranging from US dollars, euros, gold or silver to a barrel of oil. BTS coins are therefore more of a security than a currency, as they are used as collateral on the decentralised platforms.

Ultimately, it can be said that BitShares is a platform for stable crypto currencies. There are digital versions of the dollar, euro or gold that have the same prices and stability as their counterparts, but with all the advantages of crypto currencies.

The current price of Bitshares can be checked here. The price of Bitcoin, Ethereum and other Altcoins can be found in our course overview.

BitShares: technical data

BitShares is based on graphene technology, which has the potential to process up to 100,000 transactions per second (TPS). Graphene is an open source C++ blockchain implementation that has been proven to run 3,400 TPS so far.

Another reason why BitShares is so fast is the much lower block time of just 3 seconds compared to Bitcoin (10 minutes). The block reward is currently 1 BTS, which generates 1,200 BTS per hour.

In addition, the BitShares blockchain uses a Delegated Proof-Stake-Proof (DPoS) consensus mechanism, which will be discussed in more detail later.

BitShares history and team

BitShares, formerly known as ProtoShares (PTS), belongs to the blockchain and crypto veterans. BitShares X was first introduced in 2014 in a white paper entitled “A Peer-to-Peer Polymorphic Digital Asset Exchange” by Daniel Larimer, Charles Hoskinson and Stan Larimer. Shortly after the white paper was written, the project was founded by Larimer in July 2014. Charles Hoskinson was a co-founder of the original project, but left the team for Ethereum shortly after it was founded. Dan Larimer also left the BitShares project in mid-2016 because he felt it was impossible to continue the adaptation without making major changes to the protocol. As a result, he started a new project, Steem. After Steem, he also developed EOS, which is also based on the original delegated proof-of-stake consensus algorithm of BitShares.

How BitShares works…

Delegated Proof-of-Stake

BitShares was the first crypto project to introduce a delegated proof-of-stake invented by Dan Larimer. Larimer was of the opinion that the proof-of-stake would lead to a centralization of power within the network. He therefore looked for a new solution and invented the Delegated Proof-of-Stake (DPoS).

While in a Proof-of-Stake (PoS) all token holders can participate in the consensus by staking their own tokens, the DPoS is based on an additional layer that is supposed to generate democracy through elections in order to avoid centralization. Within the DPoS, delegates called witnesses at BitShares are used for this purpose. Token holders can vote for delegates (“witnesses”) according to their amount of BTS, who validate the transactions and create the blocks and write them into the block chain.

In addition, BTS holders may transfer their voting rights to another account in order to have more total voting rights. Witnesses are paid for their work with the Block Reward, a reward for creating the block. In contrast to other DPoS platforms such as EOS or Tron, the number of witnesses is not fixed but variable. For example, if the majority votes for 50 witnesses, 50 witnesses are also used. However, the minimum possible number of witnesses is set at 11.

Distributed Autonomous Companies (DACs)

As described above, decentralized autonomous enterprises (DACs) are a basic principle of BitShares. BitShares itself works according to this principle. A decentralized autonomous society (DAC), formed by the BTS owners, manages the BitShares network and ultimately decides on the future direction of the entire network.

This idea is very similar to Ethereum’s idea of a Decentralized Autonomous Organization (DAO), which was practically a decentralized venture capital fund set up to revolutionize the way venture capital is distributed. The DAO was a decentralised venture capital company, without a traditional management or board of directors to decide on the projects to be supported. Similarly, BTS owners determine the further development of the BitShares platform.

Decentralised exchanges (DEX)

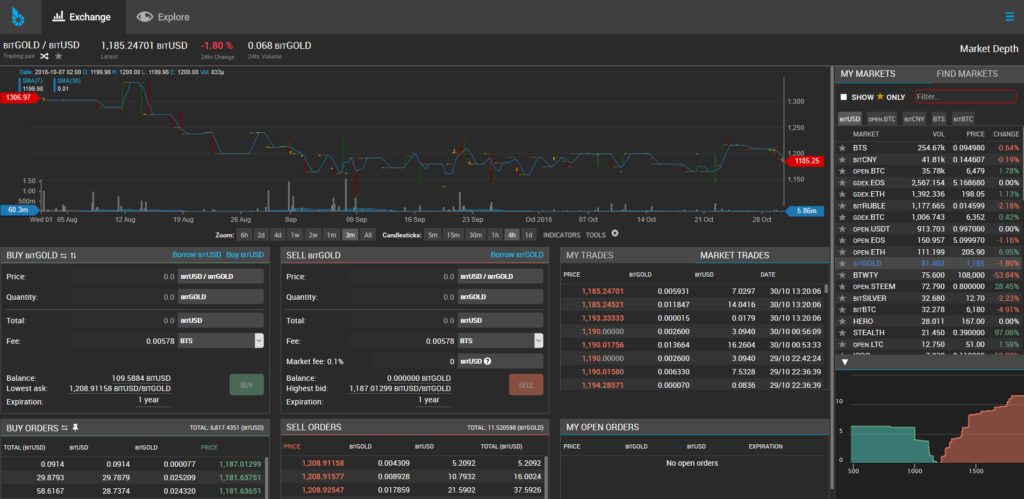

A core feature of BitShares are decentralized exchanges on which any type of asset – gold, silver, oil and crypto-based derivatives – can be traded. Another hot topic is BitAssets, such as the BitUSD, which is 1:1 pegged to the US dollar and works like a stable coin outside the BitShares platform. Any trading pairs can thus be created and exchanged against each other. A trading pair of Bitcoin/oil or BitUSD/gold would also be conceivable, for example.

In general, decentralized exchanges have numerous advantages over their centralized counterparts. These include, but are not limited to:

- No Single-Point-of-Failure: Thanks to the decentralized character of Bitshares there is no central error location.

- Control over the Private Keys: The user has full control over his Private Keys at all times. This makes them more secure than allowing an Exchange to take control of the private keys. “(“If you don’t hold the private key, you don’t own the coin either.”)

- Freedom: There are no requirements for personal data. KYC and AML can be avoided.

- No trading limits: There are no trading limits imposed by the Bitshares DEX.

- No deposit and withdrawal limits: There are no deposit or withdrawal limits as there is no account approval process or steps based on the amount of personal data.

- Low trading fees: Bitshares only charges fees of a few cents.

BitShares itself offers a decentralized exchange at dexnode.net:

Conclusion: Is BTS worth investing?

BitShares is often called a veteran in the crypto community because the project was founded in 2014. As a result, BitShares has already reached a development stage where the platform is very mature and stable to build large applications and achieve mass adoption.

However, this has not happened yet. For many, the reason for this is the bad marketing, which BitShares operates or does not operate. While other blockchains present great promises and visions, BitShares is missing at this point. For example, BitShares has not updated its roadmap on the official website since 2016. Thus it is unclear to the outsider what should happen to the project in the near future. Since founder Dan Larimer left the project, many people even believe that the project is dead, even though there is a vibrant BitShares community.

In this respect, it seems unclear where the path for BitShares will lead in the future. The project has a mature technology with up to 100,000 transactions per second (in comparison: Bitcoin has 4-7 TPS, Ethereum: 10-15 TPS; as of October 2018). However, someone seems to have to take over the role of founder Dan Larimer to drive the project forward in terms of marketing and adaptation.

Last updated: 05/07/2019

[ratings]