- Long-term Bitcoin holders are buying at a rapid rate.

- With new accumulation after months of selloff, a possible price breakout is possible.

Popular crypto analyst Credible Crypto has forecasted a 200% price rally for Bitcoin (BTC). The analyst cited the increased BTC accumulated from Long Term Holders (LTH) to back his forecast.

BTC LTH Make A Comeback

Bitcoin (BTC) is one of the biggest beneficiaries of the latest crypto market rally. The flagship coin has regained its lost valuation and is changing hands at $86,810, up 3% in the past 24 hours.

While many may argue that Bitcoin’s volatility is not yet over, Credible Crypto highlighted the resurgence of LTH to counter the claims. In an X post, he noted that those holding BTC for at least 155 days, LTH, have begun accumulating the coin after unloading their stacks for months.

Essentially, LTHs are investors that do not perform active trading. Rather, they accumulate during correction and sell as the price rises. This group of investors has a huge impact on the supply and demand equation of Bitcoin.

They accumulated over 82% of all Bitcoin in circulation when the price dropped to $30,000. They began selling again after the price increased from $58,000 to $100,000, offloading nearly 2 million BTC on this rise.

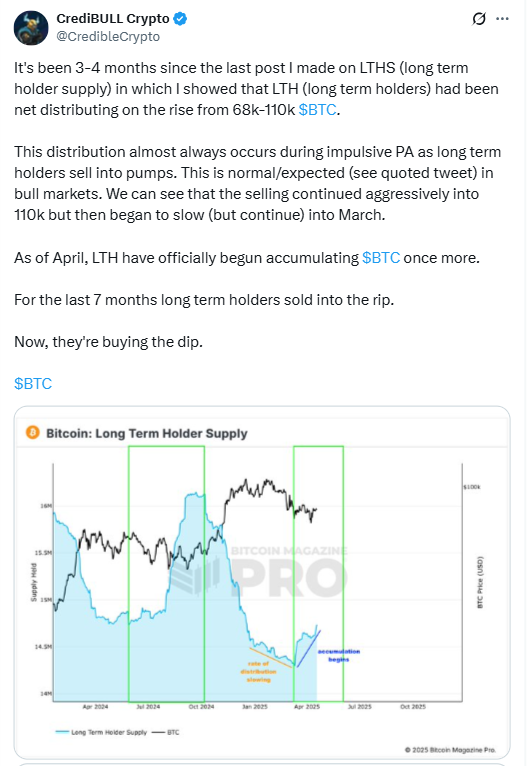

These investors have sold a substantial amount of their stash in the past seven months. Net distribution from these holders commenced when Bitcoin rose from $68,000 to $110,000. Distributions of this kind usually occur during impulsive price action as long-term holders sell into pumps.

Credible Crypto added a chart to his recent post showing long-term holders buying the dip. According to the analyst, Bitcoin is now gearing up for a major rally as long-term holders take advantage of the market correction. He believes BTC could hit new all-time highs before ending its bull cycle.

However, concerns about future volatility remain, especially concerning recent activities from short-term holders. As outlined in our recent blog post, CryptoQuant analysts identified 170,000 BTC transferred by those who bought BTC in the last three to six months.

What the Future Holds for Bitcoin

Bitcoin’s journey in the digital asset ecosystem is marked by challenges, from economic instability to massive whale dumping. Before this new revival, BTC saw a steep depression, as the price dropped to $74,500, amid renewed concerns over US tariff policies.

As it stands, BTC is back on track with its growth of more than 5% in the past week. The latest resurgence now suggests that BTC is on track to build on the massive rally it started the year with. Based on the current outlook, retesting its all-time high (ATH) of $110,000 is not impossible for the flagship coin.

An uptick in global liquidity is one major factor backing this possible price move. As featured in our recent coverage, the combined M2 money supply from the US, Europe, Japan, and China reached $90.2 trillion between December and February.