- Bitcoin’s 12% recovery in 3 days has reignited bullish sentiment, with long-term holders driving fresh accumulation.

- Positive shift in Long-Term Holder Net Position marks renewed market conviction, hinting at a potential BTC rally.

Bitcoin once again been under the spotlight with recovery of 12% in just last 3 days. Investors are now again showing interest in the Bitcoin bullish outlook ahead. Thereby, Bitcoin whales lead the charge to holding BTC with most of them holds over 155 days or more. These holders are looking for even more accumulation amid Bitcoin’s positive outlook.

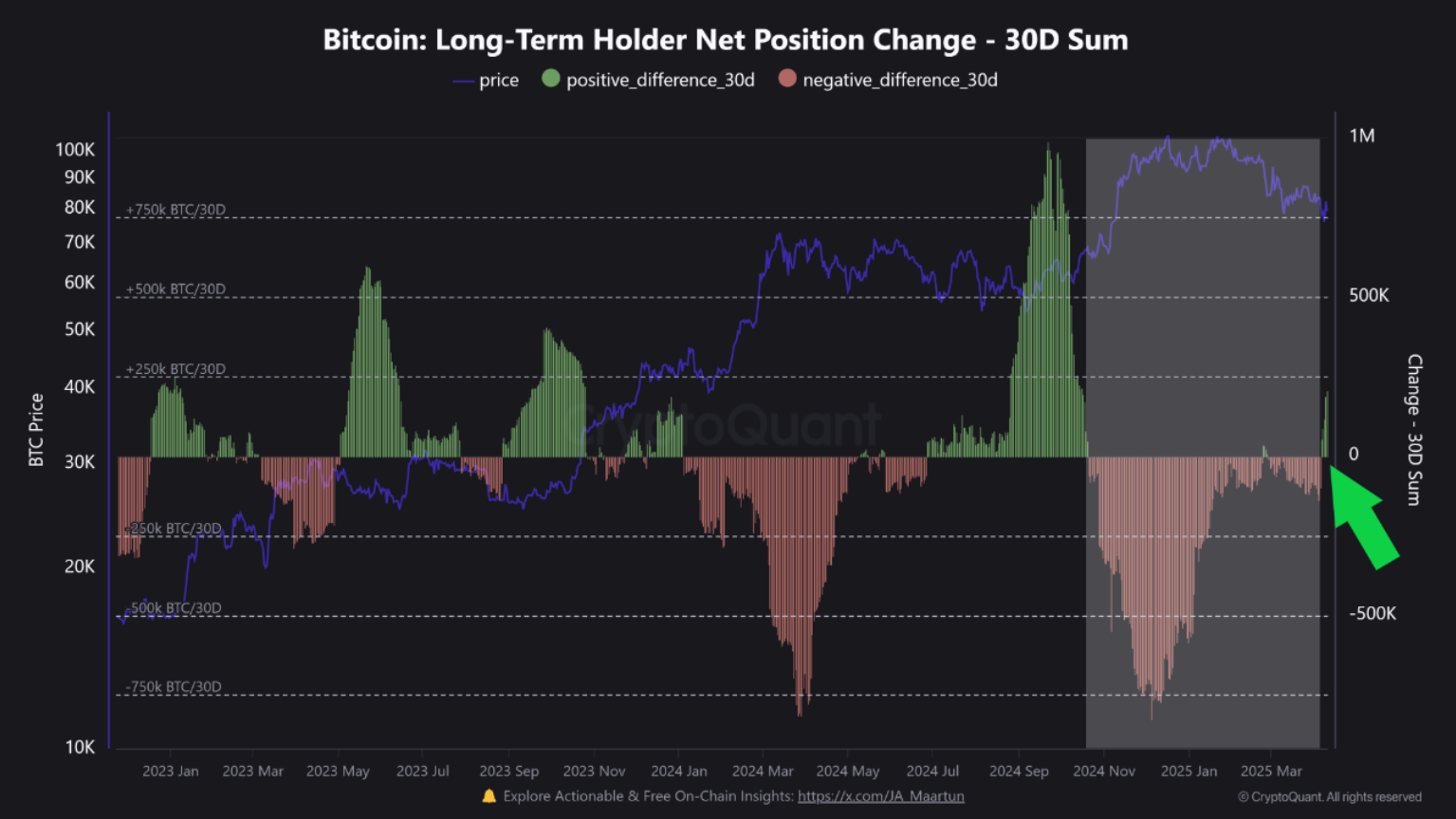

Accumulation activity has triggered new hope in the broader crypto market. Since April 6, Bitcoin’s Long-Term Holder Net Position Change turned positive for the first time in six months. This is the evidence that BTC holders are not just holding but also buying more, and all these activities potentially signal a bullish Bitcoin outlook.

Burak Kesmeci, an analyst from CryptoQuant, pointed out that this specific metric had been negative since late October. It marked months of distribution and doubt. That stretch of selling hit rock bottom on December 5, slashing the coin’s price by 32%. But now, according to Kesmeci, the wind is changing.

“While it’s too early to say definitively, the growing positive momentum in this metric could be a sign that long-term conviction is returning to the market,” said Burak.

BTC Breaks Above $81,800

This renewed conviction isn’t just theory—it’s already showing results. The surge in long-term holders accumulating BTC has pushed the price over a key level of $81,800. At the time of writing, Bitcoin is trading at $84,500, marking a 2% gain in the last 24 hours. That price push aligns closely with the timing of increased LTH accumulation. It also means a 12% increase since the accumulation began.

Another piece of this bullish puzzle is Bitcoin’s funding rate. At 0.0046%, the positive number means that long traders are paying short traders, a setup that often appears when the market expects higher prices. This kind of funding setup typically points to confidence among more aggressive traders. They’re willing to pay extra because they expect to make it back—and more—if BTC keeps climbing.

If retail traders jump on the wave and demand rises further, Bitcoin could shatter the current ceiling and aim higher. Market watchers are now eyeing the $85,000 mark, and possibly even $87,700, as a realistic near-term target.

Momentum Builds or Breaks: What’s Next?

Still, optimism has a fragile side. If long-term holders decide to lock in their recent gains, this upward push could stall. A pullback under $81,800 is possible, with a potential drop toward $74,500. That would mean a serious shakeout, especially for those who entered late.

But as it stands, the numbers are pointing up. The Long-Term Holder Net Position Change being in the green again is a powerful signal. It means that the ones with the most patience—and arguably the most insight—are placing their bets on a rally, not a retreat.

The months of selling that began in late 2023 may be over. With long-term believers stepping back in and buying, the question now is whether the rest of the market will follow their lead. If they do, the next chapter for Bitcoin could begin above $85K, not below it.