- On June 25th, $1.5 billion worth of Ethereum options will expire, the largest in 2021 and according to experts, it could largely determine what’s next for the crypto.

- The last options expiry in March was not as impactful immediately, but Ethereum would go on to plunge 17 percent in the five days that would follow before sparking the mega bull run to a new all-time high.

Professional traders have continued to troop into crypto, and with them, rapid growth in crypto investment products like ETFs, futures and options. Come June 25th, the largest Ether options expiry in 2021 will take place, and according to market analysts, it could determine the crypto’s future. For the traders, the range between $2,100 and $2,200 will determine who between the bears and the bulls takes charge of Ethereum’s future.

Ethereum options are becoming more popular by the day as traders diversify from Bitcoin. Just yesterday, Wall Street giant Goldman Sachs revealed that it plans to offer Ethereum futures and options to its ever-growing segment of crypto-savvy customers.

This growth is best seen with the growth in the value of the investment in Ethereum options. On June 25th, the largest options expiry will take place at $1.5 billion. This will be the largest expiry this year and will represent 638,000 contracts – or roughly 45 percent of the $3.4 billion worth of Ether in open interest.

On June 25, #ETH will face its largest options expiry in 2021 as $1.5 billion worth of open interest will be settled. This figure is 30% larger than March's 26 expiries, which took place as Ether price plunged 17% in 5 days. A big chance to buy the dip might come #Ethereum pic.twitter.com/Yl5hx8BNgA

— Cryptoverse💯 (@businessdriv) June 13, 2021

For those who are unaware, options are trading products that give the buyer the right, but not the obligation to buy (or sell) an asset at a specific price. They are divided into call options (or buys) which allow the buyer to get the asset at a specific price on the expiry date, and put options (or sells) which traders usually use to hedge against losses. In a manner of speaking, the calls are generally bullish while the puts are bearish.

Why a $2,200 price for Ether is the battleground

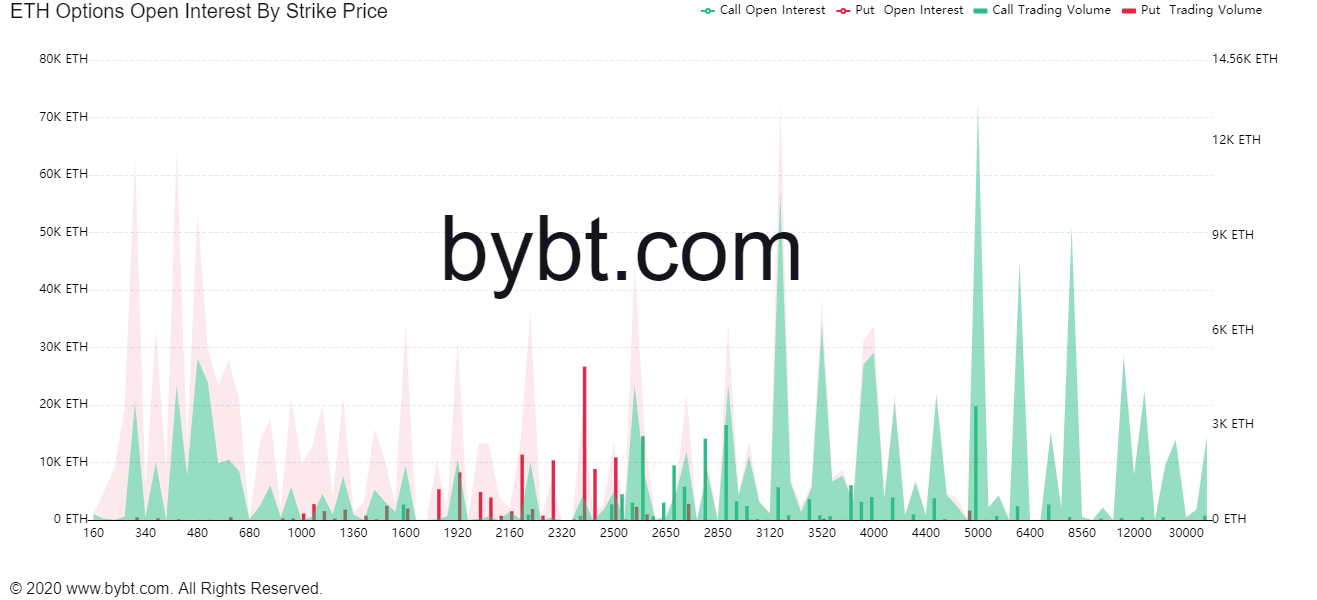

Data by derivatives data platform Bybt shows that a majority of the call options are at the $2,200 price for Ether and above.

As such, on June 25, if Ether is trading below this price, close to three-quarters of the put options will be worthless. As one outlet notes, this would leave 95,000 call options, representing a $228 million open interest.

Conversely, the majority of the bearish put options have been placed at $2,100 and lower. And just as with the former, close to three-quarters of these options will be worthless if Ethereum manages to stay above this level. This would leave just below 74,000 put options active, representing $177 million in open interest.

It will therefore all come down to the price of Ethereum on June 25, ten days from now. Currently, the top altcoin is trading at $2,570 as per our data, up 4.3 percent in the past day. In the past seven days, Ether’s lowest price was $2,265. In fact, the last time Ether traded below $2,100 was on May 23rd when it went as low as $1,850.